European car sales in July decline for the first time in 34 months

Volkswagen continued to be the best-selling brand despite a reduction in overall market share. The SUV segment continued to grow, posting an 11.9% increase.

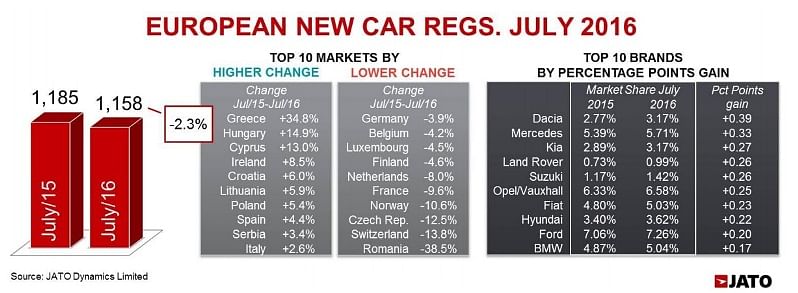

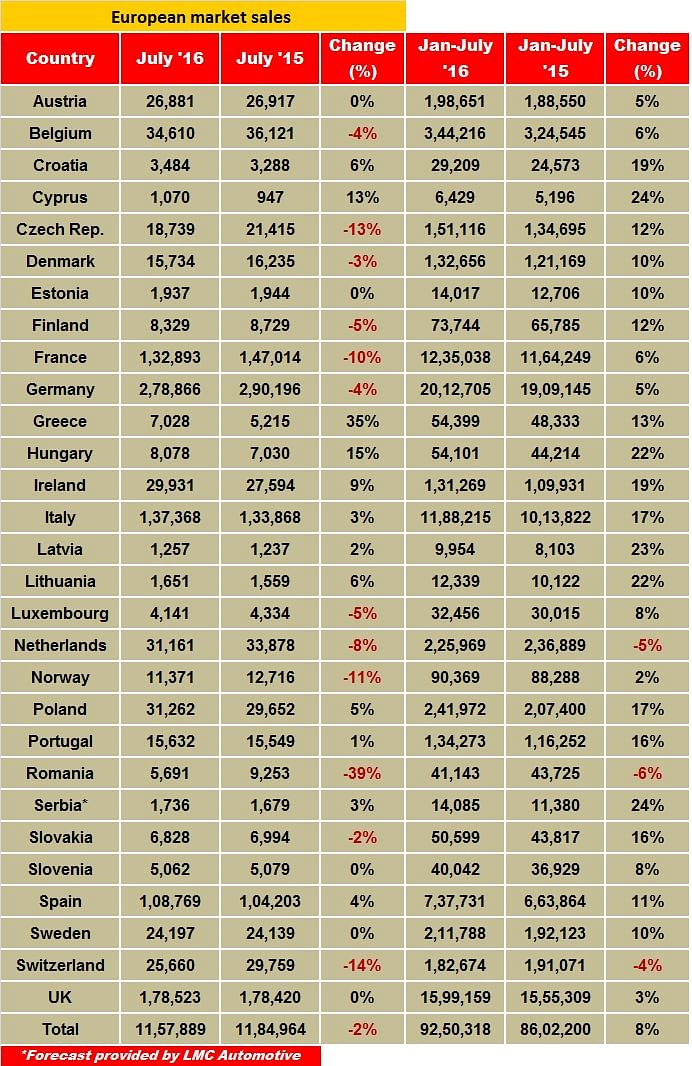

European new car sales in the 29 markets analysed by JATO Dynamics dropped by 2.3% in July, falling from 1.18 million in July 2015 to 1.16 million for the same period this year. This fall in sales marked the end of 34 months of continuous growth, the last time European sales fell was August 2013.

The two fewer working days in July may have been a contributor to the negative result, along with the significant decline of two of the largest European car groups, PSA and Volkswagen, who recorded a 13.2% and 8.8% fall in sales respectively.

The UK posted flat sales with a 0.1% increase, which is an improvement on June’s figures. Of the Big 5 markets, France and Germany recorded significant drops of 9.6% and 3.9% respectively, whilst the others recorded modest increases, with Italy posting a 2.6% rise and Spain a 4.4% increase.

