India passenger car sales growth slows down in January

The rollback of excise duty concessions appears to have dented passenger car sales in January 2015 with the rate of growth of 3.14 percent at 169,300 units

The rollback of excise duty concessions appears to have dented passenger car sales in January 2015 with the rate of growth of 3.14 percent at 169,300 units as compared to January 2014 sales numbers of 164,149. This was muted in comparison to the yearon-year (YoY) growth in December 2014 in which passenger car sales increased by 15.26 percent.

In the vans segment, sales fell 6.93 percent to 12,638 units, while UVs saw a 6.30 percent growth to 48,681 units, according to the January sales number released by the Society of Indian Automobile Manufacturers (SIAM) today.

Overall, the automotive industry posted a 1.66 percent growth to 1,65,0382 units with the largest contributor being the medium and heavy commercial vehicle (M&HCV) segment riding on the back of infrastructure development.

According to Vishnu Mathur, director general, SIAM, the slow industry growth is due to a spike in demand in December 2014 as people advanced their purchases before the rollback of excise duty incentives. Therefore, January 2015 sales reflect the overall sombre market sentiment. He expects passenger vehicles to close this fiscal year growing by between 3-5 percent.

Surprisingly, M&HCV sales in both passenger and goods carrier categories rose, with passenger carriers growing at 12.78 percent to 3,000 units and goods carriers going up 41.74 percent to 18,363 units. Mathur says the last three years were particularly tough for this segment but with the economy showing signs of improvement, fleet operators have begun to make purchases. But he cautions that though the sales percentage indicates handsome growth, actual sales figures of M&HCVs are still half – at 21,000 per month – as against 2011 figures of roughly 40,000 a month. Light commercial vehicles (LCVs) still await a sustained revival of demand though the negative numbers are now beginning to moderate.

Unfortunately, the M&HCV momentum could not be maintained by LCVs especially the goods carriers which dipped 10.47 percent to 27,924 units in January 2015 compared to a 5.17 percent growth in passenger carriers to 3,194 units. A key deterrent for the sale of LCVs is financing as most buyers are SMEs, and financiers are hesitant to extend loans to them without adequate safeguards. This is not an issue while procuring heavy-duty vehicles from the likes of Ashok Leyland and Tata Motors, which are generally bought by large fleet operators.

