UNO Minda acquires Clarton Horn of Spain, catapults into global No 2 player

The Gurgaon-based UNO Minda-N K Minda Group is in fast-forward mode to increase its global footprint. On April 29, it announced its 100 percent acquisition of Clarton Horn S.A.U. of Spain from PMAn Domestic AG that is affiliated to a US-based private equity investment firm Quantum Kapital. The estimated cost of the acquisition is pegged at 7.5 million euros (Rs 53 crore) and is funded through debt and internal accruals.

The Gurgaon-based UNO Minda-N K Minda Group is in fast-forward mode to increase its global footprint. On April 29, it announced its 100 percent acquisition of Clarton Horn S.A.U. of Spain from PMAn Domestic AG that is affiliated to a US-based private equity investment firm Quantum Kapital. The estimated cost of the acquisition is pegged at 7.5 million euros (Rs 53 crore) and is funded through debt and internal accruals. The buyout of Clarton Horn, which manufactures trumpet, disc and electronic horns and supplies to leading OEMs in Europe including BMW, Volkswagen, Mercedes-Benz, PSA-Peugeot and Renault, catapults the UNO Minda Group to the No 2 position among horn manufacturers worldwide, after FiammSpA of Italy. It also strengthens the Group’s position in the four-wheeler segment. In India, the component manufacturer caters to all segments but is especially strong in the two-wheeler horns category. A prospective customer for Clarton will be Hyundai in Korea, Europe and the US and talks are currently underway to finalise the deal with the carmaker. Fiamm at present holds a market share of 50 percent in Europe, followed closely by Clarton with a 40 percent share. Globally,Fiamm accounts for 38 percent while Minda and Clarton together will hold a 25 percent market share. Clarton has meanwhile had its share of growth pangs. After its acquisition from Robert Bosch GmbH in 2008 by Quantum Kapital AG, it was in the red. Since then, the company has undergone a successful turnaround with the support of the Quantum management team to break even. This has led to Clarton's becoming the world’s second largest manufacturer of automotive horns. It posted a turnover 38 million euros (Rs 269 crore) in 2012. For UNO Minda, which holds an over 45 percent share of the automotive horns market in India, this acquisition will help draw out a global strategy towards offering a more comprehensive range of products to customers with both the La Carolina plant in Spain and Manesar plants being complementary in nature.

In the global league

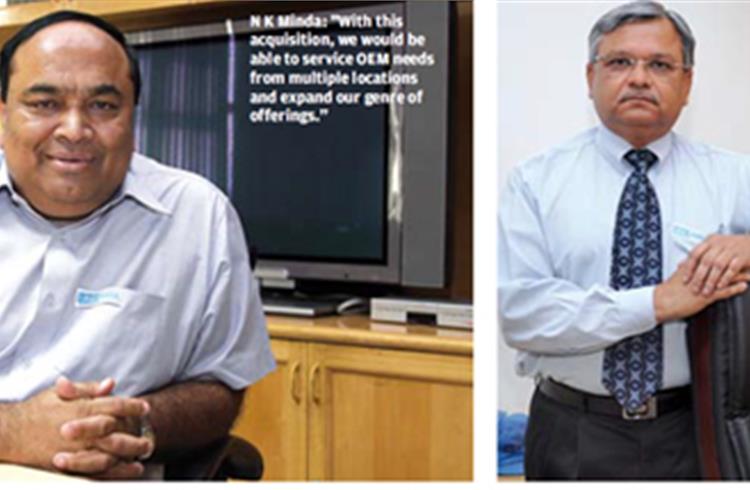

N K Minda, chairman and managing director of the UNO Minda-NK Minda Group, says: “The current acquisition will push us in the top league of suppliers of automotive horns. It complements our strategy to drive innovation through organic and inorganic growth. Clarton Horn is renowned for its technical competence, innovation and quality products. With this acquisition, we would be able to service OEM needs from multiple locations and expand our genre of offerings.” Next on the radar will be integration and consolidation activities of the Spanish plant with UNO Minda’sManesar operations. Clarton Horn also has a small assembly setup in Morocco to cater to the African market, with sales offices in Brazil, France, Germany and Korea. It supplies to Renault in Morocco but does not visualise it as a big market unless more OEMs set up base there. The Spanish component maker’s product portfolio is dominated by trumpet horns, both electronic and electromechanical; they constitute 95 percent while the rest is made of disc horns. Clarton is also strong in electronic development, an area where Minda Acoustics – the horn division of UNO Minda – is yet to find its feet.

Minda Acoustics, which has its manufacturing facility in Manesar, caters to the disc type of electromechanical horns that find large application in the Asia-Pacific region; the company also produces some electronic horns mainly of the disc variety which together make up 90 percent of its total portfolio with the balance contributed by trumpet horns. “We produce a 90mm trumpet horn at Manesar but such horns are not widely used because of space constraints in cars. Clarton produces mainly trumpet horns of 80mm diameter that are more contemporary for most passenger car OEMs. They also have a strong line-up of electronic horns in the trumpet variety; therefore, Clarton and Minda products will complement each other. Clarton’s trumpet horns are also electromechanical while Minda horns are mostly electromechanical and only a limited number are electronic. These are under development and have been supplied to a couple of off-road customers in the US in the past year. We are also developing an electronic disc horn for two OE customers in India for the bus segment,” PradeepTewari told Autocar Professional on a visit to the Manesar manufacturing facility. He is the executive executive director and CEO for Chassis and Motor Systems that includes Minda Acoustics, Clarton Horn SA and MindaNabtesco Automotive, another JV joint venture company. Tewari is also a member of the top management team at the Minda Group.

