SUVs continue to dominate Europe’s ‘Big 5’ markets in March

The SUV boom continued at an impressive pace, with the segment gaining even more market share, thanks to sales growth of 22% during March, and an overall 25% increase in Q1 of 2016.

Since the turn of the year, Europe has seen an increasing demand for SUVs with sales for March 2016 going up by 22% year-on-year (YoY). SUV sales also ranked first in the first quarter, accounting for more than one out of four passenger cars sold.

The latest figures for Germany, UK, Italy, France and Spain show further positive results for March 2016. Thanks to the traditional registrations peak in the UK, the total for the ‘Big 5’ markets surpassed the one million units mark, rising to 1.36 million new cars, up by 5% over March 2015. First quarter sales advanced 8% to 2.89 million cars, while the March SAAR came in at 11.04 million across the five markets.

The SUV boom continued at an impressive pace, with the segment gaining even more market share, thanks to sales growth of 22% during March, and an overall 25% increase in Q1 of 2016. Last month its registrations in the ‘Big 5’ European markets totalled 343,400 units, making up over 25% of the total. In contrast to this positive trend, sales of sub-compacts fell 1% over March 2015 and grew by only 3% during the first quarter. Meanwhile compact vehicles sales were up 4% in the month, and 7% in the quarter. However, these two segments were not the biggest casualties of the SUV segments surge, as the MPV figures show that their volumes have dropped by 8% in March, and 3% since January 2016. The same occurred in the large sedan/SW segment, with registrations down by 7% in March and 5% in the first quarter.

Italy sees largest sales increase

However, last month’s growth can be attributed to different factors across different regions. Italy saw the highest increase, with sales recording an 18% jump compared to the same month last year. This was possible thanks mostly to higher company car and private purchases. Despite this big increase, Italy was only the fourth largest market of the ‘Big 5’, ahead of Spain. Volumes in the UK advanced 5% to a March record of 518,700 units, taking its year-to-date total to 771,800 cars. France was the other big market to register a monthly increase (+7%), with YTD growth at 8% over the first quarter of 2015. March sales in Germany and Spain stalled at 0% and -1% respectively, though their YTD volumes were still positive at +4% in Germany and +8% in Spain.

Volkswagen continues to be bestselling brand despite sales dip

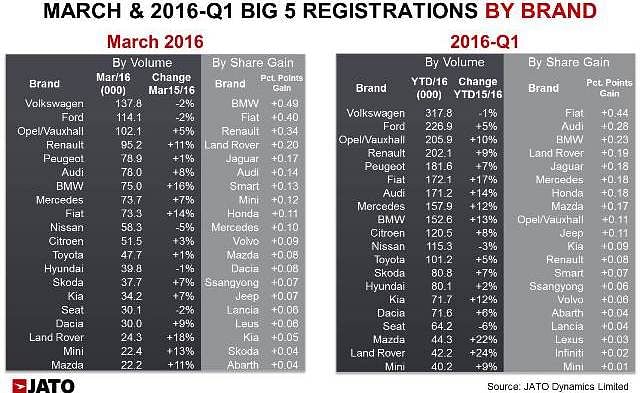

Meanwhile, Volkswagen remained the best-selling brand with 137,800 new cars, though sales dipped 2%, losing ground on its competitors by 0.77 percentage points. The German brand’s market share has now slipped for nine straight months, as the company continues to deal with the emissions issue. Volkswagen registrations dropped by 6% in Germany and 17% in Spain, and the brand lost market share in the UK and France. Only its sub-compact and compact ranges posted positive numbers. But it was not the only big brand to lose ground, as second placed Ford also suffered from lower demand in Spain (-27%) and in the UK (-5%), taking its ‘Big 5’ total to 115,800 units, down by 2% from March 2015. Meanwhile, Opel/Vauxhall and Peugeot posted small gains, leaving Renault as the best improver among the top 5 best-selling brands. The French car maker was boosted by strong double-digit growth in Italy (+31%), France and the UK, as its SUV range continues to gain popularity (+65% in March).

