European ‘Big 5’ markets grow in April as SUVs continue dominance

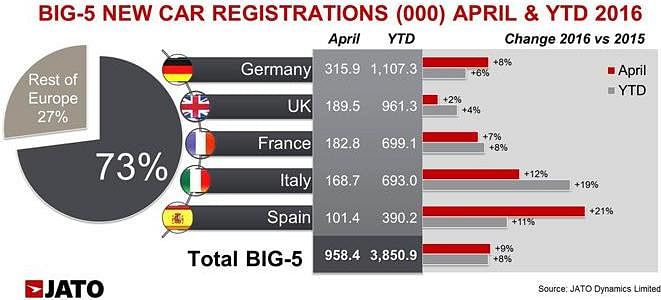

Led by strong growth in Spain and Italy, new car sales in Europe’s Big 5 markets grew by 8.6% to 958,400 units in April 2016.

Led by strong growth in Spain and Italy, new car sales in Europe’s Big 5 markets grew by 8.6% to 958,400 units in April 2016. After the UK’s traditional volume peak in March, which saw sales rise to 1.36 million, April produced further gains across the top five European markets with SUVs driving higher volume and counting for 24.4% and 24.9% of April’s and YTD’s totals respectively.

The Seasonally Adjusted Annual Rate (SAAR) came in at 11.35 million, up from March sales of 11.04 million and significantly higher than the 10.48 million in April 2015.

Germany continued to lead the market, with volume up by 8.4% at 315,900 units, accounting for a third of the Big 5’s total. After a relatively flat March, April saw sales grow healthily, bringing the YTD total to 1.11 million units, up by 5.6% over January-April 2015. Impressively, April’s volume for Germany was the highest since 2009. The UK also saw positive growth – despite only seeing a 2% rise on April 2015, last month was the best April for UK car sales for a decade. The UK total was 7,000 units higher than the total recorded in France, where the sales advanced by 7.1% at 182,800 vehicles - the best April result in France since 2010. However, the largest growth figures were recorded in Italy and Spain, where April’s volumes grew by 12.3% and 20.7% respectively. While Italy moderated its growth, after an 18% rise in January, followed by 28% in February and 18% in March, Spain returned to positive growth after a 1% decrease posted in March.

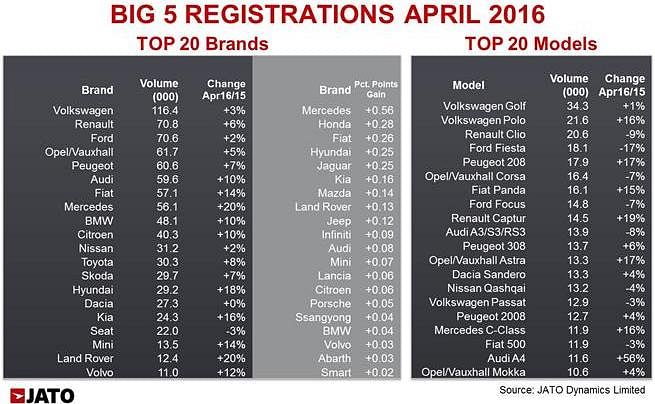

Volkswagen led the brand leader board, recording 12.2% market share at 116,400 units. However, its volume grew by only 3.1% over April 2015, leading to a market share loss of 0.66 percentage points compared to April 2015 - the largest market share fall of all the brands. The brand posted a strong increase in Spain (+31%), but lost market share in Italy (+10%), Germany (+3%) and France (+1%), and recorded a significant sales drop in the UK (-10%). Volkswagen’s SUV sales counted for 8% of its total, with volume falling by 18%. However, the German brand was not the only one to lose market share. Volume at Renault, Ford, Opel/Vauxhall and Peugeot grew less than the market’s average change, as their SUV sales growth (+32%) was offset by the decline on their subcompact volume (-6%).

Recommended: UK new car sales up again, but diesel demand drops

In contrast to the top 5 brands, Audi, BMW, Mercedes, Fiat and Citroen reported solid growth figures, with Mercedes posting the highest growth in the top ten, achieving +20.2% over April 2015. In the case of the three German premium brands, their sales were boosted by a 25% gain from the SUV range and strong increases in Spain, Italy and France. The healthy performance of the Italian market continued to be a source of strength for Fiat, which registered 63% of its cars in its home market. However, in terms of percentage growth, its volume grew faster in Spain (+31%), Germany (+19%) and France (+15%). Citroen completed the top 10 with 40,300 units sold, increasing its market share from 4.15% in April 2015 to 4.21% last month. Other big increases outside the top 10 included Land Rover (+20%), Hyundai (+19%), Kia (+16%), Mazda (+26%), Honda (+63%), Jaguar (+147%) and Infiniti (+159%).

With only two exceptions, all segments recorded market share losses, with the subcompacts losing most ground, recording 21.7% market share (vs. 22.9% in April 2015). This segment, the second largest in the Big 5, was negatively affected by the growth in popularity of SUVs, as volume dropped off 9% at Renault and 17% at Ford. The market share decline posted by the subcompacts, MPVs, compacts, city-cars and Vans was exactly the same as the percentage points gained by SUVs, up by 2.62 points from 21.7% market share in April 2015 to 24.4% one year later. The fastest growing segment in Europe was led by Nissan, although they only grew by 3%. In contrast, Renault’s sales grew by an impressive 83%, thanks to the success of the Captur and Kadjar. As a result of the success of the new Q7, Audi was able to outsell Peugeot, and become the third best-selling brand in the SUV ranking. Ford, Mercedes, Hyundai, Kia and Fiat were the other big winners.

In the model ranking Volkswagen occupied the first two places, with the Golf first with 34,300 units sold - up by only 1.0% on April 2015. The Polo ranked second, up by a strong 16% with 21,600 units sold. The top-seller lost 0.27 percentages points (pp) of share, with other loses experienced by the Opel/Vauxhall Corsa (-0.28 pp), Renault Scenic (-0.40), Clio (-0.42), Ford Fiesta (-0.58) and Hyundai ix35 (-0.68). The Polo outsold the Renault Clio (-9.2%) and Ford Fiesta (-17%), both of the latter models negatively affected by lower sales in their home markets. In April, the Peugeot 208 not only outsold the Opel/Vauxhall Corsa but also moved very close to the Fiesta. However, the stand-out performance of the month was the Renault Captur, overtaking the Nissan Qashqai to become the best-selling SUV in the Big EU 5, achieving sales of 14,500 units. This represented an increase of 19%, versus the Qashqai’s 13,200 units, respresenting a decrease of 4.1%. The small SUV from Renault benefited from rising demand in France (+29%), Germany (+26%) and UK (+19%), while the compact SUV from Nissan posted sales falls in France (-14%), UK (-5%) and Italy (-1.7%). April’s big market share winners include three SUVs (Hyundai Tucson, Renault Kadjar and Mercedes GLC), one compact (Fiat Tipo) and the new Audi A4.

Also read: Europe’s SUV boom being driven by ‘modern mums,’ millennials and ‘quintastics’

“Last month was the second best April of the last ten years,” commented Felipe Munoz, global automotive analyst at JATO Dynamics. “While Germany, France and the UK are reaching their sales peak, further growth is expected in Italy and Spain. Unlike the circumstances of a decade ago, the growth is largely driven by the outstanding expansion of the SUV segment. The appeal of SUVs continues to gain further momentum at the expense of more traditional models,” concluded Munoz.

Also read: SUVs continue to dominate Europe’s ‘Big 5’ markets in March

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

13 May 2016

13 May 2016

4532 Views

4532 Views

Ajit Dalvi

Ajit Dalvi