European car sales decline for fifth consecutive month in January 2019: JATO Dynamics

JATO Dynamics’ study finds that despite the drop, the European car market has recorded its second highest January volume in a decade.

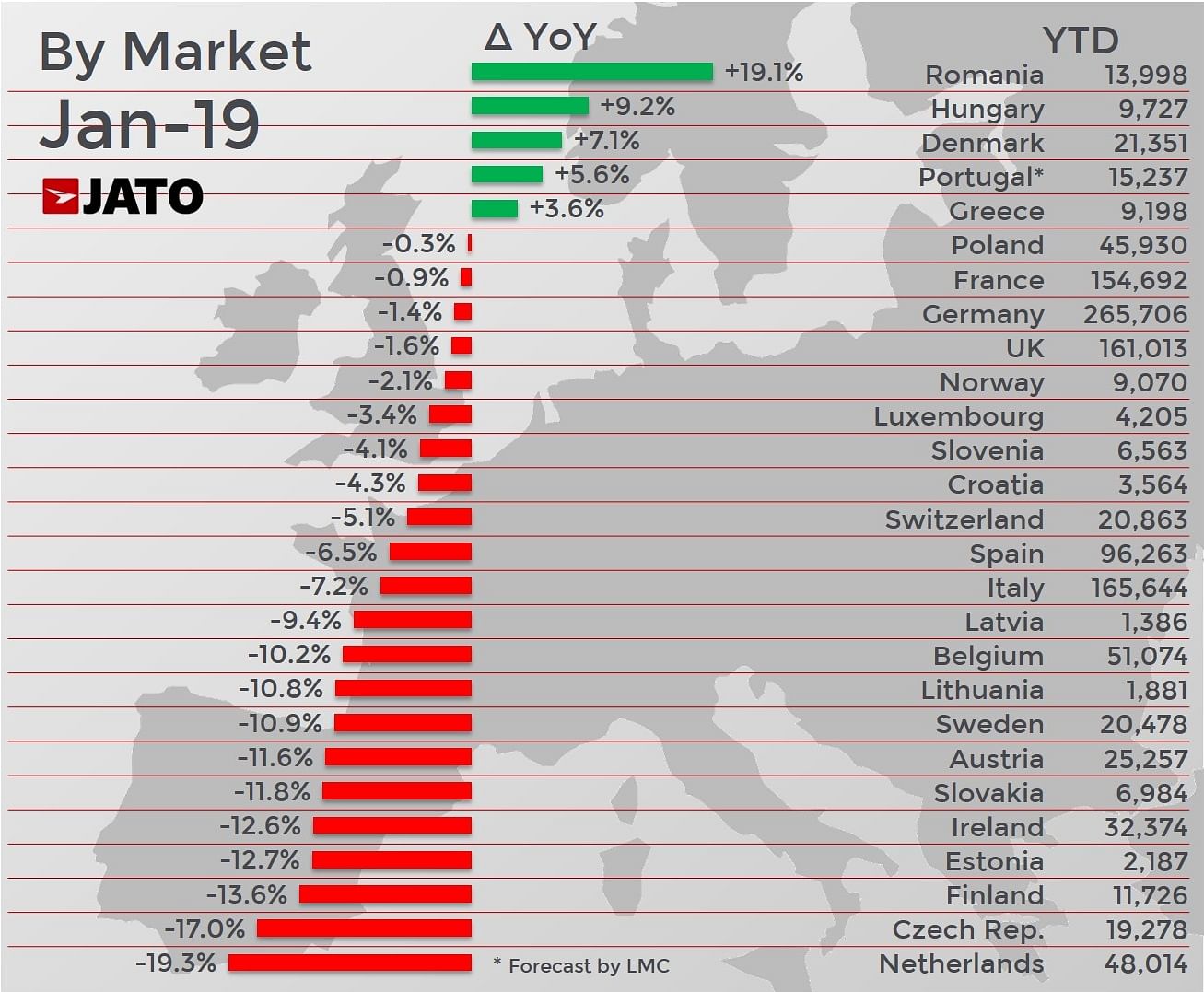

The European car market registered its fifth consecutive month of decline in January 2019, as registrations fell by 4.6 percent. However, it was the lowest monthly decline since the introduction of WLTP (Worldwide Harmonised Light Vehicle Test Procedure) in September 2018, and the second highest January volume of the last 10 years, as 1.22 million new cars were registered, says JATO Dynamics, a London based data analyst team report.