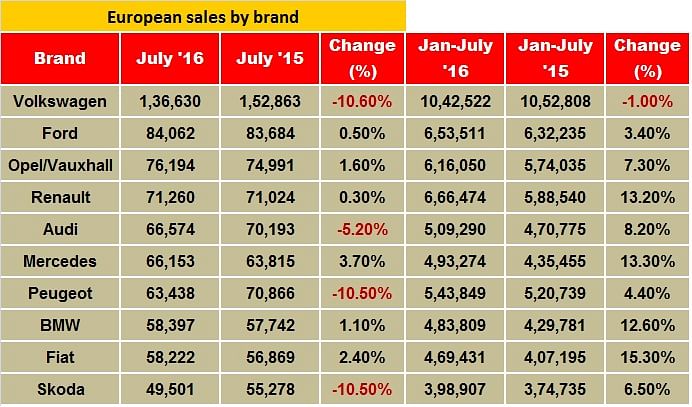

Volkswagen was the best-selling brand, with 136,393 units registered, accounting for 11.8% of the total market. But in comparison, in July 2015 its volume of 152,863 units accounted for 12.9% of the total market. Despite still leading the market in terms of sales, Volkswagen recorded the highest drop of any brand in the Top 10, falling by 10.8% compared to the same period last year, closely followed by Skoda and Peugeot who both recorded a 10.5% drop. Volkswagen’s fall in demand could be attributed to the emissions issue and anticipation ahead of the launch of the updated version of the Volkswagen Golf at the Paris Motor Show in October.

On the other hand, Mercedes posted the highest increase in the Top 10, but this was a modest 3.7%, which saw the brand register 66,153 units in July 2016. Outside of the Top 10, Dacia (+11.5%), Suzuki (+19.5%), Mini (+10.7%), Land Rover (+33%), Honda (+15.3%) and Jeep (+11.4%) recorded double-digit growth largely driven by their SUVs. Other strong performers were Infiniti which posted a dramatic increase of 218% registering 1,768 units, largely due to the popularity of the Q30 and QX30. Jaguar was another big improver, posting a 32.5% increase due to strong demand for its mid-size SUV the F-Pace.

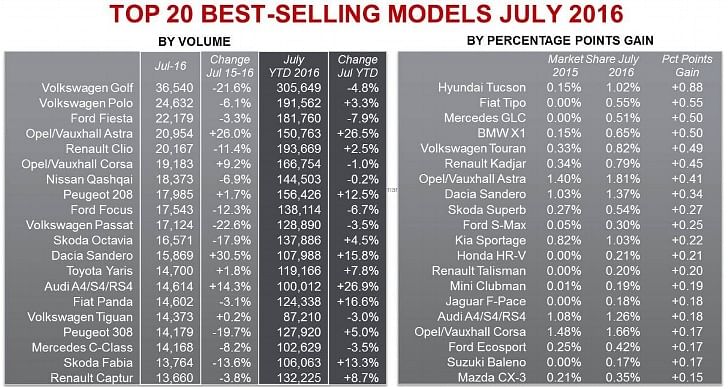

The Volkswagen Golf was still the best-selling model, with 36,540 units sold in July, but its volume dropped considerably, resulting in the model’s second lowest market share since December 2012. By comparison, in July 2015 Volkswagen sold 46,628 units. This decline coincides with the model’s biggest rival, the new generation Opel/Vauxhall Astra becoming the fourth best-selling car in Europe, selling 20,954 units, up 26% on the same period last year. The other big players all posted double digit falls, including the Ford Focus (-12.3%), Skoda Octavia (-17.9%), Peugeot 308 (-19.7%) and the Audi A3 (-25.9%). The Mercedes A-Class and the Volvo V40 were two of the C-segment models that saw an increase in sales.

