LCVs save the blushes for Mahindra & Mahindra in Q1 FY2018

With UV sales down 5%, 43,698 LCVs which accounted for 39% of total PV and CV sales, prevented overall numbers from entering negative territory. M&M now plans a sharper focus on UVs, SCVs, EVs and the rollout of a brand-new MPV.

Homegrown major Mahindra & Mahindra saw its Light Commercial Vehicles (LCVs) save the company’s overall vehicle sales from entering negative territory in the first quarter of FY2018 (April-June 2017).

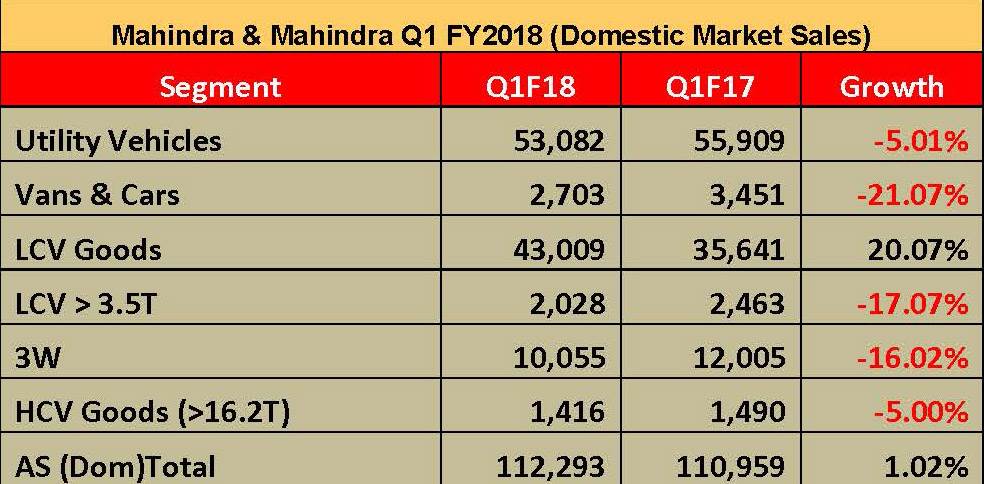

The company says it sold a total of 112,293 units across the passenger vehicle and commercial vehicle segments in Q1 FY2018, a marginal improvement of 1.2 percent (Q1 FY2017: 110,959).

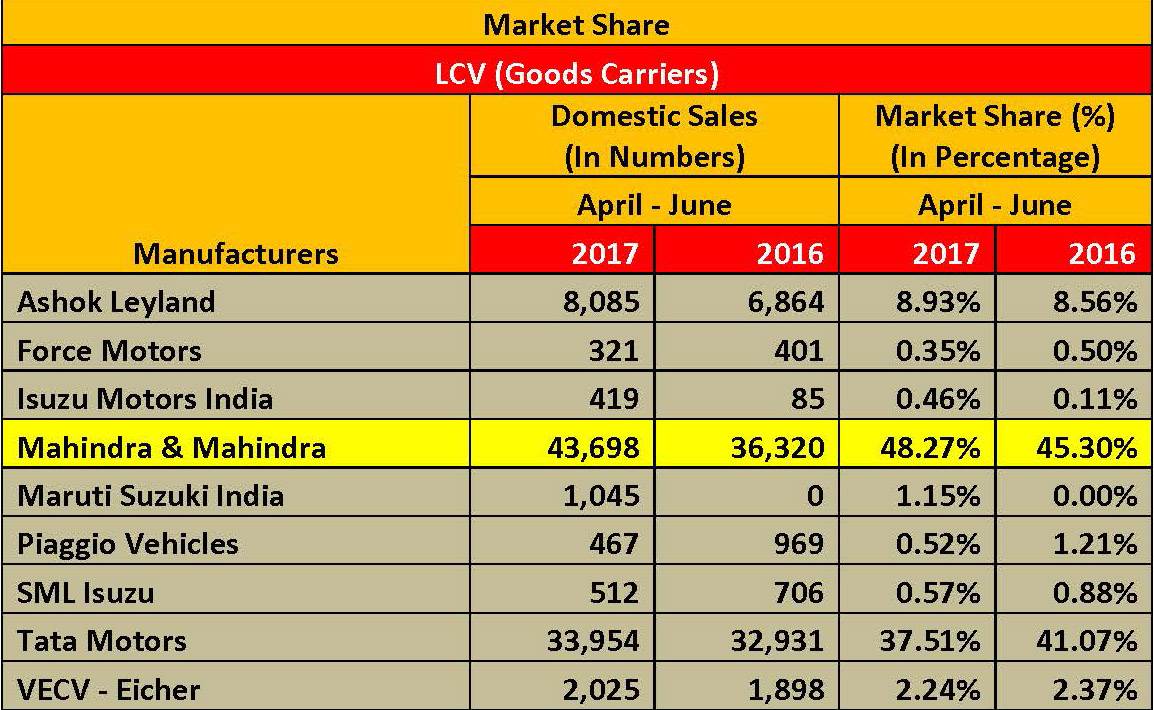

This cumulative total includes 43,698 LCVs – which constitutes 38.91 percent of the overall sales – in Q1 FY2018, a 20.31 percent growth (Q1 FY2017: 36,320). As per SIAM data, the growth in LCVs also helped increase its LCV (goods) market share to 48.27 percent from 45.30 percent in Q1 FY2017.

