MG Motor India targets profitability by FY2024

The Hector’s aggressive starting price of Rs 12.18 lakh still delivers a profit margin to MG Motor India on a per unit basis; 75% localisation at SoP and BS VI only by January 2020 could give it an advantage over Kia Motors and rivals.

The Chinese-owned British brand MG Motor has launched its first product in India – the MG Hector – at highly affordable prices ranging between Rs 12.18 lakh to Rs 16.88 lakh (ex-showroom, India). To make a compelling value proposition, the company has also bundled the 5-seater SUV, measuring 4,655mm in length, with a slew of innovative warranty, maintenance, subscription and buy-back packages, which will also instill confidence in the discerning Indian consumer into the new and relatively unheard-of brand in the country.

The MG Hector has been launched with a first-of-its-kind 5-year unlimited kilometres warranty, 5-year roadside assistance and 5-free services (as opposed to the industry norm of three). The company is also claiming maintenance expenses of 45 paise/km for the petrol-engined Hector and 49 paise/km for the diesel model. It is also offering three-year maintenance package starting at Rs 8,000.

Starting June 4, MG Motor India has been able to garner over 10,000 bookings for the MG Hector in 23 days and is now gearing up to convert majority of those into actual retails. As of June, MG Motor India has a nationwide presence of 120 touch-points, slated to be aggressively expanded to 250 outlets by September. Deliveries will commence July first week.

With 75 percent of the Hector’s bookings coming for the top two ‘Smart’ (Rs 1,468,000-Rs 1,548,000) and ‘Sharp’ (Rs 1,588,000-Rs 1,688,000) variants, MG Motor India says it has seen an ‘unprecedented demand’ for petrol and automatic variants.

Buyers show preference for petrol-engined Hector

Speaking to Autocar Professional, Rajeev Chaba, president and MD, MG Motor India, said, “Fifty percent of the bookings that we have received so far are for the petrol variants. Out of this, the DCT automatic variants in petrol are commanding a 70 percent share.”

“It is really surprising that the petrol trend is sweeping even the southern part of India and Hyderabad is the city from where we have received the maximum bookings from,” Chaba added.

Profitable by FY2024

By not offering BS VI variants at launch, MG Motor India has been able to take a price advantage and gain some hold in the market before regulations kick in for India Auto Inc from April 2020. The company is not looking at BS VI product introduction before the start of CY2020. “We will roll out BS VI-compliant vehicles from January 2020,” Chaba told this correspondent.

However, with the launch prices being introductory, Chaba aims to maximise customer interest and consideration at the outset and bring a lot of buyers in this segment which currently comprises the Tata Harrier, Jeep Compass, XUV 500, Hyundai Creta and the soon-to-be-launched Kia Seltos, into MG’s showrooms spread across 50 cities.

“We have got 10,000 bookings without even revealing the price. We will honour those customers with this price and maybe some more, but definitely this price is very introductory and we will bring a price increment very soon,” he said.

Of the 80,000 unit capacity at its plant in Halol, Gujarat, MG Motor India is prepared to produce 2,000 units every month over the next few months, which means a price increment could be due around the end of 2019 or start of CY2020.

“It is not that we are not making money with these prices. If we look at the contribution margin, we are making money on every single unit, but, just that if we take into account all the overheads of plant investment, in-house costs and logistics etcetra, we are targeting net profitabilty in the next five years in India,” he added.

While the waiting period for the DCT variants is learned to be as high as four months already, diesel MT trims will be readily available in a week’s time from now. A higher anticipatory demand by the company for diesel is the reason for the demand-supply divide.

75 percent gross localisation, high China content

MG Motor India has been able to achieve a local content of close to gross 75 percent with the Hector, with a lot of components being sourced from China as well, but from reputable suppliers.

The intercooler and the 48V starter generator on the mild-hybrid variant are being procured from Valeo in China.

