CV industry pins hopes on pre-buying, November numbers stay muted

The overall CV sales declined close to 18% in November on a year on year basis on the back of weak consumer demand and muted market condition.

Hope lies eternal and the Indian commercial vehicle industry is pinning its hopes of a badly needed revival on fleet buyers going in for aggressive pre-buying of BS IV vehicles ahead of the emission norm changeover to BS VI in April 2020.

As of end-October 2019 and the first seven months of FY2020, the CV industry is down 23% with the critical M&HCV sector down 37.78% and the LCV sector also down 13.73%. November numbers are going to add to that negative sentiment in the domestic market.

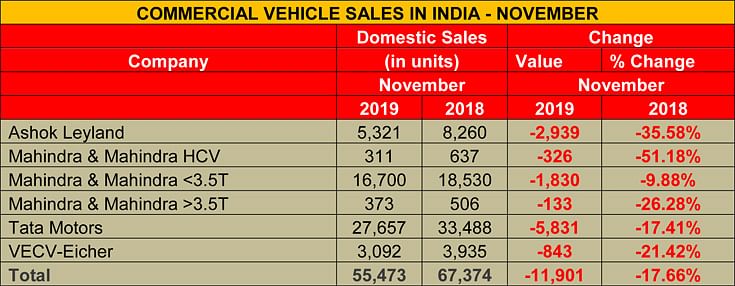

As per the individual company-announced despatches for November 2019, overall CV sales total 55,473 units, down 17.66% (November 2018: 67,374).

Tata Motors, the largest CV player and the market leader, reported sales of 27,657 units, a drop of 17.41 percent compared to the 33,488 units sold in November 2018. The company says sales are expected to pick up on the back of replacement demand and pre-BS VI buying.

According to Girish Wagh, president, Tata Motors CVBU: “As we move closer towards BS VI transition, the focus continues to be on gradual stock reduction, with retail sales in November being higher than wholesales by over 10%. M&HCV sales grew by 23.6% over the previous month, as enquiries continue to increase gradually, with fleet owners realising the economic benefits of replacement of their older vehicles. Overall system stocks being at a multi-quarter low, coupled with increasing enquiries for replacement demand, will help firm up volumes and realisations in the next few months."

Chennai-based Ashok Leyland reported sales of 5,321 units, a sharp decline of 35.58 percent compared to last November.

For Mahindra & Mahindra, the company reported overall CV sales of 17,384 units, a decline of 11.63 percent compared to 19,673 units in November 2018. Commenting on the performance, Veejay Ram Nakra, chief of Sales and Marketing, Automotive Division, Mahindra & Mahindra said, “The month after the festive season is historically a lean month for the automotive industry.”

Volvo Eicher Commercial Vehicles sold 3,092 units, down over 21% compared to 3,935 units sold during the same period last year.

The domestic CV space which has been struggling to find positive sales momentum since May 2019, is expected to continue to face strong headwinds. According to India Ratings and Research (Ind - Ra, Fitch Group), the underwhelming pace of industrial activity and the higher cost of ownership of a BS VI CV, the implementation of BS VI could add to the sector’s woes, says the ratings agency. Furthermore, given the excess supply situation and muted demand-side fundamentals in the economy, the agency believes the pre-buying of BS-IV CVs till end-Q4 FY2020 is unlikely to be meaningful as compared with the earlier occasions when new emission norms had been implemented.

Also read: CV industry may take up to 5 years to reach previous sales peak: Tata Motors' Girish Wagh

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

02 Dec 2019

02 Dec 2019

10981 Views

10981 Views

Autocar Professional Bureau

Autocar Professional Bureau