The overall fall in registrations was largely due to only Romania, Hungary, Denmark, Portugal and Greece recording growth, which are all small markets and not big enough in size to offset drops in the big five markets, or double-digit falls in midsize markets like the Netherlands, Belgium and Czech Republic.

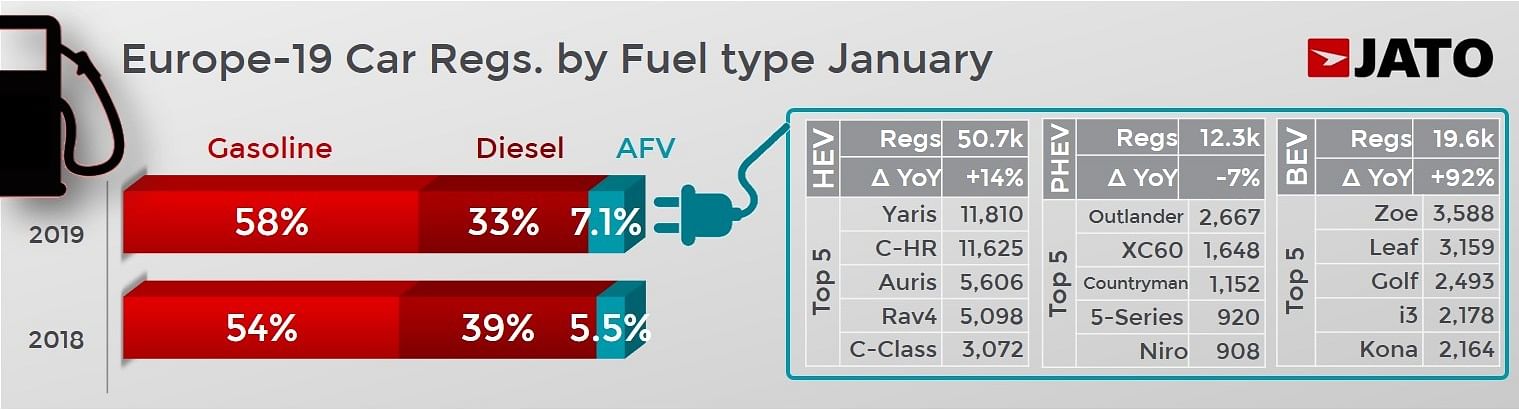

The report says the demise of diesel looks set to continue in 2019, as volume fell by 18 percent in January and counted for just 33 percent of total registrations. This came as a result of a big decline in Italy, where volume was down by 30 percent, translating to the country losing its title of being the biggest market for diesels. The Italian market was outsold by Germany – where demand grew by 8 percent – the only country to post an increase other than Estonia.