In the subcompact segment it was the Opel/Vauxhall Corsa which stood out, registering a significant increase of 9.2% in contrast to its major rivals such as the Volkswagen Polo, Ford Fiesta and Renault Clio which posted declines of 6.1%, 3.3% and 11.4% respectively. The Dacia Sandero was the other popular subcompact to post an increase with a dramatic 30.5% rise on the same period last year.

Felipe Munoz, global automotive analyst at JATO Dynamics commented: “July marked the first decline in new car sales in almost three years. This was largely driven by market conditions but there have been some significant drops recorded by some of the most popular models and brands.”

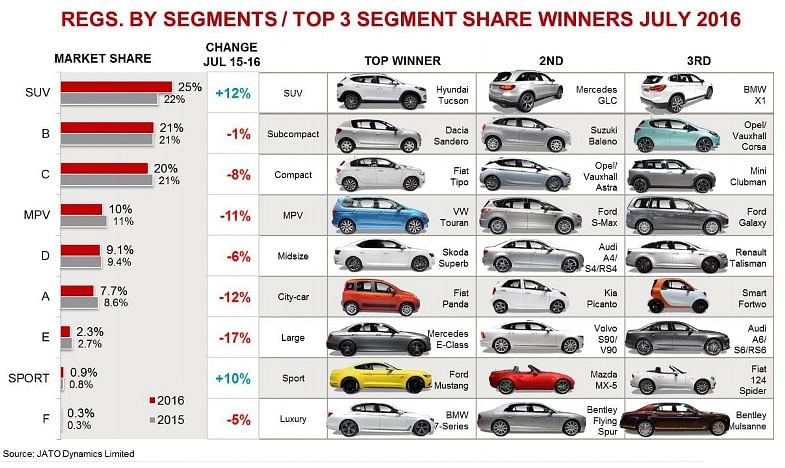

The SUV segment continued to grow, increasing sales by 11.9% compared to July 2015, meaning it now accounts for 25.5% of the overall market, largely due to growth amongst the D-SUV and C-SUV groups, at the expense of the Compact, MPV and large Sedan/SW segments. The Nissan Qashqai kept its position as the best-selling SUV, selling 18,373 units, but this was a 6.9% drop on the same period last year. It was its newer rivals such as the Renault Kadjar, Hyundai Tucson and Kia Sportage which drove the segment’s growth, posting significant increases of 127%, 586% and 24% respectively. The new generation of the Volkswagen Tiguan meant the model reversed the downward trend seen last month, posting a small 0.2% increase.

The Peugeot 2008 boosted the B-SUV segment’s sales with a rise of 6.9%. Amongst the larger SUVs, the Volvo XC60 maintained its lead of the mid-size group despite the rise of the Mercedes GLC, beating both the Audi Q5 and BMW X3. The Jaguar F-Pace was the eighth best-selling D-SUV. Volvo also led in the large SUV segment, thanks to the 15% increase posted by the XC90 which surpassed the BMW X5 (-4.8%), Mercedes GLE (+78%), Audi Q7 (+5.3%) and Range Rover Sport (+31%).

MPVs continued to decline, with sales down by 11% despite the strong performance of the Volkswagen Touran which posted the highest percentage increase of the month (+144%). Other big segment winners were the midsize Audi A4 and Skoda Superb, the compact SUV BMW X1, the B-SUVs Ford Ecosport, Suzuki Vitara and Jeep Renegade, and the midsize SUV Nissan X-Trail. At the other end of the spectrum, the biggest drops were recorded by the Mercedes CLS, Porsche Panamera and Cayenne, Volkswagen Touareg, Citroen C5, DS 5, Nissan Pulsar, Hyundai i40 and Mitsubishi Space Star.

“Despite July’s slightly disappointing results, the full year figures are unlikely to be impacted too severely. The lower growth rates we are currently seeing are likely to moderate the larger growth rates we have seen in some of the biggest markets over the past three years,” concluded Munoz.

You may like:

- Renault overtakes Ford to become Europe’s second largest car brand

- Slowdown in Europe’s Big 5 markets as new car sales drop 2% in July

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

26 Aug 2016

26 Aug 2016

9437 Views

9437 Views

Ajit Dalvi

Ajit Dalvi