The new product will be ready within three months; due to its robust application in transport buses, electronic horns will be better suited here. Likely customers could be Ashok Leyland or Tata Motors though Tewari does not rule out Volvo, saying the horns could even target both the Swedish company’s luxury coaches and transport buses. While Clarton will supply both electronic and electromechanical trumpet horns to European markets, the Indian plant will focus more on the domestic market and the Asia-Pacific region including Thailand, Vietnam and Indonesia. Also on the anvil is entry into new markets like the US, China and Mexico, from the Clarton unit in Spain.

Future growth strategy

Based on OEMs’ market strategies, UNO Minda’s own global growth plan sees it setting up assembly operations in China over the next two years and within a year in the US. While both these markets are new to UNO Minda, the horns used here are similar to those sold in Europe and Asia Pacific. Thus, inputs for both electronic and electromechanical trumpet horns can be sourced from Clarton’s Spanish plant. For disc horns, the technical knowhow will be sourced from India and will revolve around design expertise, manufacturing processes and controls for manufacturing. But overall, the share of Clarton products is likely to be higher in the new facilities, finding more extensive applications in the four-wheeler segment where Clarton dominates. However, Tewari says the strategy for the new markets is yet to crystallise and is dependent on customer interactions over the next two quarters. “If we set up plants in more locations, it has to be a follow-through business with customers and will depend on their encouragement. Moreover, we need to first understand Clarton’s operations, supplier base and inherent technical capabilities before we crystallise our strategy.” Thanks to its strong business relationship with both Ford and General Motors, UNO Minda believes it can make headway in the US, especially in the B- and C-segment passenger cars market, including SUVs. With Clarton on board, UNO Minda’s total horn production capacity will increase to up to 45 million in the next three years; while Clarton will produce 20 million horns per annum, the Manesar plant will contribute 25 million horns annually. At present, the combined capacity is 32 million units per annum with Clarton’s 12-13 million and Minda Acoustics 19-20 million. UNO Minda’s trumpet horns, which were developed with technical knowhow from Fiamm (the four-year pact ended in 2009), are targeted at the aftermarket. However, Fiamm continues to source some products from Manesar under a buy-and-sell contract.The technology for disc horns was developed indigenously by UNO Minda.

Smooth takeover

The buyout is expected to drive home considerable tech benefits for UNO Minda. Clarton, which has 250 staffers at its Carolina plant including an R&D setup with 16 engineers, is known for its technological expertise in the field. All its suppliers are mostly Europe-based. The takeover has been smooth and Minda says, “This acquisition will have no adverse impact on the employee, supplier and customer eco-system of Clarton Horn. Its employees are now a part of the ever evolving UNO Minda-N K Minda Group. It is our commitment to maintain and grow the company.” The Group is now eyeing sharing of engineering and technical capability with Clarton which will exchange electronic horn tech for disc horn application as well as problem-solving skills. In terms of trends, China and India are high- usage markets compared to Europe and North America where trumpet horns are preferred. However, increasingly, electronic horns are finding application in India and China as they last longer, almost one million cycles compared to 100,000 cycles of traditional horns. Also, customers in India are indicating their preference for electronic horns in trumpet and in disc form. But Tewari says electronic horns are almost three times more expensive than the electromechanical variety. Further, in India, where blowing the horn is commonplace, vehicle owners change horns frequently and hence expensive electronic horns have not caught on. Disc horns are sealed horns and shriller while trumpet horns are open and more soothing. But the high dust and moisture conditions in India make disc horns more successful. Size-wise, the Indian automotive horn industry is worth an estimated Rs 300 crore and sees 4-5 major players including UNO Minda, Hella and Roots.Given the Clarton buy, UNO Minda is striving for a 50 percent growth in its existing turnover of around Rs 430 crore over the next 3-4 years from both its Spanish and Manesar horn operations. At present, Minda Acoustics contributes Rs 160 crore with Clarton pitching in the balance. About 25 percent of the turnover is exported from Manesar to buyers in the Asia-Pacific region. In comparison, exports from Clarton constitute over 90 percent of the total. All in all, reason enough for UNO Minda to blow its trumpet.

RELATED ARTICLES

Branded content: HL Klemove inaugurates first Local ADAS Radar Manufacturing Unit in India, marks a significant achievement in “Make in India” initiative

The inauguration ceremony was held in the presence of Vinod Sahay, President and CPO of Mahindra & Mahindra Ltd. and Dr....

BluWheelz to 'Green Up' logistics sector

With their EVs-as-a-service solution, the startup is playing it smart with costs and looking to electrify the entire seg...

BRANDED CONTENT: Spearheading the EV revolution in India

Jio-bp is a joint venture between Reliance Industries and BP PLC where both entities have married international expertis...

By Autocar Pro News Desk

By Autocar Pro News Desk

15 May 2013

15 May 2013

19672 Views

19672 Views