India: ready to roll again

The dynamics of the Indian auto market were on hold in recent years and industry used the respite to work on costs and export readiness.

The dynamics of the Indian auto market were on hold in recent years and industry used the respite to work on costs and export readiness. New government initiatives will help India get back on track in 2015, says Wilfried Aulbur, managing partner of Roland Berger Strategy Consultants.

Despite all odds, the Indian automotive industry has made its presence felt globally. Starting from humble beginnings at the time of liberalisation in 1991, India is today the sixth-largest motor vehicle producer globally and the third-largest market in Asia. Besides four-wheelers, the country boasts the world’s second largest two-wheeler market and the largest tractor market globally. India’s suppliers are rapidly upgrading skills and scale to leverage this opportunity. Some have already transformed themselves into global power houses.

India’s promise and long-term potential are undeniable. By 2025 the motorisation rate will increase five-fold. At 72 vehicles per 1,000 inhabitants, the country’s motorisation rate will be 60 to 70 percent higher than that of China in 2010. Drivers of this development are higher aspirations, better infrastructure, and increasing living standards and disposable income.

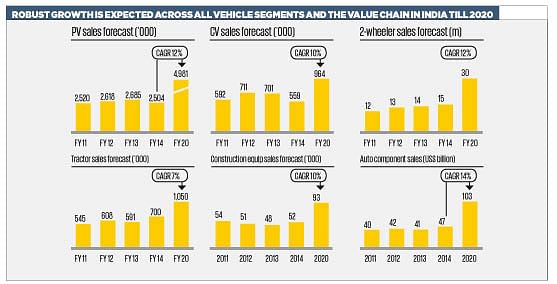

We see solid growth across all segments. Passenger vehicles will reach about five million sales by 2020. Commercial vehicles should see a solid growth of 10 percent per year on average to reach about one million units by 2020. Two-wheelers are likely to achieve sales volumes of 30 million units with scooters growing twice as fast as motorcycles. Conservative estimates for tractors, a segment that still depends heavily on the monsoon, put growth rates at 7 percent and the volume at around to one million units in 2020. India’s construction equipment market will grow at 10 percent per year to reach about 90,000 units in 2020. Here, volumes will not be the problem, but profits may prove to be elusive due to the massive global overcapacity that has been put on the ground in China.

Some indicators show that the dynamics of the Indian market was on hold in recent years: Low economic growth, investment blockage and red tape have stunted growth in passenger, commercial and off-road vehicles. In the financial year 2014 capacity utilisation for passenger vehicles has fallen significantly. When market leaders Maruti Suzuki (capacity utilisation of 80 percent) and Hyundai (capacity utilisation of 93 percent) are not taken into account, it was lower than 60 percent. In commercial vehicles, capacity utilisation has fallen to a painfully low level of 40 percent.

Taking Advantage

Low capacity utilisation puts pressure on organisations to ‘move the metal’. A sales drive ensues to protect market share and volumes via incentives for customers and the sales organisation, special editions and promotion. Reduced profitability is often the consequence which is compounded by an extremely competitive Indian industry environment which allows razor-thin margins, especially for many sub-scale players in the passenger vehicle and commercial vehicle space as well as their dealers.

Despite the recent weakness, nearly all international players bet on India’s future by setting up substantial operations in the country. The capacity expansion of car manufacturers has grown 12 percent per year on average since 2009. Over the last 14 years, foreign direct investments (FDI) in the automotive sector have amounted to about 4.5 percent of total FDI inflows into India. Private equity companies have also managed to unlock through investments in Hero MotoCorp, International Tractors, Agile Electric, Alliance Tyres, Endurance and Avtec, among others.