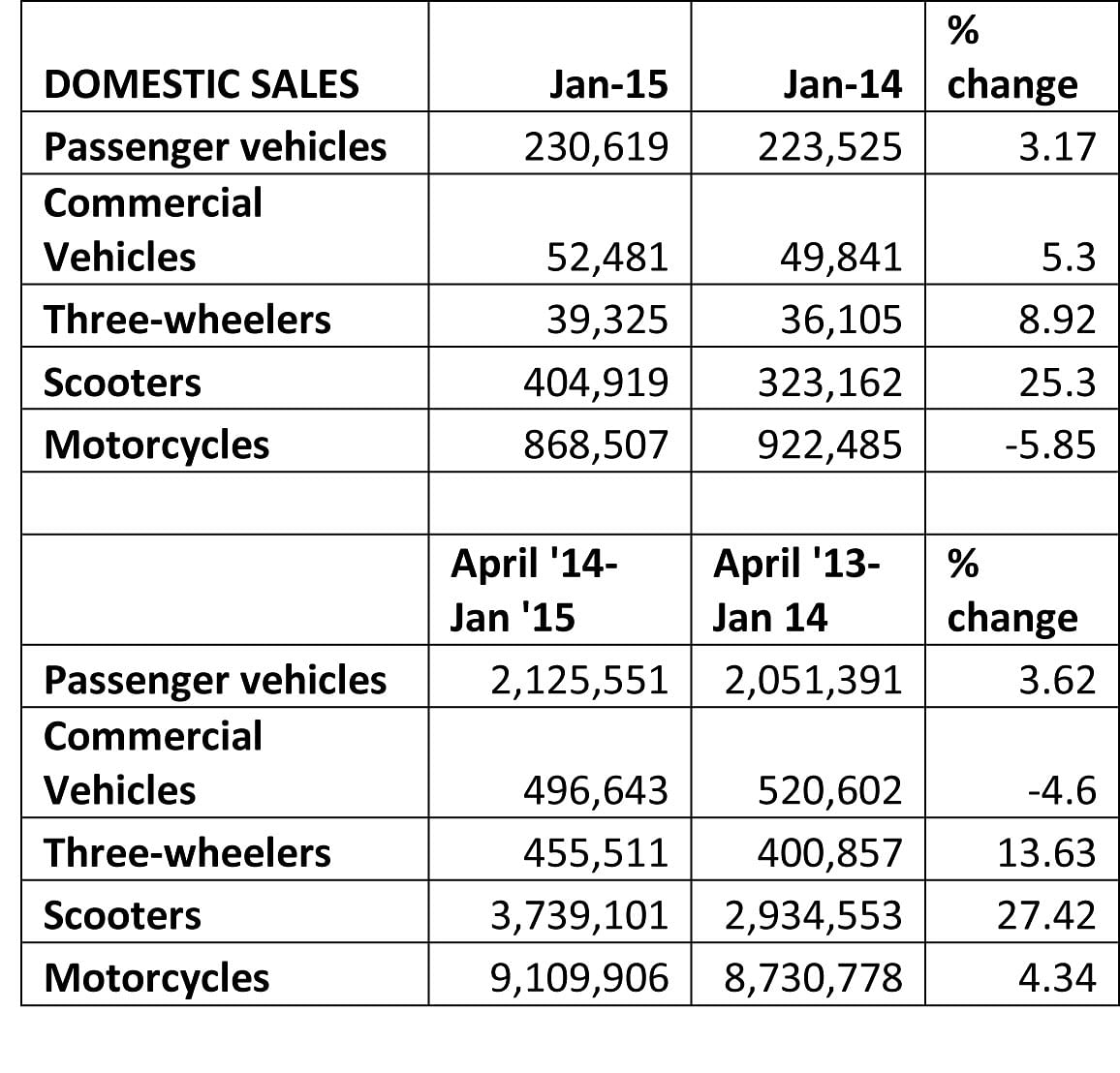

Some industry experts feel that the LCV market will take another 6-8 months to pick up steam. Overall, however, the CV sector is not in the red, growing 5.30 percent over January 2014 to 52,481 units last month.

In three-wheelers, passenger carriers posted a higher growth of 11.64 percent to 30,819 units compared to goods carriers, which experienced stunted growth of 0.07 percent at 8,506 units.

Scooters continued to enthral customers over motorcycles, growing a robust 25.30 percent to 404,919 units in January 2015 while motorcycles de-grew at 5.85 percent to 868,507 units. Moped sales fell 20.17 percent to 54,531 units while total two-wheeler sales stood at 13,27,957 units with a poor showing of just 1.07 percent growth.

The decline in motorcycles has come as a shocker in January but Mathur says the two-wheeler market has a different scenario and has become bifurcated between the urban and rural markets. While in the urban areas, scooters are replacing bikes in terms of stoking demand, motorcycles which once contributed to a major chunk of sales in the rural regions have not climbed up. One reason is that customers don’t have enough money at their disposal as a result of a poor monsoon.

Industry notches 8.71 percent growth in April 2014-January 2015

SIAM’s April 2014-January 2015 sales statistics show an overall industry growth of 8.71 percent at 16,551,018 units with the largest chunk coming from the three-wheeler segment at 455,511 units, growing at a rate of 13.63 percent. Three-wheeler passenger carriers carried the day with a growth of 15.14 percent to 373,166 units while goods carriers grew 7.27 percent to 82,345 units.

Passenger vehicles grew by 3.62 percent to 2,125,551 units with passenger cars up 4.79 percent to 15,28,279 units; utility vehicles rose 5.58 percent to 454,943 units while vans declined by 12.15 percent to 142,329 units over sales in the corresponding period the previous year.

The overall CV segment registered de-growth of 4.60 percent with sales of 496,643 units. While M&HCVs grew by 12.91 percent to 181,393 units, LCVs fell 12.42 percent to 315,250 units.

Two-wheelers sales recorded growth of 9.97 percent to 13,473,313 units with the largest sales coming from scooters at 27.42 percent at 37,39,101 units. Motorcycles grew 4.34 percent to 91,09,906 units. Mopeds also posted a growth of 6.38 percent to 6,24,306 units.

Overall, automobile exports grew by 19.40 percent during April-January 2014-15 to 3,07,0588 units. Passenger vehicles, commercial vehicles, three-wheelers and two-wheelers grew by 6.66 percent to 527,467 units, 14.73 percent to 69,368 units, 18.98 percent to 3,49,450 units and 23.30 percent to 21,24,303 units respectively.

SIAM is maintaining a cautious stance on projections for the fiscal year 2015-16 as it does not expect any major jump in sales over the next two months of the current fiscal. But an improved economic growth and a revival in construction and road-building activities could lead to increased sales.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

10 Feb 2015

10 Feb 2015

4133 Views

4133 Views

Autocar Professional Bureau

Autocar Professional Bureau