'If industry is given due time to plan and adopt new technologies, everything can be achieved.'

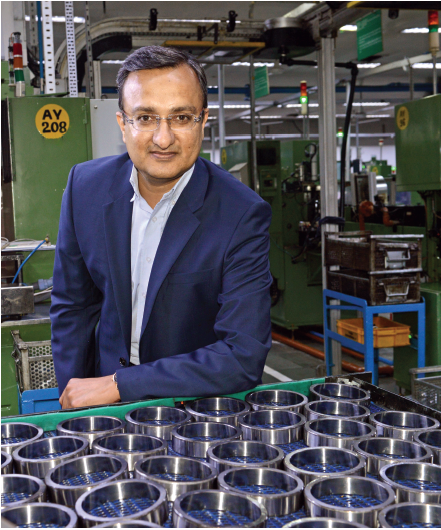

Rohit Saboo, president and CEO, NEI, on eyeing new acquisitions, strategy to double turnover every 4 years, new investments, developing bearings for a German OEM's hybrid car, impact of BS VI and electrification on the company.

Rohit Saboo, president and CEO, National Engineering Industries, speaks to Amit Panday on eyeing new acquisitions to fuel inorganic growth, the strategy to double turnover every four years, new investments, guidance from its German OEM customers in developing bearings for hybrid vehicles, focus on R&D in smaller yet robust bearings and associated technology verticals, and the impact of BS VI and electrification of vehicles on the company’s product portfolio in future. Excerpts:

How do you view the Indian government’s push for the electrification of vehicles?

The intent and the direction of the government (electrification of vehicles by 2030-32) is very good. We need to now detail it out as to how the industry can become capable to achieve that target. This is where the industry and the government need to hold regular discussions.

If the industry is given due time to plan and adopt new technologies, everything can be achieved. We are aware of the new developments globally and everybody is preparing already. It’s just that the government and the industry need to be on the same page.

The industry had voiced issues when it was told to move to BS IV norms earlier this year. That did not even require as much work that is now being done to prepare for the BS VI norms by 2020. The government is sharper this time. Transitioning to electric vehicles (EVs) moves the core fundamentals of the industry.

While industry seeks more clarity on the EV pathway, do you think SIAM and ACMA must increase their level of engagement with the transport ministry to address these issues?

The move from BS III to BS IV norms came from the Supreme Court of India. For implementation of BS VI norms by 2020, the industry has at least been given some time. The core issue is that the government and the industry need to jointly work on making plans. It is not feasible that the government singlehandedly tells the industry to go ahead and (make investments) work on new technologies. We are part of the same game and we have to understand that we are in this together. It is not that the government will work and the industry will sit or vice-versa.

This requires coordinated efforts, which I am sure both SIAM and ACMA are putting in well to get more clarity on the future roadmap. We, as vendors, are getting information from our customers (OEMs) on the new areas we need to work on and prepare for the future.

I think the message is clear. If the transition is smooth and interactive and both parties understand each other’s issues, it is much better and positive. I think the interaction is fair (between ACMA and the industry). If there is a disruptive change, then the interaction definitely needs to increase. For example, electrification of vehicles is a disruptive change.

I believe the government fears industry will demand subsidies and the industry fears the government will force it upon us. The best way forward is to hold discussions and be clear on how much the government can support and how much the industry can do.

How does the transition to BS VI norms by 2020 and the drive to push EVs in India impact a bearings manufacturing like NEI?

Bearings find applications in all vehicles powered by ICE engines across the powertrain, wheels and other areas. For example, a motorcycle will have about 12-15 bearings, a passenger car may have 20-30 bearings and more in commercial vehicles, depending on their size. The average number of bearings required for an electric vehicle is only, say, ten. So the volume (of bearings per vehicle) comes down sharply.

On the other hand, you have to understand that an EV is a noiseless vehicle. Secondly, the electric motors are high speed and hence they require friction to be as low as possible. This requires higher-quality bearings as far as tolerances are concerned. We require certain inputs on the process side so that the bearing runs more smoothly. On the design side too, there will be inputs on how bearings can run at high speeds without generating much heat. We need to learn the impact of other substances such as grease on how can they help in reducing friction. This also means that we need to have the right type of grease for high-speed applications.

We also need to look at alternate materials for lightweighting and reducing friction. We, as a company, are currently looking into all of these factors.

We have already introduced low torque bearings, which we are supplying to one of our customers. They have reported a reduction of around 13 percent in their vehicle’s fuel consumption. We are studying a lot of new technologies associated with the bearings.

On the CV side, we are offering optimised solutions so that the variability is lesser boosting smoother running and indirectly benefit via reduction in fuel consumption and maintenance.

On the lightweighting front, we are working to reduce the size of bearings while the loads on them remain the same or higher. We have to design bearings that are smaller but can take more load. This is a big challenge on the material, design and specifically the heat treatment levels. The latter helps in creating a surface, which does not disintegrate at high loads. Research activities in these areas are already on at NEI. We have had some breakthroughs and have applied for patents too.

This means the shift to EVs will involve substantial R&D work on different levels for NEI. Preparing now is the only way forward?

Absolutely and it brings so much work not only for us but for most component manufacturers. This is the right time when we need to re-think about our future. As Dr Abhay Firodia (chairman of Force Motors and SIAM president) said, whether it comes in three years or five years, it is anybody’s guess. However, we need to move in that direction and only the progressive companies which are ready with solutions will survive. This is very clear.

What are the opportunities that NEI is looking forward to tap in the EV market?

We have already got the opportunity to supply motor bearings to one of the major German carmakers for its new vehicle programs. We learnt a lot from them because normal bearings would not have worked in those applications. They had also engaged with us and we had jointly developed these new type of bearings. These are bearings required for motors in a hybrid vehicle. The motor in this case will largely remain the same in electric vehicles.

