Petrol, diesel excise duty cut by Rs 2 a litre but there’s scope for more

In November 2014, the Central government’s excise duty on petrol was Rs 9.48 and Rs 3.56 a litre on diesel, which has gone up to Rs 21.48 on petrol (+ Rs 12 a litre) and Rs 17.33 on diesel (+ Rs 13.77) a litre as on October 4, 2017.

The sharp spike in the prices of petrol and diesel over the past two-and-a-half months finally saw some respite in the form of a Rs 2 per litre excise duty cut from the government of India, effective from midnight of October 4.

Petrol and diesel prices had hit a new high yesterday, when petrol cost Rs 79.99 a litre and diesel Rs 62.82 per litre, the highest yet since dynamic or daily pricing came into effect on June 16 this year.

This decision marks the first time since November 2014 that the current government has reduced excise duty after having hiked it 11 times over a 36-month period. In November 2014, the Central government’s excise duty on petrol was Rs 9.48 and Rs 3.56 a litre on diesel, which has gone up to Rs 21.48 on petrol (+ Rs 12 a litre) and Rs 17.33 on diesel (+ Rs 13.77) a litre as on October 4, 2017.

Scope for more price cuts

Following decontrol of petrol prices in 2010 and later of diesel, by the previous UPA government, fossil fuel prices had first seen an upward movement. It was in 2014, when OMCs (oil marketing companies) began market-linked pricing initially for diesel.

In addition to the latest Rs 2 excise duty cut, there’s scope for more price cuts on petrol and diesel through reductions in the value-added tax (VAT) that state governments levy and estimated at 30-40 percent on petrol and 20-25 percent on diesel. In the recent past, a number of state governments have hiked VAT on petrol and diesel. While Maharashtra raised VAT on petrol by Rs 3 a litre in end-April, Delhi hiked VAT from 20 percent to 27 percent.

As both excise duty and VAT on petrol and diesel generate a humungous amount of revenue for the Central and State governments, they are loathe to cut them and thereby reduce prices.

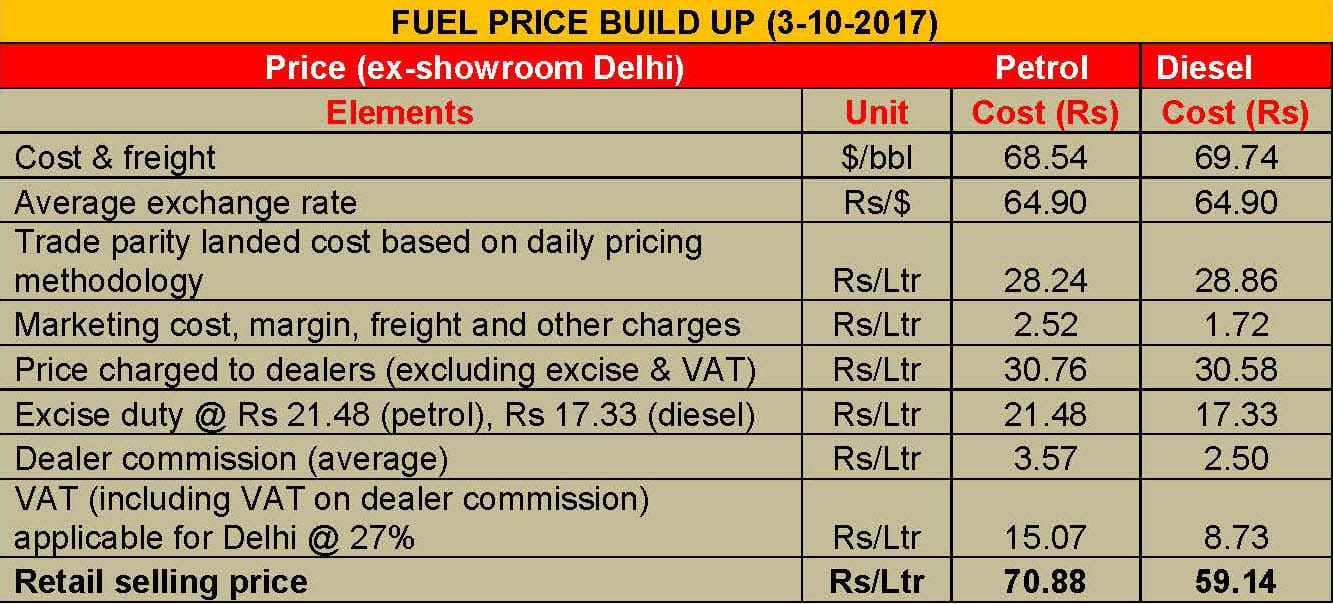

As a result of heightened taxation on these fossil fuels over the past few years, the beleaguered Indian motorist pays more tax on petrol and diesel than what they really should cost. As of October 3, New Delhi motorists were paying Rs 36.55 or 51.56 percent as tax (excise duty and VAT) on a litre of petrol which cost Rs 70.88 and Rs 26.06 or 44 percent on a litre of diesel priced at Rs 59.14 (see detailed table below).

In an official statement released yesterday, the government said: ““The government has decided to reduce the central excise duty on petrol and diesel by Rs 2 per litre effective from October 4, 2017. This measure would help reducing the prices of petrol and diesel and giving relief to consumers. In the past few weeks, the prices of petrol and diesel have been rising due to increase in their prices in the international market. State governments are also being requested to make reduction in VAT imposed by them on petrol and diesel. The revenue loss on account of these reductions in excise duty is about Rs 26,000 crore in a full year, and about Rs 13,000 crore during the remaining part of the current financial year.”

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

By Autocar Professional Bureau

By Autocar Professional Bureau

04 Oct 2017

04 Oct 2017

4138 Views

4138 Views