Mahindra First Choice Wheels to expand network to 5,000 dealers by 2020

Mahindra First Choice Wheels aims to expand dealer network to 5,000 by 2020. The company is growing at 40 percent, while the organized dealer in the industry averaged 26 percent. The company sold 14,000 vehicles in August, 2017.

Mahindra First Choice Wheels (MFCW) organised a press conference for the launch of the second edition of ‘India Pre-Owned Car Market Report’ by IndianBlueBook. MFCW which currently has a 1,400 dealer network spread across 700 towns, is optimistic to have a network of 2,000 dealers by the current year end and further expand to achieve a dealership network of 4-5,000 dealer by 2020.

Commenting on his views on the challenges that were faced by the industry in the past year, Dr Palle said, “While these reforms have no doubt disrupted the status quo, they have necessitated that all stakeholders change with the times and become ‘more organised’. Not withstanding the short term hiccups, we strongly believe these market reforms are good for the organised industry in the long term.”

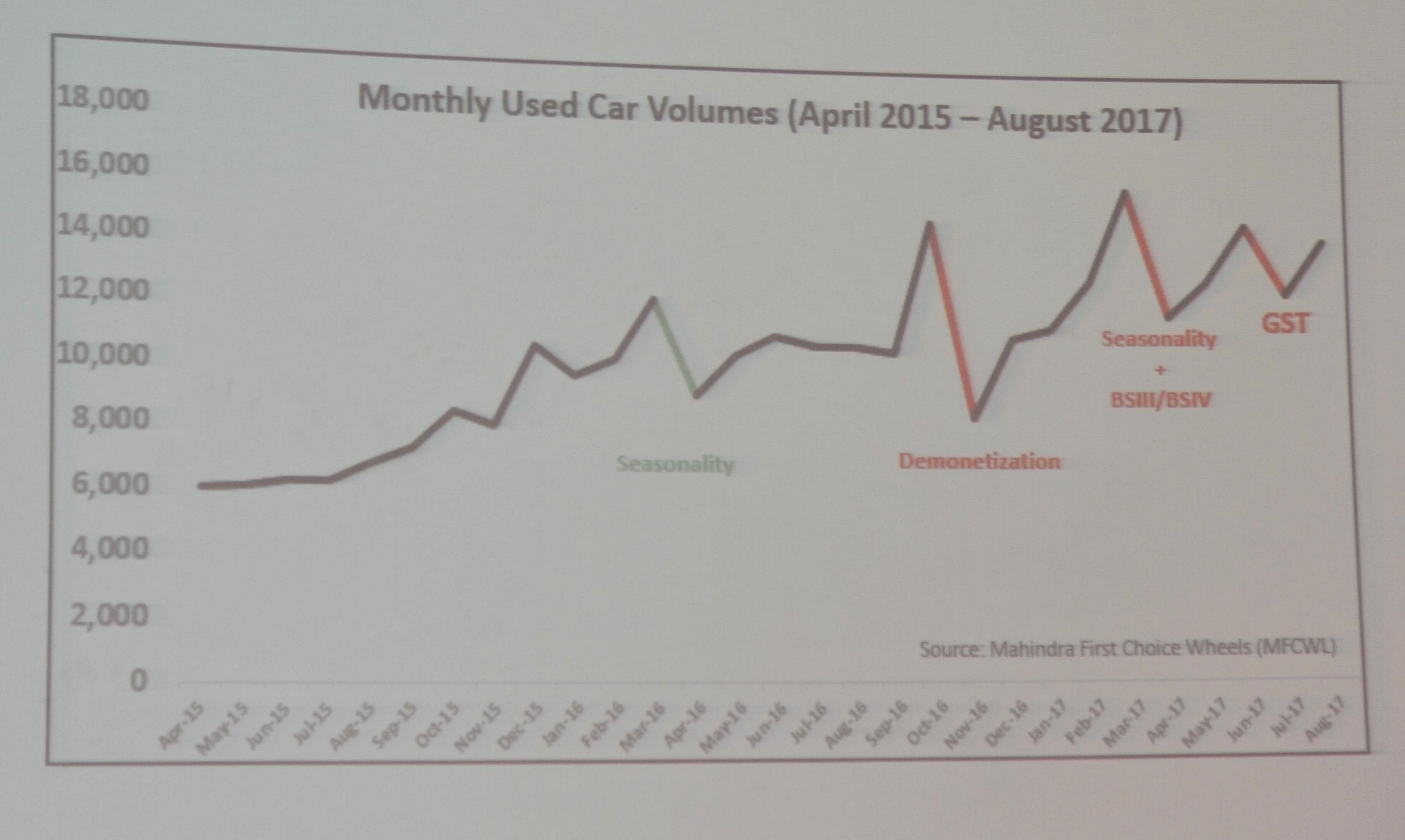

Launching the report, Dr. Nagendra Palle, MD & CEO, Mahindra First Choice Wheels, said despite the various issues that were faced by the industry (Demonetisation, BS III to BS IV transition, GST), MFCW managed to grow 40 percent from Jan-Aug, 2017, affirming his belief that the used-car segment is here to grow.

The overall used-car market size is 3.6 million vehicles that was 9 percent higher than 2016, that could have achieved a growth of another 6 percent (15 percent growth) taking the total size to 3.8 million vehicles if the demonetisation exercise did not happen. Another impact of the exercise was witnessed in the overall used-car dealership network that saw flat growth, while the organised sector managed to grow 23 percent YoY.

There is a shift from the unorganised towards the organised market for used-car sector, as a growing number of consumers prefer buying a car that gives them a sense of assurance. The share of sales between metros and non-metros stood at 45 percent and 55 percent respectively.

Optimistic towards the growth in the used-car segment MFCW is currently adding 50 new dealers a month. As per the company claims MFCW dealers have a global best inventory-turnaround time of 23 days, compared to industry average of 40 days, incidentally as per Dr Palle, the average turnaround time in a developed market like the United States has an average inventory turnaround time of 60 days.

Describing the customer profile of a used car consumer, Dr Palle said, “60 percent of the customers are first time car buyers, while the remaining are customers who are looking to buy a bigger car or a second small car.”

