Brexit: LMC Automotive slashes UK car sales forecast

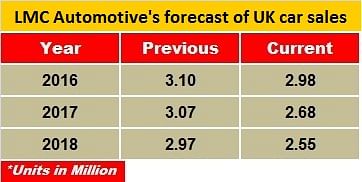

The UK's light vehicle demand is expected to fall 15% to 2.55 million units in 2018 versus 3 million units earlier.

The UK’s European Union membership referendum on Thursday 23 June has resulted in a vote to leave the EU, with 52% of the voting for ‘Brexit’. As a result global research agency LMC Automotive today slashed its car sales forecast in the UK by 15% for 2018.

“With an effective increase in prices due to sterling depreciating, lower economic growth forecasts and weaker confidence, we have lowered our forecast for light vehicle sales in the UK. Our new base forecast for the UK light vehicle market is for demand to fall 15% to 2.55 million units in 2018 (versus 3.0 million units in 2018 earlier); this represents a reduction in the volume of 410,000 units in 2018 versus the previous forecast” LMC said in a note today.

“There will likely be a great deal of uncertainty in coming weeks, months and (potentially) years relating to the UK’s exit from its membership of the EU. After the announced resignation of the UK Prime Minister (in October) and lack of immediate need to trigger the exit process, the official process to leave the EU would take time due to a two-year negotiation period between the UK and the European Council (EC),” the note explained.

Oxford Economics assumes that it will take the UK longer than two years to negotiate trade deals with the EU and other countries, a view supported by trade negotiators from a variety of institutions. Therefore, at the end of the two-year negotiation period, the UK looks set to revert to trading under WTO rules.

The depreciation of pound sterling will effectively lead to higher prices of imported vehicles. Slower economic growth for the UK is expected, with Oxford Economics estimating that 1.3 percentage points will be knocked off GDP in the next two years. Business and consumer confidence are likely to be hit by uncertainty and a weaker growth outlook.

Commenting on the immediate impact of the UK’s decision to leave the EU, LMC said that a sell-off of UK financial assets and a sharp depreciation in the pound sterling is on the anvil. While a weaker currency might provide some support to UK exporters during the negotiation period, but uncertainty over the future of the UK’s relationship with the EU will weigh on business and consumer sentiment and depress overall growth.

“Uncertainty will likely hold back investment, and hiring decisions, as businesses consider their options and wait for greater clarity, something which is unlikely to come quickly,” it added.

Wider impact on EU

The UK imports almost 90% of its light vehicles, of which 80% are imported from the EU. The loss of sales volume of 410,000 units in 2018 alone will, therefore, impact European build most heavily. According to LMC, Germany will see the greatest volume adjustment, losing 130,000 units compared to the previous base case.

The interconnectedness of the auto industry between countries in the EU is undeniable; the UK exports almost 80% of car production, half of which heads to the EU. As the UK looks to unpick its current trading relationship with the EU, the uncertainty and barriers to trade risk hitting investment in the UK automotive production.

“Under our new base case forecast, we do not assume the UK’s leave vote will fuel an EU economic downturn. However, heightened uncertainty about the future political (especially with more countries likely to bring into question their own EU membership) and economic landscape in Europe could have a meaningful impact on business confidence and market sentiment. If this leads to a slowing of EU GDP growth, then this will naturally have a negative impact on light vehicle demand and production in the region. More negative scenarios for Europe as a whole are, therefore, plausible,” LMC warned.

Recommended:

- Automakers brace for Brexit impact

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

24 Jun 2016

24 Jun 2016

5926 Views

5926 Views

Ajit Dalvi

Ajit Dalvi