Diesel declines, BEVs start seeing acceptance

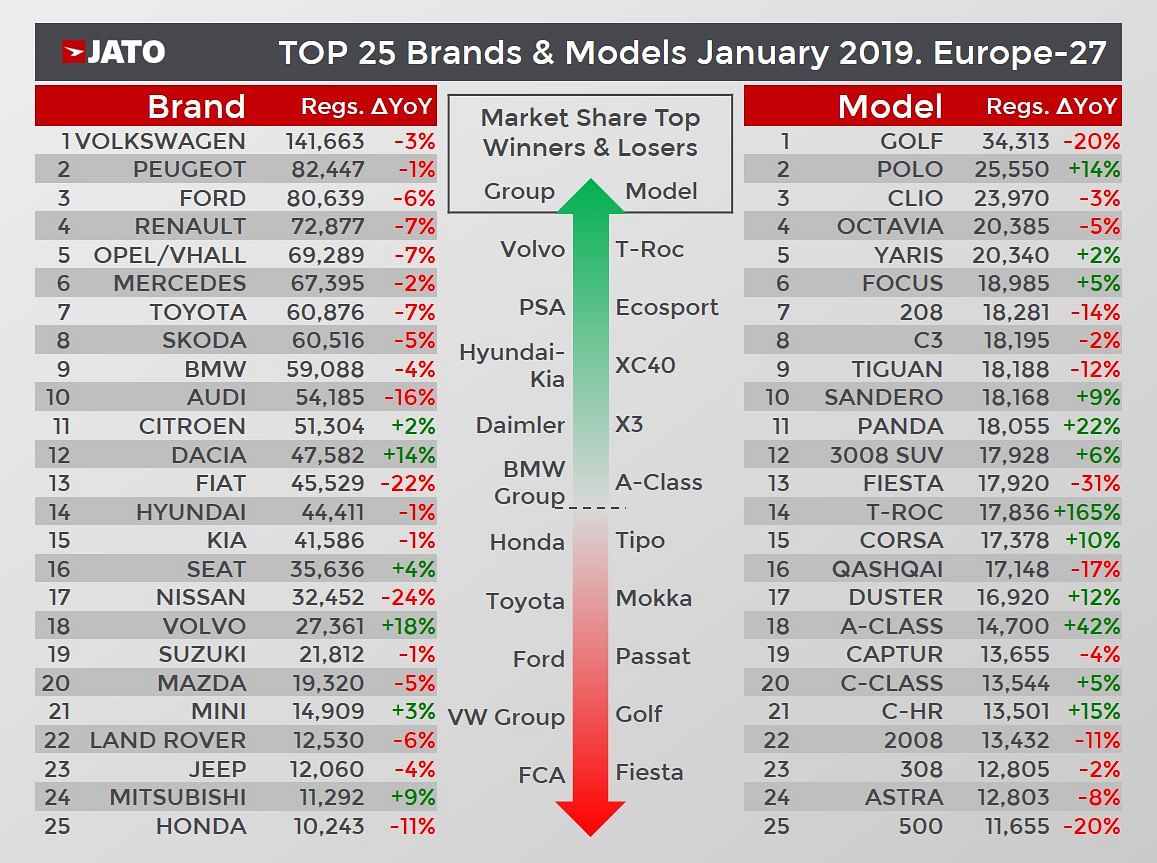

In terms of OEMs, Volkswagen, Volvo, Seat and DS were the only brands to post diesel registration increases. Meanwhile, petrol cars accounted for 58 percent of total registrations, as volume increased by 2.1 percent. This marks almost 4 more percentage points than the total recorded in January 2018 and JATO Dynamics says this confirms the continuous shift away from diesel and towards petrol/AFVs (alternate fuel vehicles).

The AFV registrations grew by 22 percent in January 2019 accounting for 7.1 percent of the total market, with battery electric vehicles (BEV) responsible for driving this growth. BEV registrations almost doubled from 10,200 in January 2018 to 19,600 last month. The research body says the BEV boom wouldn’t have been possible without the outstanding results of the Renault Zoe (the top-selling BEV in Europe), Nissan Leaf and Hyundai Kona. Meanwhile, Kia recorded 666 registrations of the e-Niro, Jaguar recorded 509 registrations of the I-Pace, and Audi clocked 430 registrations of the E-Tron. “These results confirm that battery electric vehicles are finally taking off thanks to the arrival of SUVs,” commented Felipe Munoz, JATO’s global analyst.