UVs take a beating as do other segments

For M&M, its UV offerings make up the bulk of its passenger vehicle portfolio (9 out of 12). In Q1 FY2018, its UV sales dropped 5.1 percent to 53,082 units (Q1 FY2017: 55,509). As a result, its UV market share also dropped to 27.92 percent from 31.62 percent. It also meant that rival Maruti Suzuki, with its popular Brezza and Ertiga models, grew its market share from 22.26 percent to 30.5 percent. Clearly, Maruti has benefited at the cost of Mahindra and other UV makers.

Other segments where M&M has a presence were also in the negative – Vans & Cars (-21.7%), above 3.5T LCVs (-17.7%), three-wheelers (-16.2%) and above 16.2T HCV goods carriers (-5.0%).

As per the financial results declared by the company today, gross revenue for the quarter is Rs 12,433 crore, a marginal increase of 3.95 percent (Q1 FY17: Rs 11,961 crore); PAT at Rs 768 crore is a decrease of 20.17 percent (the company has marked Rs 144 crore as a one-time provision for loss arising due to GST transition).

According to M&M, the automotive industry in Q1 F2018 was impacted due to the impending transition to GST from July 1 with PV sales being adversely impacted in anticipation of a price reduction due to GST and the industry reporting a nominal growth of 4.4 percent. HCV (goods carriers) sales recorded a dip due to pre-buying of BS III vehicles in Q4 F2017, saturation of replacement demand and production constraints of BS IV models, leading to Q1 FY2018 sales being the lowest in the past 13 quarters.

However, for M&M’s Farm Equipment Sector, tractor sales of 81,270 units helped increase market share to an all-time high of 45.8 percent.

The road ahead: Innova-challenger coming up, further push on SCVs

M&M plans to introduce an MPV (codenamed U321) in the next three months, while the S201 will be launched in the next fiscal. The company is readying a slew of product refreshments aimed at a sustained sales trajectory.

Commenting on the future growth game-plan, Dr Pawan Goenka, MD, Mahindra & Mahindra, said, “We have our focus firmly on the UV, SCV and LCV segments. In the SCV segment, we have a market share of close to 52 percent and expect it to further improve as we move forward. In HCVs, we are on a growth path, especially after BS-IV which came as a blessing in disguise. There is some struggle in the UV segment, where we have had de-growth in our market share. That is where most of our efforts will go in to turnaround the products that have not done well and to launch new products and refreshments in the next 6-9 months.

These three sub-sections are important to us, while the fourth is the electric vehicle segment which probably will get a lot more attention than these three. At present, EV activity is less in terms of volumes, but there is a lot of activity going on behind the scenes. We are looking at making EVs affordable for fleet operations, whether it is for aggregators like Ola or fleet management services like Lithium Technologies (Bangalore) or for corporate buying in the short term. For the long-term, work on higher range and higher-performance vehicles is going on in parallel. We are also looking at backward integration in terms of batteries, motor and electronics.”

Speaking to Autocar Professional on the growth outlook, Dr. Goenka said, “I expect the passenger vehicle segment to grow by 10-12 percent and within it the UV segment by 13-15 percent. While the SCV segment will grow by 8-9 percent, the M&HCV segment will mostly remain flat this year. It will pick up pace next year depending on the economic activity.”

Indicating that demand in the year has not been realistic due to different factors affecting the sales pattern – BS IV transition, discounts offered in June by dealers due to pre-GST stock clearance among others – Dr. Goenka expects that with the country’s macro-economic indicators being stable, growth will return to its realistic pattern.

The company is optimistic about recording higher sales in FY2018 as will the overall automotive industry. With the macro-fundamentals in the country remaining robust due to sustainable growth, steady commodity prices, reformative GST easing vehicle movement, inflation remaining low, RBI’s rate cut, an above-average monsoon and positive consumer sentiment, M&M expects stable growth in the months ahead.

Also read: Jeeto helps Mahindra win in mini-truck market

Video: Dr Pawan Goenka on the fate of the diesel powertrain, strategies for electric and fossil fuel powertrains, collaboration with SsangYong and other OEMs, reclaiming UV market share, and much more.

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

04 Aug 2017

04 Aug 2017

5623 Views

5623 Views

Autocar Pro News Desk

Autocar Pro News Desk