Third party motor vehicle insurance premiums hiked by up to 40%

The regulatory authority said that increase in premiums is in accordance with the increase in the cost inflation index.

Owning a car or a two-wheeler in the country is set to become even more expensive now after the Insurance Regulatory and Development Authority of India’s (IRDAI) decision to hike third party motor insurance premiums by up to 40 percent starting April 1.

The regulatory authority said that increase in premiums is in accordance with the increase in the cost inflation index.

“It is observed that the cost inflation index (CII) has increased by 5.57 percent over the previous year, i.e. from 1024 in FY 2014-15 to 1081 in FY 2015-16. Accordingly, the Authority issued an exposure draft on March 4, 2016 on revision of premium rates for motor third party insurance covers for FY 2016-17 inviting comments on the proposed rates from all stakeholders concerned.”

All vehicles need a third-party cover under the Motor Vehicles Act and insurers will have to ensure that the policy is available at their every underwriting offices, the regulator said. The mandatory third party insurance is revised yearly by IRDAI based upon the inflation and claims. To arrive at the new third-party motor premium in April, the regulator had used data available with Insurance Information Bureau for the experience period of the underwriting years 2007-08 to 2014-15 for number of policies, number of claims reported and amount of claims paid up to March 31, 2015.

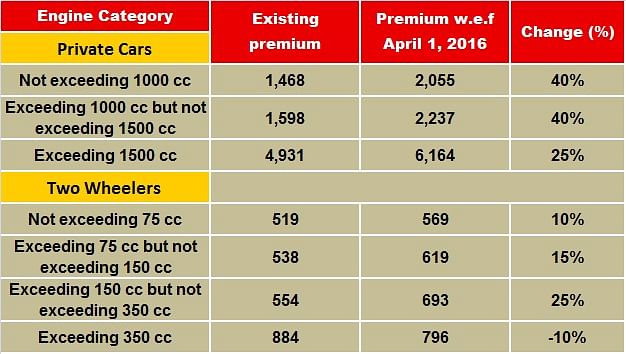

With this year’s hike, the rates will go up by 40 percent for all private cars with engine capacity under 1,500cc and will increase by 25 per cent for cars with a higher engine capacity than 1,500cc.

For two-wheelers, premiums would go up 10-15 percent for vehicles with engine capacities up to 150cc, while there would be a 25 percent hike in premiums rates for two-vehicles with engine capacity of 150-350cc. The only positive from the revision in premiums is for high-powered motorcycles with engine capacity of more than 350cc, which will see a decline of 10 percent in premiums from April 1.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Shourya Harwani

By Shourya Harwani

29 Mar 2016

29 Mar 2016

4785 Views

4785 Views

Autocar Professional Bureau

Autocar Professional Bureau