Suzuki bets on scooters and premium motorcycles for growth in India

A booming domestic scooter market and uptick in demand for premium bikes sees Suzuki rejig its two-wheeler growth strategy to hit sales of a million two-wheelers by FY2020.

The winds of change in the Indian two-wheeler market are having an impact on company strategy. The continued surge in demand for scooters and a consistent uptick for premium motorcycles is seeing some OEMs rejig their product game-plan. Suzuki Motorcycle India, which launched the Intruder 150 yesterday, is one such player.

Suzuki Motorcycle India, the two-wheeler arm of the Japanese automobile major, has revealed plans to ride away from the mass commuter bike segment and instead sharpen its focus on the booming scooter segment, where it is much better placed overall. At present, the company has only a single commuter model – the 110cc Hayate. The company plans to discontinue the Hayate once BS-VI emission norms kick in April 2020. The company will, instead, concentrate entirely on introducing in new scooters, as well as sportier and desirable motorcycles above 150cc in engine capacity.

Speaking at the launch of its new Intruder 150, Satoshi Uchida, managing director, Suzuki Motorcycle India, said, “The recent customer trend is moving towards stylish and premium products and taking that into account, we have launched the Intruder 150. Going forward, we will be introducing at least two new products every year in the scooter and premium motorcycle segments, with an aim to reach sales of 1 million units (Scooters: 800,000, Motorcycles: 200,000) by FY2019-20.”

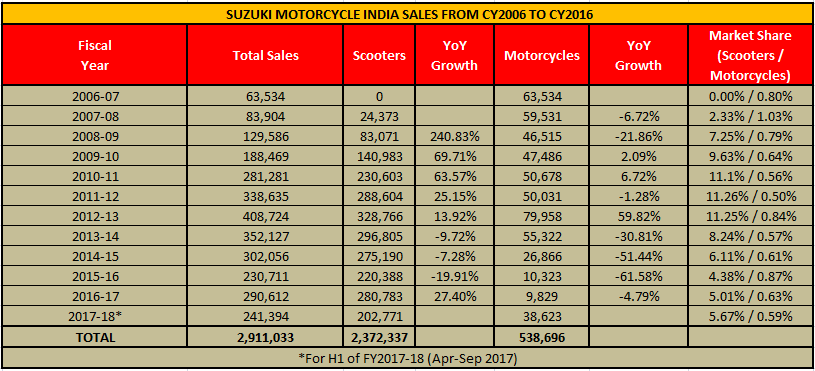

How the numbers stack up over 10 years

The Indian scooter market has seen cumulative sales of 3,09,03,649 units between FY2006-07 and FY2016-17. During this time, the scooter market has seen a surge in demand, growing at an average rate of 18.11 percent in the past decade, with sales crossing the 20-million mark by end of FY2010-11 and posting best-ever growth of 41.79 percent in the fiscal.

At the same time, motorcycles have been losing out to these convenient automatic commuter scooters, with sales hovering around the 90-million mark (+22.86%) in 2010-11, and marginally growing to reach the 10,000,000 milestone (+11.94%) in FY2011-12 and closing FY2016-17 with a total of 1,10,94,543 units (+3.68%). The average growth rate during this decade has stood at slightly over 5 percent for the segment.

Considering the slowing buyer affinity for motorcycles in the mass-market segment, Suzuki Motorcycle India’s step comes across as a logical decision, since the manufacturer is already witnessing aggressive offensive from commuter bike competition which includes the Hero Splendor, Honda Dream series and the TVS Star City and Sport models, all strong players in the 110-125cc segment.

During April-September 2016, Suzuki sold a total of 34,870 motorcycles while its scooter sales stood at 125,318 units. This performance could be attributed to its refreshed Access 125, which was launched at the 2016 Auto Expo. The model has been a longstanding rival to Honda’s Activa series and continuing demand only strengthens its case further.

The Access has gone on to help the company clinch the No. 5 spot in the Indian two-wheeler market. In H1 FY2018, Suzuki sold a total of 202,771 scooters, registering solid 62 percent growth. In comparison, motorcycle sales comprised 38,609 units between April-September 2017. Suzuki Motorcycle India’s current overall two-wheeler market share is 2.30 percent (April-September 2017), up from the 1.68 percent in April-September 2016. Its scooters have clearly contributed to this growth with scooter market share up from 4.11 percent in H1 FY2017 to 5.67 percent in HI FY2018. The same period has seen its motorcycle share remain stagnant at 0.59 percent.

The company has also seen a de-growth in the contribution of the sub-150cc segment motorcycles in its total sales over the last few years, with the products declining from contributing 54 percent (FY2015-16) of the sales to 50 percent (FY2016-17). On the other hand, scooters’ contribution rose from 46 percent (FY2015-16) in total sales to 50 percent (FY2016-17), with future projection of growing up to nearly 56 percent by FY2019-20, when its sub-150cc motorcycles will be limited to 44 percent of the total sales.

So, even as Honda has launched the Grazia 125cc scooter, which squarely targets the Access 125, Suzuki will be working on future product plans all aimed at riding the humongous wave of scooter demand in the country.

In the premium motorcycle segment, Suzuki currently only offers the Gixxer and the Gixxer SF twins in the 150cc category, catering to the young and enthusiastic buyer. With a strong attack from players including Bajaj Auto with its Pulsar line-up, as well as Yamaha with its FZ 15 series, the Japanese manufacturer has it act cut out for the Indian market.

RELATED ARTICLES

Kia Carens gets 3-star Global NCAP rating in fresh tests

The Carens MPV, which was tested twice under the new protocol, scored zero stars for adult occupancy in the first test.

Tata Elxsi-Renesas MCU for EVs enables cost optimisation, speedier time to market

Modular, scalable design of Motor Control Unit enables integration across diverse EV applications. Claimed to be reduce ...

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

09 Nov 2017

09 Nov 2017

10335 Views

10335 Views

Autocar Pro News Desk

Autocar Pro News Desk