ASEAN sales up 2% in H1 2016, new models to drive numbers in H2

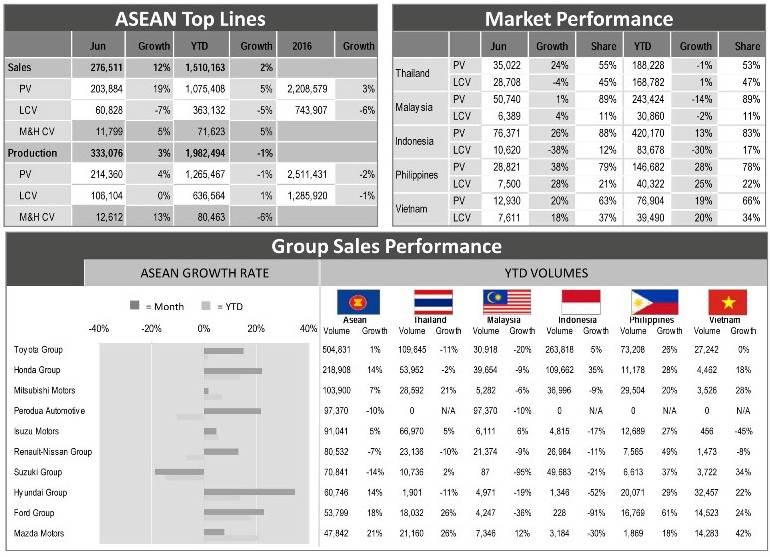

Sales in the ASEAN Light Vehicle (LV) market rose marginally by 2% to 1,510,163 units. Strong sales in June 2016 (+12%/276,511)) prevented overall numbers from falling into negative territory.

Sales in the ASEAN Light Vehicle (LV) market rose marginally by 2% to 1,510,163 units. Strong sales in June 2016 (+12%/276,511)) prevented overall numbers from falling into negative territory.

According to LMC Automotive, while Passenger Vehicle (PV) YTD sales saw increasing growth in all countries (+5%/1,075,408) except Malaysia, Light Commercial Vehicle (LCV) YTD sales were down (-5%/363,132) due to weak sales in Indonesia and Malaysia.

Businesses in both countries have cut and delayed their spending as there were no significant positive economic signals. In Thailand, LCV sales rose by 1% year on year to 168,782 units even though the economy remained weak. This is due to aggressive sales campaigns for pickup trucks which are used for both personal and commercial transportation in Thailand.

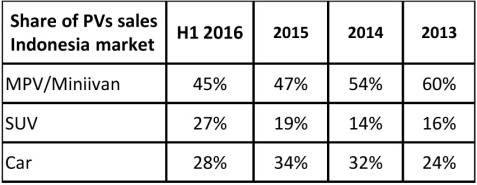

LV sales in Indonesia rose by 2%YoY in H1 2016 since the PV demand (-13% YoY/420,170) could offset the sluggish LCV sales (-30% YoY/83,678). PV sales were largely driven by SUVs, in particular new models like the Honda NRV, HR-V, Toyota Fortuner and the Mitsubishi Pajero Sport. These models contributed to 16% of the total Indonesian market in H1 2016. Also, the SUV share of the total market rose from 14% in 2015 to 22% in H1 2016.

Demand grows for Toyota Innova, Daihatsu Xenia, Datsun Go+ in Indonesia

Sales of Multi-Purpose Vehicles (MPVs), which is the largest segment in Indonesia, increased by 11% YoY in H1 2016 as a result of strong demand for the new version of the Toyota Innova, facelifted Toyota Avanza, its sister model Daihatsu Xenia and also for the low-cost green car (LCGC) Datsun Go+. The MPV share of the total market grew from 36% in 2015 to 38% in H1 2016, but its share of total PV sales dropped from 47% in 2015 to 45% in H1 2016. It is worth noting that the MPV/Minivan share stood at 54% in 2015 and 60% in 2013.

SUVs are likely to steal market share from MPVs after automakers introduced compact SUVs at affordable prices and also 7-seater SUVs which directly compete with MPVs (see table below).

However, MPV sales are expected to increase in the second half of this year after Toyota introduced its MPV LCGC models – the Toyota Calya and Daihatsu Sigra – in August 2016.

Sales in Malaysia slow down, Honda becomes No. 2 top-selling brand

Sales in Malaysia dropped 13% YoY in H1 2016; while LCV sales fell by 2%, PVs saw a sharp drop of 14%. However the Malaysian market is expected to rebound in H2 2016 as a result of national brands like Perodua and Proton launching new models. The Perodua Bezza sedan was launched in July, all-new Proton Perdana in June, new Proton Persona in August, while the Proton Saga will be introduced in September and the Proton-rebadged Ertiga in October this year.

The weak sales performance in H1 2016 can be attributed to Proton launching its four new models in H2 2016 and also to the carmaker losing market share to Perodua. The national brand’s share of the Malaysian market remained at the same levels of 48.2% and 48.5% in H1 2016, but Proton’s share dropped from 15.6% of the total market in 2015 to 13.0% in H1 2016.

For non-Malaysian brands, Honda’s YTD sales dropped by 9% YTD but were better than the overall market (-13%) and Proton (-28%), which makes the Japanese carmaker the second top-selling brand in the country, ahead of Proton.

Data courtesy: LMC Automotive

RELATED ARTICLES

Antolin unveils sustainable tech solutions at Beijing Motor Show

In line with its China market roadmap, Antolin is showcasing its latest advances in lighting, HMI, electronics, and sust...

Visteon wins $1.4 billion in new business in Q1 2024, launches 26 new products

Digitisation of vehicle cockpit megatrend is a key growth driver for Visteon with over $400 million of displays wins; Vi...

BMW uses Catena-X ecosystem using real-world CO2 data to enhance quality

Working together with partners and suppliers, the company has modelled a complete data chain for the first time using re...

By Autocar Pro News Desk

By Autocar Pro News Desk

18 Aug 2016

18 Aug 2016

4256 Views

4256 Views