Auto component industry reports $300 million trade surplus in FY24 with $21.2 billion in exports

The component imports during the period grew by 3 % to $20.9 billion, according to the Automotive Component Manufacturers Association of India (ACMA). The industry had recorded a trade deficit of $200 million in the financial year 2023.

India’s auto component industry posted a trade surplus of $300 million during the financial year 2024 with exports witnessing a growth of 5.5% to Rs. $21.2 billion, according to the data from the Automotive Component Manufacturers Association of India (ACMA). The component imports during the period grew by 3 % to $20.9 billion. The industry had recorded a trade deficit of $200 million in the financial year 2023.

“On the front of trade, whilst overall merchandise exports from India witnessed degrowth in FY24, auto components exports have grown despite geopolitical challenges and increase in logistics costs. That apart, growth in imports has been comparatively lesser, leading to trade surplus, indicating thrust by the industry on front of localization,” Shradha Suri Marwah, President, ACMA & CMD, Subros said. Overall, the industry’s turnover grew by 9.8% to Rs. 6.14 lakh crore in FY24 on the back of steady vehicle production in the country, a robust aftermarket and growth in exports.

Region-wise, North-America accounted for 32% of exports saw a growth of 4.5% while Europe accounted for another 33% and Asia for 24%. Exports to Europe grew 12% to $6.89 billion and North-America by 4% to $6.79 billion while exports to Asia remained flat, according to ACMA. The key export items, it adds, included drive transmission & steering, engine components, body & chassis, suspension & braking systems etc. In fact, engine components and drive transmission & steering accounted for more than half of exports.

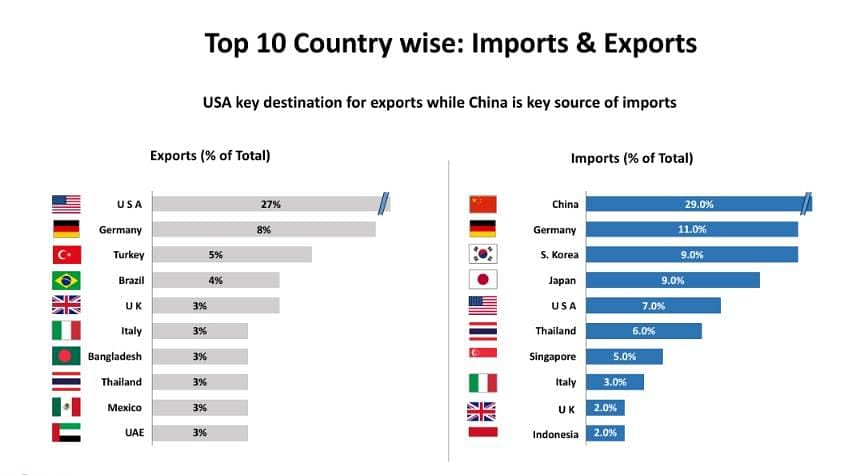

Exports to USA formed 27% of the total exports in FY24 followed by Germany and Turkey at 8% and 5%, respectively. While USA was key destination for exports, China is key source of imports for India. Imports from China stood at 29% of total exports while Germany was at 11% and South Korea at 9%. Overall, Asia accounted for 66% of imports followed by Europe and North America at 26% and 8%, respectively. Imports from Asia grew 3% to $13.73 billion and from Europe by 4% to $5.40 billion. However, imports from North America remained flat in FY24. The key import items included engine components, body & chassis, suspension & braking, drive transmission & steering etc. Body/Chassis & Steering and accounted for 41% of imports.

Going forward, ACMA adds, that the tailwinds for the industry include factors like high estimated GDP growth for FY 2025, domestic vehicle demand, emphasis on infrastructure development, stable international demand/exports, focus on clean and new technology and new entrants in the mobility space. However, the industry also faces headwinds including geo-political challenges, increasing freight costs and high GST rates on auto components.

RELATED ARTICLES

Motherson and Marelli Inaugurate Automotive Lighting Plant in Sanand

The facility is the first in India capable of manufacturing edge-to-edge single-piece long lighting parts.

Nissan Motor India Offers 5.55% ROI Finance on Magnite Until March 2026

Scheme through NRFSI covers up to 100% on-road funding with loan tenures of up to seven years.

BorgWarner Secures European OEM Contract for Hybrid Range-Extended Vehicle Drive Module

The automotive supplier will deliver an 800V Integrated Drive Module combining generator and propulsion functions into a...

25 Jul 2024

25 Jul 2024

8060 Views

8060 Views

Shruti Shiraguppi

Shruti Shiraguppi

Sarthak Mahajan

Sarthak Mahajan