Car Makers Struggle as Two-Wheeler Exports Drive Growth in June: Report

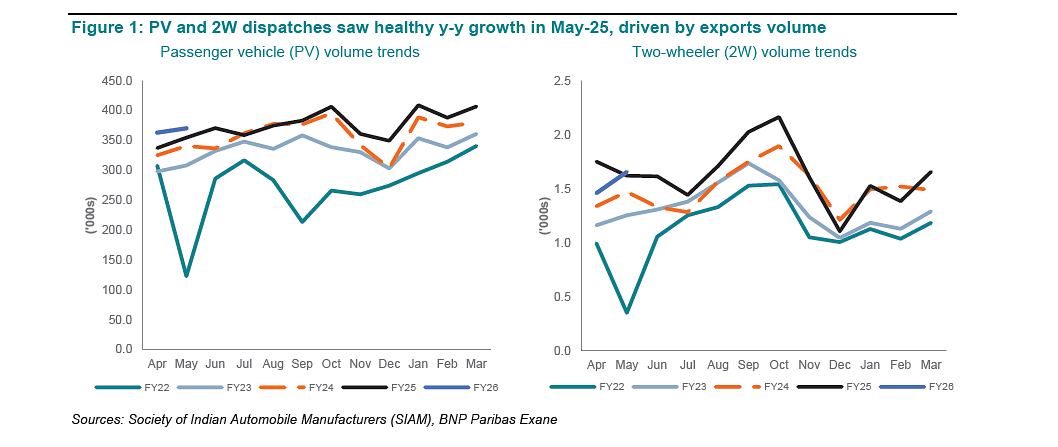

Car sales fell 8% in June 2025 due to weak domestic demand and seasonal factors, with most major manufacturers reporting declines. Strong export growth in two-wheelers and robust tractor sales helped offset some of the weakness in the overall automotive sector.

The Indian automotive industry displayed a mixed performance in June 2025, with two-wheeler exports and tractor sales driving growth while passenger vehicle sales faced headwinds, according to a research report by BNP Paribas.

Industry Highlights

Passenger Vehicle Sales Decline: Domestic passenger vehicle (PV) wholesale volumes dropped 8% compared to the same period last year. Most car manufacturers, except Mahindra & Mahindra, reported lower sales due to weak demand and seasonal factors. Companies were also adjusting their inventory levels as retail sales remained flat.

Two-Wheeler Growth: The two-wheeler segment showed better performance with domestic wholesale volumes growing 4% year-on-year, matching retail sales growth. Export volumes continued their strong momentum, particularly in Latin American markets.

Commercial Vehicle Weakness: Commercial vehicle sales fell year-on-year, with both light commercial vehicles (LCV) and medium and heavy commercial vehicles (MHCV) segments declining. However, bus sales showed mixed results.

Tractor Sales Surge: Tractor dispatches recorded strong growth, mainly driven by Mahindra & Mahindra's performance.

Industry-wise Performance (June 2025)

- Two-wheelers: +4% domestic wholesale growth

- Passenger vehicles: -8% domestic wholesale decline

- Commercial vehicles: -4% decline

- Three-wheelers: +9% growth

- Tractors: +10% growth

- Two-wheeler retail: +5% growth

- Passenger vehicle retail: Flat performance

Company Performance

Maruti Suzuki

India's largest carmaker saw overall volumes decline 6% as domestic business struggled across all categories. Passenger car sales fell 17%, while light commercial vehicles dropped 12%. However, UV (utility vehicle) sales declined only 8.5%, and their share in the company's mix improved. Export volumes provided some relief, rising 22% and increasing export share to 22.5% from 17.3% last year.

Mahindra & Mahindra

The company continued to outperform competitors across segments. Automotive division volumes grew 14%, driven by utility vehicles (+18%) and three-wheelers (+37%). Tractor volumes rose 13% with strong performance in both domestic and export markets.

Tata Motors

Domestic passenger vehicle sales fell 15% due to soft demand. However, electric vehicle volumes grew 12%, improving EV penetration to 14% from around 10% last year. Commercial vehicle volumes declined 5% overall, with domestic sales down 9% but exports up 70%.

Ashok Leyland

The commercial vehicle maker reported 3% volume growth, helped by strong export performance while domestic business remained weak. Domestic truck dispatches fell 12%, but bus segment sales surged over 41%. Export volumes jumped 69%.

Hero MotoCorp

The two-wheeler leader showed strong performance with export volumes rising 140% while domestic volumes grew 7%. Scooter sales performed particularly well with 37% growth, outpacing competitors.

Bajaj Auto

Total dispatches remained flat as strong export growth offset weak domestic two-wheeler sales. Domestic two-wheeler volumes fell 16% due to soft demand and inventory adjustments. However, exports grew 21%, with two-wheeler exports up 18% and three-wheeler exports rising 49%.

TVS Motor

Overall volumes increased 20.5% with domestic dispatches up 11%. However, electric scooter volumes declined 9%, reducing EV penetration in scooters. Export performance was mixed with two-wheeler exports up 58% but overall exports down 54%.

Market Share Changes

In passenger vehicles, Mahindra & Mahindra and Toyota gained market share, while Maruti Suzuki, Tata Motors, and Hyundai lost ground due to volume declines.

In the two-wheeler segment, TVS Motor and Royal Enfield gained domestic market share, while Hero MotoCorp and Bajaj Auto likely lost share.

Industry Outlook

Commodity costs remained stable in June, with steel price declines offset by higher base metal prices. Diesel demand continued to rise while freight rates stayed flat, indicating improving logistics activity. This trend is expected to support gradual recovery in medium and heavy commercial vehicle demand in coming quarters.

The automotive sector continues to navigate challenges from seasonal demand patterns and inventory adjustments, while export markets provide growth opportunities for several companies.

RELATED ARTICLES

Delhi Government Urges CAQM to Defer Fuel Ban on End-of-Life Vehicles

In a letter to the Commission for Air Quality Management (CAQM), the government cited operational and infrastructure cha...

Hero Leads June 2025 Bike and Scooter Sales

The gap between Hero and Honda is more than 1.30 lakh units.

Dacia CEO Confirms Renault Duster EV

An all-electric powertrain option, along with a 4x4 option will be offered on the Duster.

By Arunima Pal

By Arunima Pal

02 Jul 2025

02 Jul 2025

816 Views

816 Views

Kiran Murali

Kiran Murali