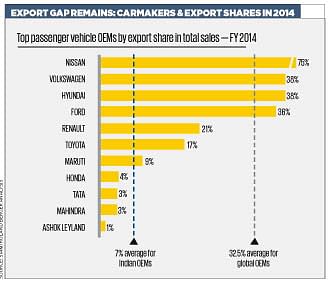

The challenges of the last five years have not been only negative for the country. They triggered some important structural changes. Increased competition and low capacity utilisation for domestic sales have forced multinational companies and local players to actively leverage India as a vehicle export hub. Besides better fixed cost degression exports provide higher margins and therefore support domestic business of car manufacturers as well as the balance of payments of the country. In the financial year 2014, global car manufacturers on average exported 32.5 percent of their total sales out of India. For domestic car manufacturers the corresponding number is 7 percent, which is poised to grow due to an increased export focus of Maruti Suzuki India.

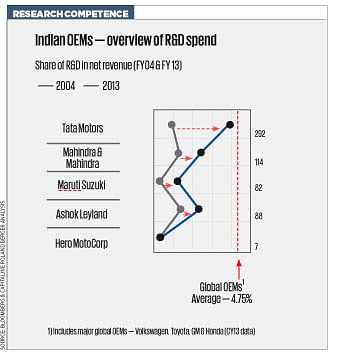

In addition, the country’s fascination with the newest and latest models has resulted in a much stronger focus of domestic companies on research and development (R&D), driving constant product upgrades. R&D investments as a percentage of revenue have risen dramatically for Ashok Leyland, Maruti Suzuki, Mahindra & Mahindra and Tata Motors. Tata Motors has even reached levels in line with its global peers.

Indian Invention Machine

Many multinational companies have realised that local R&D expertise enables local teams to react faster to market developments. As a first step, factors not critical to safety – such as increasing ground clearance for Indian vehicles and localisation of non-critical parts – must get development clearance locally to avoid endless iterations between the local team and over-burdened headquarter engineers in the US, Europe, Japan or South Korea.

Further drivers of strengthening local capacities are constant price pressure and exchange rate volatility. Subsequently, several car manufacturers are leading the way by developing clear strategies to build vehicle variation capability in India and to leverage this capacity globally. Some, like BharatBenz, have even developed specific vehicles for the local market and in the process changed long-held paradigms of the parent company.

Going forward, not only the long-term but also the short-to-mid-term opportunities in India look positive. The old government cleared several thousand crores worth of projects in the last year of their tenure. If the new government can ensure swift execution of these projects, it will have a positive impact on the economy. The Supreme Court lifted the ban on mining iron ore in Goa, and put an annual cap of 20 million tonnes on excavation, which again is a relevant step in reviving the economy.

The solid majority of the new government and its announcements and actions so far clearly indicate decisive pro-growth action, which is sorely needed. The need of the hour is to build on this momentum via decisive reform. Growth and the virtuous cycle that it drives need to be nurtured and supported rather than taken for granted as the last government has clearly shown.

Bright Outlook

Sales of medium and heavy commercial vehicles are picking up, which typically is a six- to nine-month lead indicator for the economy and private consumption. Footfalls in dealerships are increasing. The Index of Industrial Production (IIP) grew at 3.4 percent after languishing for a long time around zero, and inflation seems to be slowly coming down.

With the right focus, driving India’s growth to five to six percent GDP in the financial year 2015 (which ends in March 2016) seems feasible. A return to growth rates of around seven to eight percent in the financial year 2016 is what we expect. India’s automotive industry seems to be ready to roll again. Fasten your seatbelts and enjoy the ride.

RELATED ARTICLES

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

How the India-EU Trade Deal Could Quietly Reshape the Auto Industry

While immediate price relief for the buyer is unlikely, the India-EU FTA will help reshape long-term industry strategy, ...

Policy, Protectionism and Pressure: Inside India’s Construction Equipment Downturn

India’s construction equipment sector faces a tough battle as it takes on cheaper imports from China and a slowdown in g...

By Autocar Professional Bureau

By Autocar Professional Bureau

24 Feb 2015

24 Feb 2015

6171 Views

6171 Views

Shahkar Abidi

Shahkar Abidi

Prerna Lidhoo

Prerna Lidhoo