The top 5 mainstream brands were followed by the three German premiums, which gained market share thanks mostly to their SUV sales, and were collectively up by 37%. Sales of BMW’s ‘X’ family grew 43%, accounting for almost 24% of its total sales in March. That was higher than the comparative shares for Audi’s Q-range (21.7%, up by 16%) and Mercedes’ SUV family (20.8%, up by 61%). Fiat occupied ninth place, with 5.4% market share and a 14% jump in March, thanks mostly to its popularity (+22%) in the Italian market. Italy accounted for 57% of Fiat’s volumes within Europe’s ‘Big 5’. The top 10 was completed by Nissan, which experienced a 5% drop, reducing its market share from 4.8% in March 2015 to 4.3% as of last month.

The premium segment was boosted by strong sales increases coming from Land Rover, Volvo and Jaguar, as well as Infiniti, which more than doubled its volume over March 2015. Other key improvers included Ssangyong, Honda, Mini, Smart, Abarth and Lancia.

VW Golf mirrors the brand’s sales trend

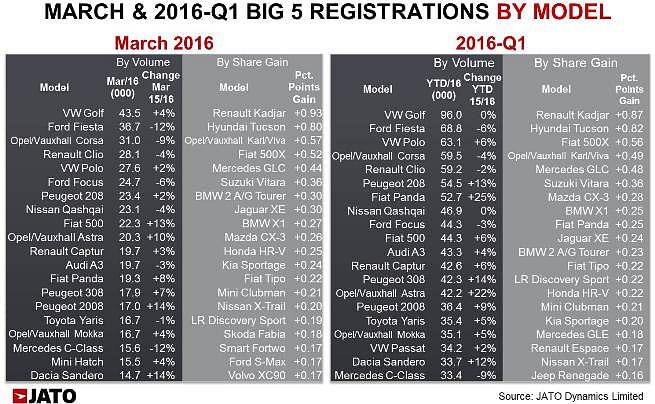

The Volkswagen Golf topped the model ranking, with sales rising 4% to 43,500 units, while its cumulative results since January remained stalled (+0%). Despite its low growth rate, Volkswagen’s model did better than others at the top of the table, as Ford recorded a 12% drop on its Fiesta registrations, similar to the Opel/Vauxhall Corsa (-9%) and Renault Clio (-4%). In fact, there were only two models among the top 10 to gain market share: the Fiat 500 and Opel/Vauxhall Astra. The small Fiat re-entered the top 10 with a 13% rise, due largely to strong increases in Italy, France and Spain, while the Astra recorded a 10% increase. Among the big market share winners were the Renault Kadjar, Hyundai Tucson, Opel/Vauxhall Karl/Viva, Fiat 500X and Mercedes GLC.

“With lower increases across the Big 5 markets, we have seen an overall slowdown in growth. However the situation continues to be positive, with an overall growth rate of 8% for Q1 in 2016. The shift from traditional segments to SUVs continues, as more carmakers invest in what has proved to be an impressively popular and high-growth segment” concluded Felipe Munoz, global automotive analyst at JATO Dynamics.

Also read: Surging SUV sales pep up European new car market in February

RELATED ARTICLES

Trump slashes import tariff for UK-made vehicles to 10%

Tax applies to first 100,000 cars exported from UK to US; reduced from a previously announced 25% rate.

Hyundai Mobis develops battery system with built-in fire extinguishing feature

The new system prevents heat from being transferred to adjacent cells and extinguishes a fire early by spraying an agent...

FORVIA and Smart Eye unveil in-car iris and facial biometric authentication

This world-first innovation not only enhances the user experience by enabling seamless and secure payments but also open...

By Autocar Professional Bureau

By Autocar Professional Bureau

18 Apr 2016

18 Apr 2016

4326 Views

4326 Views