Ford and Hyundai battle to be India’s No. 1 car exporter in FY2018

The coming months should see Ford, Hyundai and Maruti battle hard, both in the domestic as well as overseas markets. Which makes the made-in-India all that more exciting.

Even as the domestic passenger vehicle market is well set to notch record sales numbers in FY2018, the Make-In-India export story is picking up steam for some carmakers.

Cumulative PV exports, at 480,341 units, for the April-November 2017 period are down 3.69 percent on the year-ago shipments but from the looks of it, growing demand for some models, particularly from Ford India, Hyundai Motor India and Volkswagen India are set to uplift fortunes for made-in-India cars. Maruti Suzuki India is currently seeing flat growth in its exports but that could be mainly due to the company ensuring supplies to the strong demand in the domestic market.

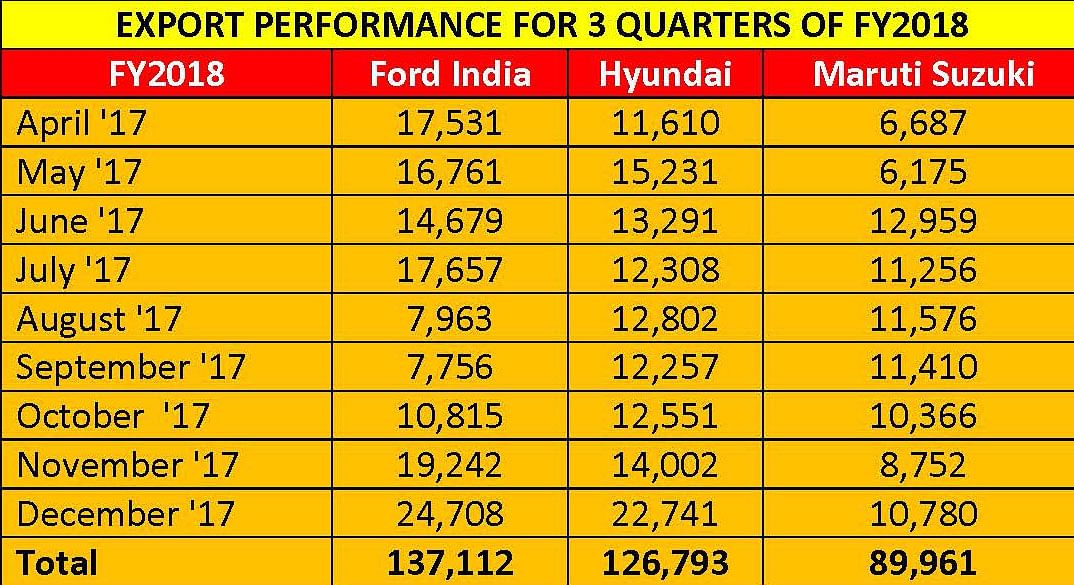

With three quarters of FY2018 completed and only three months left in the fiscal, the battle to be top dog among PV exporters is currently on – and the close tussle is between Ford and Hyundai.

Ford India, which spent much of its time in CY2017 prepping its new EcoSport crossover to regain its diminishing sheen, has otherwise kept its nerve and performed noticeably well on the exports front.

Ford leading right now

In the first nine months of FY2018, Ford India leads the table in terms of its outbound shipments, despatching a total of 137,112 units between April-December 2017, registering a growth of 14 percent in its export business. Monthly exports in December 2017 also witnessed their best ever performance, reaching 24,708 units, which marks sizeable 38 percent growth (December 2016: 17,904).

Ford has been maintaining its lead over Hyundai for some months now. The handsome tally in December is a result of the introduction of the EcoSport facelift, which was launched in India in November 2017 and also subsequently resumed its deliveries to the North American markets. In its maiden month of launch, the compact crossover sold 5,474 units in the domestic market itself, hinting at strong customer affinity for its contemporary features and overall packaging.

Ford exports the second-generation Ford Figo/ KA+ hatchback and the Ford Aspire compact sedan, both built at its Sanand factory in Gujarat, along with the made-in-Chennai Ford EcoSport models to more than 50 countries across Europe, Middle-East, Sub-Saharan Africa, Asia, and to emerging markets in North America as well as in Australia.

While the updated EcoSport (pictured above) also received an all-new 1.5-litre, three-cylinder petrol motor from Ford's Dragon series in India, the engine, mated to a six-speed automatic gearbox is also being exported, to accompany the more popular 1.0-litre Ecoboost turbocharged petrol variant of the crossover abroad.

The export bound KA+, Aspire and the EcoSport also see enhanced safety kit, with equipment including six airbags, hill start assist and dynamic stability control among others being the standard safety features on-board.

Ford India closed FY2017 at No. 2 spot with cumulative shipments of 158,469 units (+42.94%) behind Hyundai Motor India's strong performance of 167,120 units (+3.02%), and as per the current trend, with its buoyant numbers, the American giant is looking set to clinch the top spot in export shipments by end of March 2018.

But will its neighbour from Chennai allow that to happen? In December 2017, Hyundai Motor India with its 22,741 units shipped abroad was a close second in December sales.

Hyundai revving up its export game

Hyundai, whose cumulative exports between April-December 2017 stand at 126,793 units, is running hot on Ford’s heels, the two OEMs currently separated by only 10,319 units. After introducing the third-generation of its Verna sedan in the country, Hyundai Motor India, in October 2017, also bagged the biggest order of 10,501 units for the feature loaded C-segment sedan from some Middle-Eastern markets, where it will start shipping the car from January 2018 onwards.

The Verna is sold under the Accent nameplate in these markets and the order is the largest ever for the sedan, and a big jump as compared to the earlier iterations of the car. Hyundai also ships the car to South Africa, Gulf and other Asian countries as well.

Apart from Ford and Hyundai, the country's largest carmaker, Maruti Suzuki India, is likely to complete the winning trio in the export rally. Maruti has been seeing its Baleno hatchback contribute to the bulk of its export numbers in the recent times, with its deliveries to Europe and Japan. The company has shipped a total of 89,961 units across all its key offerings in the first three quarters of FY2018.

The coming months will see all three carmakers battle hard both in the domestic as well as overseas markets. Which makes the made-in-India all that more exciting. Stay tuned for our reports.

Also read:

Volkswagen India produces 150,150 cars in 2017, up 3.45% YoY

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

04 Jan 2018

04 Jan 2018

9098 Views

9098 Views

Autocar Professional Bureau

Autocar Professional Bureau