We are already in that direction and as a team, which is exclusively trying to learn the implications of EVs on bearings, we have learnt from our existing customers and where do we need to go. Simultaneously, we have several ongoing research projects. Tesla is giving a lifetime warranty on its cars. This clearly means that we need to make products that can never fail. We are working in that direction and are confident that whenever it will be introduced, we will be ready. For this, we are not only looking at India. Instead, we are looking at the global markets.

Secondly, the more we engage with the existing companies, the more we will learn so that when it becomes a mass phenomenon, we are ready with the solutions. We are engaging with the companies who are currently working on the hybrid and EV programs. Currently, we are supplying to two global carmakers.

When did NEI start work on developing bearings for electric motors in the German OEM's hybrid vehicle?

We started work with this German OEM in 2013. It took us about a year-and-a-half to develop the bearings. This was the development time given to us by them. The existing models are being updated and for the new ones we are again developing the motor-specific bearings.

How did the company fare in FY2017 and how do you foresee growth in FY2018?

I would not say that FY2017 was very good. Traditionally, we have been growing at a CAGR of 13.5 percent. Last year, we grew in low single digit. Having said that, the first five months of this fiscal have been very good for us. We are back on our growth trajectory. We had a number of activities to cut costs but R&D is one area where we have continued to increase our investments. Last fiscal, our turnover stood at Rs 1,700 crore and are looking to grow by over 13 percent in this fiscal.

What percentage of your turnover do you invest in R&D annually?

Four years ago, we used to invest 0.2 percent of our annual turnover into R&D per year. Currently, we are investing about 1.25 percent of our annual turnover into our R&D projects. We are aiming to invest about 2 percent of our annual turnover into R&D activities per year. This is our medium term (three-year) target and we will review this after that. Our chairman is also very keen on transitioning NEI into a technology-oriented company.

We are expanding our R&D team, which includes hiring research doctorates and highly educated and skilled engineers. We had 50-odd people in R&D in 2008 and now I have a team of about 120 engineers. About 30 percent of our engineers are PhDs, post doctorates and masters.

There is a complete shift from the way we used to run our R&D earlier. Fortunately, we have some great customers in India and abroad who challenge us and teach us. They realise that it’s important for us to be up to the mark so that it does not affect them in the future. That way our integration is very good.

What new investments has NEI earmarked for the future?

In the past five years, we have invested about Rs 1,000 crore including a new plant in Savli (Gujarat). We follow a target of doubling our turnover every four years (despite all market challenges). This includes organic and inorganic growth.

I would say that we plan to invest another Rs 1,000 crore over the next five years i.e. by 2017-2021.

What kind of new acquisitions are you open to?

We are open for new acquisitions based on three factors – it brings us new technology, new market(s) and customers, and new strength in a different geography outside India. These are three basic criteria for the possible acquisition we are looking at.

This means you are willing to acquire a company that can add an all-new product line (to NEI’s current portfolio) suitable for future growth?

Absolutely, yes. Technology is our number one criteria for making such an acquisition. If we start from zero, then it will take a certain amount of time before we achieve proven levels of technology. However, if I can find somebody who is already advanced on technology, it shortens my development time and time-to-market. Hence, this is why the technology is a key criterion.

Can you throw some light on what type of new products or specific technology vertical that you are looking to acquire? Will it be associated with bearings too?

Currently we are looking at bearings and its adjacent value added product lines, which comprise a complete bearing system. For example, we have developed a wheel hub, which is maintenance-free for commercial vehicles. This bearing technology guarantees zero maintenance for 300,000- 400,000km as against only 50,000km in old-generation bearings.

In the context of newer technologies, we are also working on how to integrate electronics and sensors in the bearings to eventually help our customers with necessary data. Although we have not initiated any activity in this direction but we can look at some startups. We can invest in them and they can work with us in this area. So we are open for acquisition on this front (sensorisation of bearings). However, as of now, I do not have anything on my plate.

I believe that the data analytics (of the data generated by the sensors) is going to be critical.

How soon do you expect to make this new technology acquisition?

I would love to make this happen as soon as possible. But you have to understand that this is a very closed industry for the aforementioned criteria. It is a difficult deal to crack. We have had some opportunities earlier and you never know what’s in store for us in the near future.

Lastly, do you forecast that business for NEI will increase majorly due to the electrification of vehicles or across all segments and technologies?

Currently, our global business across the USA, Europe and Japan is growing well on the front of the vehicles with the ICE engines. The share of business from electric vehicles globally is extremely small right now. The percentage of electric vehicle sales relative to the overall vehicle sales globally is also very small.

However, I believe that the business will continue to grow with regular vehicle sales while preparedness with new technology is required for being future ready. Therefore, we are developing those bearings to be future-ready.

(This interview was first published in the September 15, 2017 print edition of Autocar Professional)

RELATED ARTICLES

Setrans Mobility Booster Charging top-up 25% EV range in 15 minutes

Two enterprising tech-savvy entrepreneurs Rana Roshan Singh and Vivek Ummat of Noida, Uttar Pradesh-based start-up Setra...

'Our products are proudly 100% designed and made in India'

Creatara Mobility, a New Delhi based electric two-wheeler startup, claims to have tackled various challenges in making i...

'EVs have been around for a much smaller time than ICE, so best practices are still evolving'

EV OEMs and start-ups are under pressure to reduce production costs and bring them close to ICE counterparts. Vaibhav Ku...

03 Oct 2017

03 Oct 2017

5082 Views

5082 Views

Autocar Pro News Desk

Autocar Pro News Desk