SUV sales witness slowdown

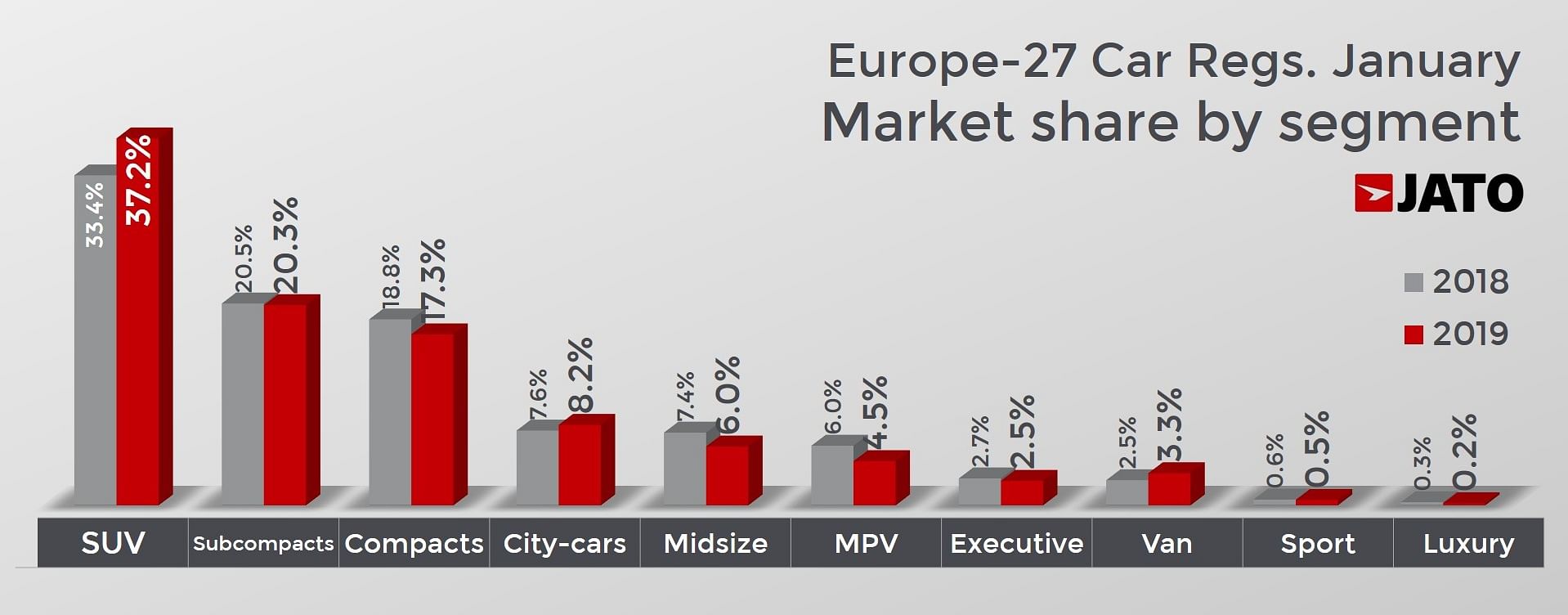

Although SUV registrations continued to grow, there was a significant slowdown to just 6.1 percent. However, Munoz said “This can be blamed on the current situation of the European market rather than a lack of consumer interest in the segment."

The introduction of 14 new models over the course of 2018 also resulted in growth for the segment, and in terms of small SUVs registrations in January they performed well recording 171,700 registrations. The volume was up 13 percent as the Volkswagen T-Roc led the sub-segment for the first time. Volkswagen also led the compact SUV sub-segment, having posted an increase of 4 percent to 191,000 registrations. Elsewhere, city-cars were the fourth best-selling segment, and also posted an increase thanks to strong results from PSA, Toyota and Renault-Nissan.

However, JATO found FCA continued to lead, recording almost 30 percent of the market share. Volkswagen Group continued to lead the market, despite their market share falling from 24.6 percent in January 2018 to 24.2 percent last month. The German car maker was negatively affected by big declines at its two main premium brands (Audi and Porsche) as Seat and Lamborghini were the only brands to grow. For the first time, Volkswagen Group sold more SUVs than any other type of car, reflecting the success of its latest launches in the segment, as it was also the overall top-selling SUV maker during the month.

PSA was the second biggest car maker during January, as volume fell by only 2 percent to 206,100 registrations, equivalent to just 90,000 less than VW Group. Meanwhile, Opel/Vauxhall continued to fall in the rankings, mostly due to growing competition for the Mokka SUV. FCA saw the highest market share decline, falling from 6.6 percent in January 2018 to 5.8 percent last month. The Italian carmaker felt the effects of having an aging range, which even resulted in difficulties in its home market of Italy, where it posted the lowest January market share of the last 20 years. With the exceptions of Lancia and Abarth, all other brands posted a decline. Conversely, Volvo was the top market share winner of the month and the only brand to post an increase within the top 10 car makers.

Also read: 2018 diesel car sales lowest since 2001 in Europe: JATO

European passenger cars start 2019 slow, decline 4.6% in January

UK car production falls due to slump in overseas demand

Chinese and European auto industries join hands to further global positions

RELATED ARTICLES

Isuzu unveils D-Max EV at 2025 Commercial Vehicle Show

Revealed at the 2025 Commercial Vehicle Show in Birmingham, the Isuzu -Max EV is the first fully electric commercial pic...

Hyundai unveils next−gen highly efficient hybrid system

The next-gen hybrid system is claimed to offer 45% better fuel efficiency and 19% more power compared with ICE powertrai...

Horse Powertrain reveals hybrid conversion for electric cars

Engine-making joint venture of Geely and the Renault Group announces new hybrid powertrain that fits into the same space...

By Autocar Professional Bureau

By Autocar Professional Bureau

28 Feb 2019

28 Feb 2019

8840 Views

8840 Views