Government Mandates ABS for All Two-Wheelers from January 2026

New safety regulations expected to increase vehicle prices by 3-5% in entry-level segment.

The Ministry of Road Transport and Highways has published draft amendments to the Central Motor Vehicle Rules, 1989, mandating that all two-wheelers manufactured on or after January 1, 2026, must be fitted with anti-lock braking systems (ABS). The regulations also require manufacturers to supply two protective helmets with each two-wheeler purchase, effective three months from the amendment date.

The new requirements will primarily impact the entry-level segment, as two-wheelers with engines of 125cc and above already come equipped with ABS. According to ICRA analysis, the mandate will affect approximately 77% of current two-wheeler sales, representing models below 125cc that currently use Combined Braking Systems (CBS).

ICRA estimates the ABS implementation will increase vehicle prices by 3-5% across the affected segment, translating to an absolute price increase of Rs. 2,500-4,000 for entry-level motorcycles. This price escalation may further constrain demand in a segment that has yet to recover to pre-pandemic levels.

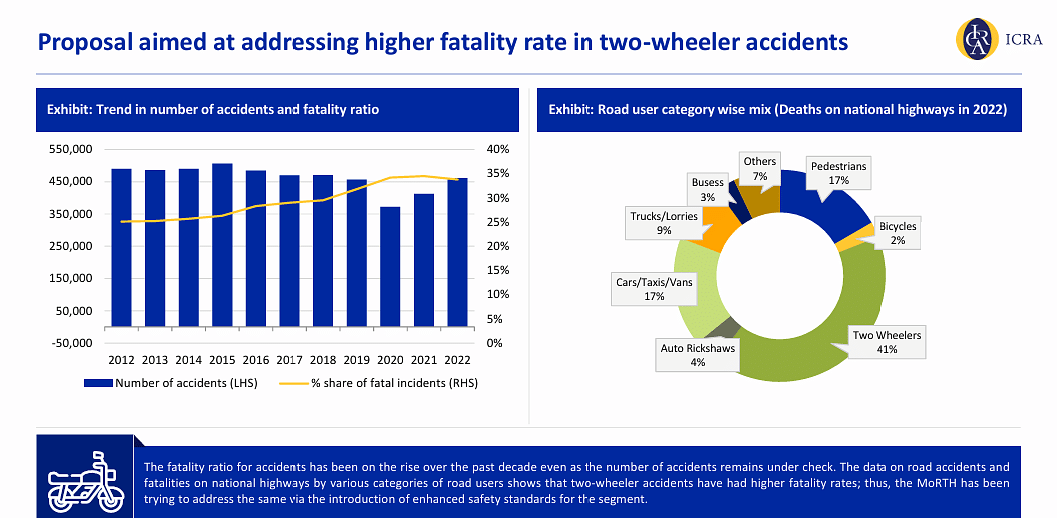

The regulatory change addresses India's rising road accident fatality rates, particularly for two-wheeler users. Data from the Ministry of Road Transport and Highways indicates that two-wheeler accidents account for 41% of deaths on national highways, the highest among all vehicle categories. The fatality ratio for accidents has increased over the past decade despite the number of accidents remaining relatively stable.

ABS technology prevents wheels from locking during braking, especially on slippery surfaces, allowing riders to maintain steering control and avoid skidding. This represents a significant safety advancement over CBS, which distributes braking force to both wheels when either brake lever is applied but does not prevent wheel lock.

