Has the US election triggered vehicle market turbulence?

What impact would the US presidential election have on Light Vehicle sales? Is future policy going to impact vehicle sales differently? Or is the election itself disruptive to sales?

It’s finally over and the action has shifted to the courts. The automotive industry, particularly in the USA, is keen to know what impact the US presidential election will have on light vehicle sales. Is future policy going to impact vehicle sales differently? Or is the election itself disruptive to sales?

According to LMC Automotive’s managing director Pete Kelly, this question typically has two potential implications. Is future policy going to impact vehicle sales differently, depending on which candidate wins? Or is the election itself disruptive to sales?

The answer, according to Kelly, to the first question is likely ‘yes’, though perhaps not overly so, at the total market level. That said, environmental policy differences between the two candidates could readily lead to different levels of future vehicle electrification, with a more pronounced focus on CO2 reduction from Mr Biden than Mr Trump.

When it comes to the second question, it is more an issue of whether the election will change the local short-term economic/consumer climate, as opposed to altering the vehicle industry itself.

History tells us that the answer is almost certainly ‘no’.

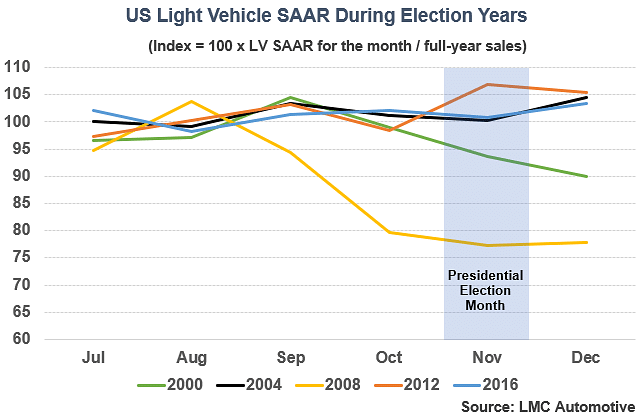

The chart above shows how the seasonally adjusted annualised rate (SAAR) for Light Vehicle sales in the US varied in the previous five presidential elections. For 2000 and 2008, the economy was already heading downwards prior to the election, while existing slowdowns (the Dotcom bust and Global Financial Crisis, respectively) carried over into the following years. For the other years, there was no discernible effect.

While this election has been unusually intense in many ways, we do not expect it to throw up short-term disruption for vehicle sales in any meaningful way. Other – far more significant – factors are likely to swamp temporary electoral impacts, not least the enormous pandemic that is playing havoc with many vehicle markets. In other national markets, political events have, historically, caused disruption – for example, when widespread and violent civil unrest has taken place – but we are optimistic that no such scenario will pan out in the US.

In short, any potential short-term vehicle market volatility is likely to come from sources other than the election.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

09 Nov 2020

09 Nov 2020

4159 Views

4159 Views