Kia India to Pass on Full GST Reduction Benefits to Customers from September 22

Price cuts of up to INR 4.48 lakh announced across entire ICE vehicle portfolio following government tax reforms

Kia India announced it will transfer the complete benefit of the recent Goods and Services Tax (GST) reduction to customers across its entire Internal Combustion Engine (ICE) portfolio, with the price reductions taking effect from September 22, 2025.

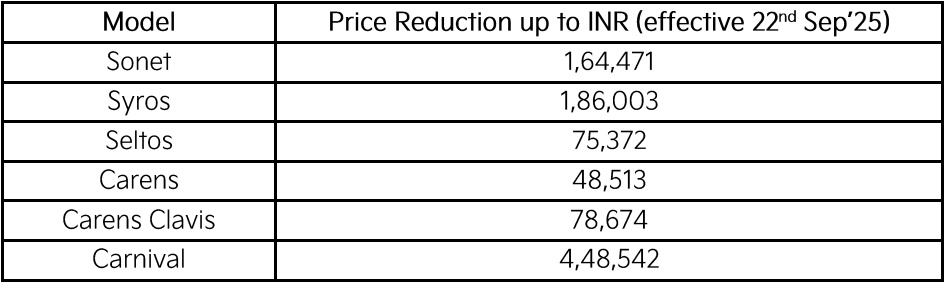

The mass-premium automobile manufacturer revealed price cuts ranging from INR 48,513 to INR 4.48 lakh across six models in response to the government's GST reform on passenger vehicles.

Price Reduction Details

The benefit distribution varies significantly across Kia's model range:

The luxury MPV Carnival receives the highest benefit at nearly INR 4.5 lakh, while the Carens sees the smallest reduction at under INR 50,000.

Gwanggu Lee, Managing Director and CEO of Kia India, welcomed the government's initiative, stating: "We welcome the Government of India's visionary citizen-centric reforms to reduce the GST on passenger vehicles. This transformative measure represents a progressive and timely decision towards making vehicle purchase more affordable for consumers and bringing a boost to the automotive sector's growth".

Lee emphasized the company's commitment to customer affordability: "In line with this vision, we are proud to pass on the full benefit of the GST rate reductions to our customers, ensuring more affordability and greater accessibility".

The CEO also highlighted the reform's broader impact, noting: "This significant reform simplifies the taxation framework and reinforces the government's commitment to sustainable economic growth and innovative mobility solutions. We are confident this move will energize consumer sentiment and drive demand during the upcoming festive season".

The manufacturer's Indian portfolio includes nine vehicles: Seltos, Syros, Sonet, Carens, Carens Clavis, Carens Clavis EV, Carnival, EV6, and EV9.

The GST benefit transfer positions Kia India among automotive manufacturers responding to the government's tax policy changes aimed at stimulating the passenger vehicle market ahead of the festive season.

RELATED ARTICLES

Euler Motors, Jio-bp Partner to Expand Commercial EV Charging Infrastructure

The partnership aims to deploy charging stations at high-demand logistics hubs across India, supporting the adoption of ...

SWITCH Mobility Deploys 272 Electric Buses in Delhi as Part of 950-Unit Order

SWITCH Mobility has flagged off 272 electric buses in Delhi under a CESL tender, marking Phase 2 of a 950-bus deployment...

GreenCell Mobility Announces 570-Bus Electric Fleet Expansion in Delhi

GreenCell Mobility has announced the deployment of 570 electric buses in Delhi following an USD 89 million investment ro...

By Glenn Noronha

By Glenn Noronha

08 Sep 2025

08 Sep 2025

5135 Views

5135 Views

Sarthak Mahajan

Sarthak Mahajan