India's automobile production plunges to 28-year low in FY2020

With a YoY decline of 14.7% in FY2020, industry output dives to a new low and 'betters' previous low of 11% in FY1992 as a result of poor consumer demand, reduced production of BS IV products and shift to BS VI and finally the Covid-19 outbreak.

FY2020, as is now well known, was a fiscal the Indian automotive industry would like to forget in a hurry. Eighteen months of continuous slowdown, hugely dampened market and consumer sentiment, no relief on high GST, increased vehicle prices due to the BS VI upgrade and stringent safety norms, and no government-driven incentives whatsoever to rev up the market meant that overall industry sales fell 18% YoY to 215,48,494 units with all vehicle segments in the red.

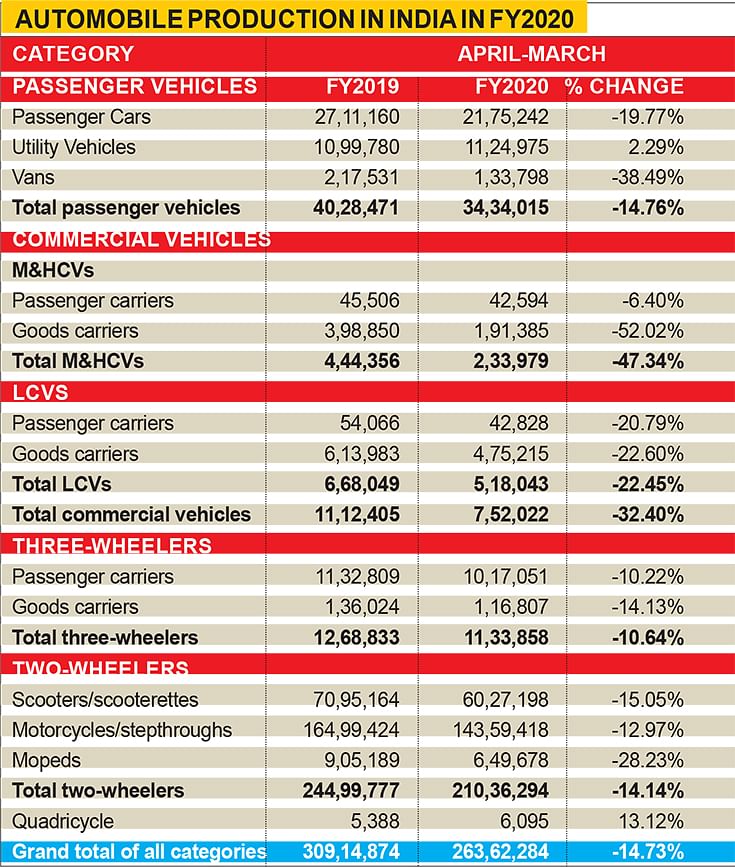

With consumer demand diving and also to ensure minimal BS IV inventory while beginning BS VI-compliant vehicle production, companies had midway through FY2020 begun applying the brakes on production. Therefore, it comes as no surprise that total production at Indian OEMs fell sharply by 14.7% to 2,63,62,284 units.

The country-wide lockdown just ahead of April proved to be the final nail in the production coffin as plants were shuttered at all OEMs and their suppliers. This constitutes a 28-year low, considering the previous 'best' low came in FY1992: 20,23,852 units (-11.0%), albeit the scale of production and sales over the three decades is now hugely different.

In FY2020, OEMs rolled out all of 2,63,62,284 vehicles, a substantial decline of 14.7 percent YoY. While CV output was down by a massive 32.4 percent to 752,022 units, PV production fell 14.7% to 34,34,015 units, three-wheelers by 10.64% to 11,33,858 units and that of two-wheelers by 14.14% to 210,36,294 units.

Past imperfect, future tense?

FY1992 was a defining year for India’s economy in general and the automobile industry in particular. The Indian economy, which was long considered dirigisme (state controlled), had just begun to open up though it took some years before the benefits started trickling in. It was also the period when the country witnessed one of its worst communal riots and the subsequent serial blasts, which crippled the economy.

Thus it was that the automobile industry recorded a YoY sales decline of 11 percent. As per data collated by the CARE Ratings' Centre for Monitoring Indian Economy (CMIE), total production in FY1992 was 20,23,852 units comprising 143,172 CVs (-1%), 197,920 PVs (-9.7%), and 16,82,760 two- an three-wheelers clubbed together (-11.9%). With the country and economy returning to normally in FY1993, the post-1992 era is considered to be the second phase of foreign direct investment, one which saw the entry of new players as well as existing OEMs expand their operations.

Production restart a challenging affair

With the countrywide lockdown still in place, resumption of production for OEMs including the entire supply chain will prove to be a challenging affair. These challenges would include staggered plant opening, adherence to safety and social distancing norms and health care support among others.

Nonetheless, some OEMs are aggressively working at planning their restart operations. Bangalore-based Toyota Kirloskar Motor, which has access to Toyota's global best practices and years of experience, has published a comprehensive ‘Restart Manual’ as a guide for industries to follow once the lockdown is lifted, albeit gradually in some places. A team of cross-functional experts have gone into the minutest details of various operations and created a Standard Operating Procedure (SoP) that would ensure the safest possible restart to manufacturing by securing the workers from any health hazards.

Will FY2021 be better than FY2020?

That's the multi-crore rupee question which depends on a number of factors and the new normal of 'social distancing'. Will PV buyers shun dealer showrooms and accelerate their drive to the digital world, which means OEMs and dealers will have to rejig their sales strategies? Will PVs see a new sales surge because commuters who can afford to buy new cars will shun shared mobility and public transport? Will two-wheeler sales also take off because of a similar reason? Will demand for sanitised buses grow in the near future? Lots of questions but few answers at this stage as India and the Indian automotive industry deals with a new dynamic.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

20 Apr 2020

20 Apr 2020

15299 Views

15299 Views

Autocar Professional Bureau

Autocar Professional Bureau