MFCW started its operations in April 2015 with 250 dealers and sold around 6,000 vehicles currently sells more than 10,000 vehicles per month on an average, the company sold 14,000 vehicles in August, 2017, growing at 40 percent . The company’s sale averaged Rs 3.5 lakh compared to the industry average of Rs 2.5 lakh, explaining the premium pricing, Dr Palle, said, “When a customer buys a car he looks for basically four things, condition of vehicle, paperwork, pricing and experience. When a customer buys a vehicle from us he is assured that he will get the best Total Cost of Ownership.”

The average age of pre-owned cars that were sold were less than 5 years old accounting for 70 percent of the total sales, along with 70 percent of car sales being under Rs 4 lakh. The sales demand in metros make up for mostly petrol vehicles, while non-metros witness demand for diesel.

The customers opting for finance post demonetisation have gone up to 20 percent, MFSW saw double or almost 40 percent of its customers taking the same route.

Challenges and Future plans

As per Dr Nalle, any industry sees challenges in growth but the recent experience of uncertain policies affects the industry at large. Speaking to Autocar Professional, on the current situation of discussions with government on the new tax regime affecting organised pre-owned segment, Dr Nalle said, “The industry has already conveyed the situation to the government, it was not taken up at their last meeting, but I am positive that the government will look into our concern in their next meeting.”

The company is also getting a lot of enquiries from yellow boards for business. MFCW is planning a new business model and will start a pilot project in Bangalore and Chennai that will deal in yellow board vehicles. Explaining the concept, Dr Nalle said, “There was a huge boom few years back from the people who bought new vehicles and saw huge revenues from driving for shared mobility providers. Unfortunately, if you look at the picture today, the revenues have come down for new people joining the board. There are people who would want to sell their taxis and there are buyers who would like to purchase them, we will cater to this demand.”

Replying to a question from Autocar Professional on reselling of EVs by MFCW, Dr Nalle said, “EVs constitute a small market, but yes, we deal into them as well, and presently one of our dealers in Bengaluru sells used EVs.”

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

13 Sep 2017

13 Sep 2017

12079 Views

12079 Views

Autocar Professional Bureau

Autocar Professional Bureau