Two-wheeler demand crawls in December 2018

Hero MotoCorp's Pawan Munjal moots reduction of GST on two-wheelers from 28% to 18% to drive demand; industry hopeful of better show in Q4 FY2019.

Initial wholesale data released by the top five two-wheeler manufacturers, except Honda Motorcycle & Scooter India (HMSI), suggests that two-wheeler demand crawled in December 2018.

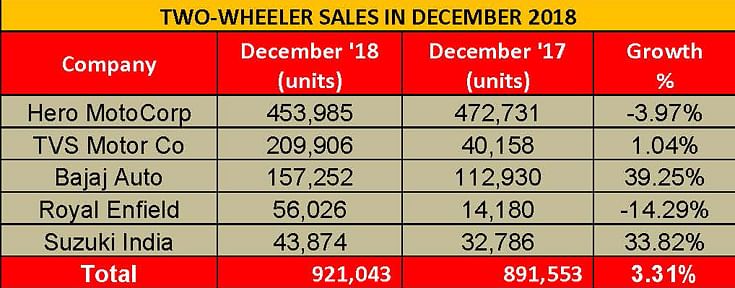

The total wholesale despatches released by Hero MotoCorp, Bajaj Auto, TVS Motor Company, Royal Enfield and Suzuki Motorcycle India cumulatively stood at 921,043 units, thereby marking a flat growth of 3.31 percent year-on-year (YoY). Meanwhile, Honda Motorcycle & Scooter India's sales/despatch numbers are expected later today. As is known, companies reveal only their factory despatch numbers to showrooms to industry body SIAM each month.

December, the last month of any calendar year, typically sees a decline in retail sales in the automotive industry, which directly impacts the wholesale despatches from the manufacturing units. While few vehicle manufacturers offer year-end schemes to lure buyers into making purchases during December, the overall market conventionally sees deferred purchase to the New Year.

The two-wheeler industry leader, Hero MotoCorp has reported total despatches of 453,985 units (including exports) in December 2018, down by about 4 percent YoY. (December 2017: 472,731 units). The company, however, has had a good run in CY2018 as well as during the three quarters of FY2019. It recorded total cumulative dispatches of 8,039,472 units during CY2018 (including exports), averaging 669,956 units per month through the year. The monthly average wholesale (domestic) despatches for Hero MotoCorp in CY2017 stood at 585,280 units.

On the other hand, the cumulative data for the three quarters of FY 2019 put together has now risen to 6,037,901 units.

In an official communication, Pawan Munjal, chairman, Hero MotoCorp voiced his outlook of CY2018. “2018 was a challenging year for the global economy. While the continuing volatility in currency and commodities slowed down the pace of growth, the global geopolitical and trade conflicts also affected sentiments in markets and industries across the world. The increased cost of two-wheeler insurance ahead of the Diwali festive season and the prevailing liquidity crunch in the market impacted the overall momentum of growth in the industry during the entire third quarter,” he said.

Stressing on the concern about an anticipated price rise, he added, “The cost of two-wheelers will further go up once the new set of regulations around safety comes into force, followed by the transition to BS-VI emission norms. All these will put severe stress on the extremely cost-sensitive commuters, for whom the two- wheeler is a lifeline.”

Munjal has also suggested that two-wheelers be placed in the 18 percent GST bracket as against 28 percent category, which is levied on the luxury goods.

“Given that two-wheelers provide basic mobility to the masses, there is an urgent need to reduce the GST rate on two-wheelers from the 28 percent bracket of luxury goods to that of 18 percent for mass usage items. This will provide the much-needed relief to millions of two-wheeler customers across the country, as well as the entire value chain dependent on the sector.”

He, however, remains bullish about the turnaround during Q4 FY2019. “With an improved liquidity in the market, and the upcoming festive season in many parts of the country, the industry is expecting a positive turnaround in the fourth quarter,” he said.

The company, which has appointed cricketer Virat Kohli as its new brand ambassador and has also forayed into the premium motorcycle and scooter categories via 200cc Xtreme 200R and Destini 125 scooter, has been lately repositioning its market perception domestically.

Wholesale numbers reported by TVS Motor Company, Bajaj Auto and Suzuki Motorcycle India were positive while Royal Enfield reported a decline of about 14 percent YoY.

TVS Motor Company reported domestic wholesale despatches of 209,906 units in December 2018, recording a flat growth of 1.04 percent YoY. According to the company release, scooter despatches grew by 9 percent from 83,638 units in December 2017 to 91,480 units in December 2018.

"Motorcycle despatches, on the other hand, grew by 13 percent increasing from 95,246 units in December 2017 to 107,189 units in December 2018,” quoted the official statement by TVS Motor. These numbers, however, included the export shipments.

Bajaj Auto stands out as the only company in the two-wheeler industry to report robust YoY growth in December 2018. It recorded total domestic despatches of 157,252 units last month, up an impressive 39.25 percent YoY (December 2017: 112,930 units). Riding on the demand for its affordable brands such as CT 100 and Platina and also its evergreen performer Pulsar, the company is expected to easily breach the two-million-unit mark this financial year.

Roayl Enfield’s volumes are now clearly on a downward trend. The company has reported total domestic despatches of 56,026 units in December 2018, thereby marking a sharp decline of 14.29 percent YoY. The company has recently launched its 650cc twin-cylinder models – Interceptor 650 and Continental GT 650. Analysts say that although Royal Enfield may not be able to grow its numbers like it did in the past, the new models will contribute in terms of stabilising its earning margins.

Riding on the growing demand for its Access 125 scooter, Suzuki Motorcycle India has reported domestic wholesale despatches of 43,874 units in December 2018, up 34 percent YoY (December 2017: 32,786 units).

While the two-wheeler industry's priorities remain about adhering to new and upcoming safety and emission mandates as per varying deadlines, OEMs expect a turnaround in Q4 FY2019. It would be interesting to take note of how the major players, which witnessed declining volumes in December, are going to pull up in the last quarter of this fiscal. Stay tuned for more news and analysis on this front.

Also read: Mandatory norms to make Indian two-wheelers and cars safer in 2019

Car sales remain in slow growth mode, OEMs look to January to jump-start numbers

M&HCV sales skid for second month in a row

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

05 Jan 2019

05 Jan 2019

18234 Views

18234 Views

Autocar Professional Bureau

Autocar Professional Bureau