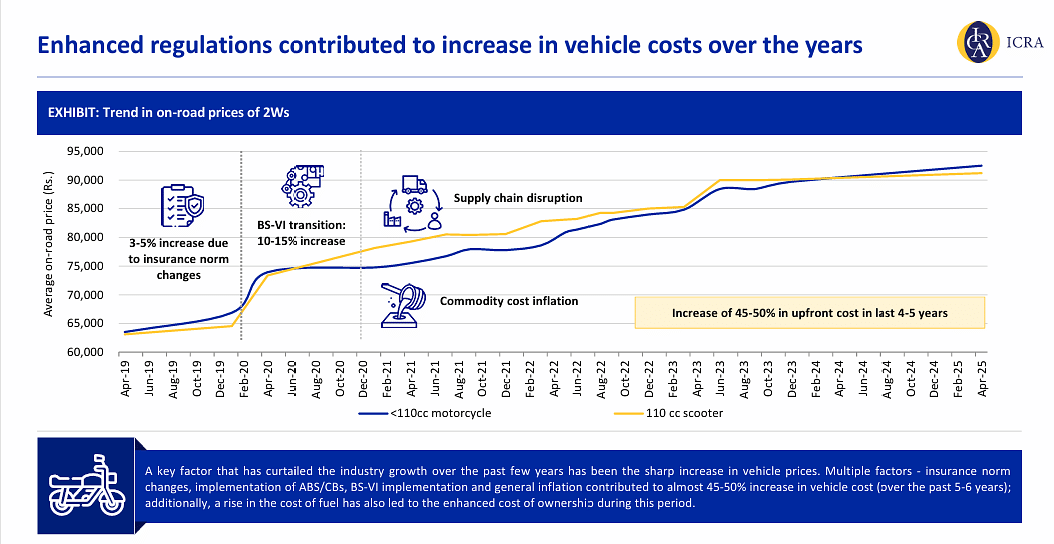

The Indian two-wheeler industry has faced sustained challenges since FY2019, with volumes declining by approximately 35% from all-time peak levels of 21.2 million units. Multiple regulatory changes over the past five to six years have contributed to a 45-50% increase in vehicle costs, including insurance norm changes, BS-VI emission standard implementation, and general commodity inflation.

The affordability gap has widened as vehicle prices have increased faster than household incomes, particularly affecting lower-income segments that form the core customer base for entry-level two-wheelers. This divergence became more pronounced following Covid-19 disruptions, when many households experienced job losses and salary reductions.

Industry volumes have gradually recovered over the past few years, reaching approximately 19.7 million units in FY2025, but remain below historical peaks. The entry-level motorcycle segment, which represented 62% of total motorcycle sales in FY2019, has seen its share decline to 46% in FY2025 as customers have migrated to higher-capacity vehicles.

The ABS mandate represents the latest in a series of safety initiatives by the government. Previous regulations include mandatory CBS for bikes below 125cc in 2018, automatic headlamps in 2016, and mandatory reflective tapes in 2021. Future regulations under consideration include side stand engine cut-off switches and enhanced on-board diagnostics.

Original equipment manufacturers are expected to pass through the incremental ABS costs to consumers, potentially delaying recovery in the entry-level segment. The segment currently operates at approximately 67% of its FY2019 volume levels for motorcycles under 110cc.

The regulatory timeline follows global safety standards, with Europe having implemented mandatory ABS for motorcycles above 125cc in 2016-2017. India's approach extends the requirement to all two-wheelers regardless of engine capacity, representing a more comprehensive safety mandate.

Industry stakeholders anticipate that while the enhanced safety features will provide long-term benefits, the immediate impact on affordability may constrain market growth in the near term. The entry-level segment's recovery trajectory, already challenged by affordability constraints, may face additional headwinds from the mandatory ABS implementation.

RELATED ARTICLES

Schaeffler India Q4 Revenue Rises 27%

For the year ended December 31, 2025, revenue from operations increased 16.3% year-on-year.

Maharashtra EV Policy Could Be His First Policy Failure in 36 Years, Says Rajiv Bajaj

In the CNBC-TV18 interview, Bajaj revealed that the company has received only a fraction of the subsidies owed by the Ma...

Video: Diesel Still Matters As Ev Adoption Remains Uneven: Pierpaolo Antonioli Of Dumarey Automotive

Pierpaolo Antonioli of Dumarey Automotive Italia explains why clean diesel, hybrids and alternative fuels will remain re...

By Shruti Shiraguppi

By Shruti Shiraguppi

04 Jul 2025

04 Jul 2025

12403 Views

12403 Views

Arunima Pal

Arunima Pal

Prerna Lidhoo

Prerna Lidhoo