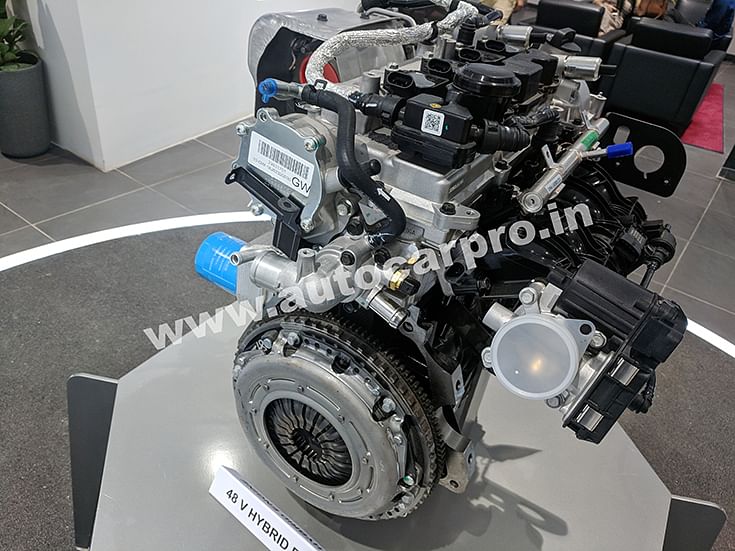

A closer look at some of the components on display at the company’s flagship store in Gurgaon, where the launch took place, reveals that a major portion of the powertrain components are from China, and are being produced under the SGMW – SAIC-GM-Wuling – umbrella.

The engine block and the head of the 1.5-litre, four-cylinder turbocharged petrol motor is stamped with SGMW markings, including the ignition coils and the oil filter, all of which are being made in China and being imported.

The turbocharger unit too is from Honeywell Garrett in China and the intake manifold is being made by Bosch in China for SGMW. The intercooler and the 48V starter generator on the mild-hybrid variant are being procured from Valeo in China. The starter-generator in its motor form can provide a boost of up to 9.5kW and 18Nm at 5,000rpm. The Li-ion battery for the mild-hybrid system is being manufactured by Bosch in China.

On the plastic trim front, the ORVMs are being locally sourced from SMR (Samvardhana Motherson Reflectec) and the glass from Saint Gobain in India. Glass for the sunroof, though, is being imported from China.

In terms of safety, the airbag module and its steering coil are being manufactured by a Chinese supplier named Ningbo China. Seatbelts are from Zhe Jiang SongYuan Automotive Safety Company.

Driving into EVs

MG Motor India plans to immediately step into the EV territory by introducing the assembled-in-India (CKD) eZS SUV, which will be introduced in December 2019 and also increase its capacity utilisation. The company will prepare its dealer touch- points with the necessary charging infrastructure and the all-electric SUV will be sold in five main cities to begin with.

“Delhi, Mumbai, Bangalore, Hyderabad and Ahmedabad will be the cities where eZS will go on sale. We will provide home-charging points to customers and dealers will have charging points too,” Chaba told journalists at the launch.

“We have tied up with Fortrum (Swedish company) to create public charging infrastructure at our dealerships. We are also tying up with other local partners who will help in establishing charging points at customer homes at an extra cost. A charging cable will also be provided with the car,” added Chaba.

Can MG make it work?

With ownership trends among private buyers moving towards the concept of shard mobility, MG Motor India is also keeping its bases covered by offering a subscription model in collaboration with Myles. With closest competitor Tata Harrier only a stone’s throw away in terms of pricing, but lacks an automatic, hybrid, or even comfort features such as a sunroof, can the Hector then pull off a masterstroke for MG’s innings in India?

At 10,000 bookings in a market that is seeing negative growth, the Hector has already got customers interested enough to reach its showrooms. A few months’ time and the verdict will be out on how well the first MG product in India has fared in the marketplace.

Component photography: Mayank Dhingra

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

27 Jun 2019

27 Jun 2019

23731 Views

23731 Views

Autocar Professional Bureau

Autocar Professional Bureau