Carmakers’ February sales impacted by weak market sentiment

The first five carmakers to reveal their February sales numbers clearly indicate that good sales momentum is still some time away.

As the Indian automobile industry reels under the impact of a slowdown brought in by the liquidity crunch in the market from around September 2018, and rising fuel prices further impeding buyers from making new purchases, the on-ground situation continues to be rather adverse six months on, with most passenger vehicle manufacturers struggling to lift off with low- to- moderate growth curves.

While sales in September 2018, which also marked the onset of the festivities in most parts of the country dwindled by 5.61 percent with overall PV sales of 292,658 units, it, however, started a declining trend which continued well towards the main festive month of November (266,000 / -3.43%), leading manufacturers to liquidate inventories in the pipeline by moderating productions in December and even in January.

From almost six percent slump, the condition hasn’t improved much, when January 2019 sales clocked 280,125 units, de-growing 1.87 percent year on year. While overall results will take a week or more to come, individual company-wise performance numbers for February indicate at a gloomy situation, with most hovering in the flat growth area. Let’s see how some carmakers have fared:

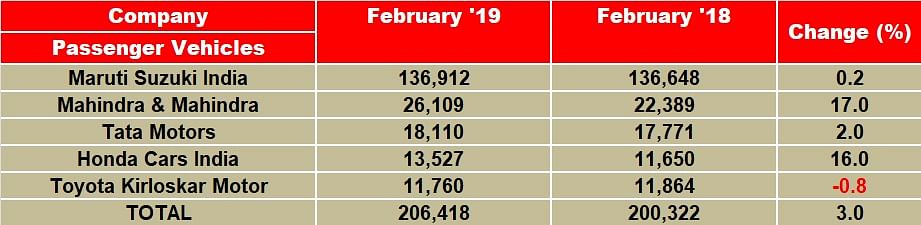

Maruti Suzuki India: At 136,912 units, the bellwether of the Indian PV industry has recorded flat 0.2 percent year-on-year growth (February 2018: 136,648). And this is the story for the sixth month in a row. Just like the entire industry, Maruti had also resorted to managing its extra inventory in the pipeline by moderating production and, as a result, its wholesales were low from November through to the start of 2019. Now, even as it brought a notable model refresh and a new launch in January, sales have witnessed no substantial uptick for Maruti in February.

Maruti's entry-level duo of the Alto and the Wagon R posted a significant slump of 26.7 percent with sales of 24,751 units in the month (February 2018: 33,789). While the Alto was the best-selling car in India in January, the company has clarified that the new third-generation Wagon R, which it launched on January 23, now moves to the ‘compact’ category of cars and joins its other siblings Celerio, Swift, Ignis, Baleno and the Dzire. The 27 percent drop is attributed to this as the data only includes the remaining numbers of the outgoing Wagon R.

The compact models together garnered total volumes of 72,678 units and registered growth of 11.4 percent (February 2018: 65,213). While the Swift, Dzire and the Baleno continue to do well, Maruti has given a minor facelift to the Ignis as well. Maruti’s midsize sedan, the Ciaz, has been facing the heat from the competition and the car clocked only 3,084 units in the month, declining 37 percent (February 2018: 4,897).

Utility vehicles, on the other hand, saved the blushes for the company, with the Vitara Brezza, S-Cross and the Ertiga going home to 21,834 buyers and growing 7.4 percent (February 2018: 20,324). Interestingly, the new second-generation Ertiga is getting good traction in private and fleet sales alike.

Vans posted strong YoY growth with the Omni and Eeco garnering notable growth of 17.2 percent and selling 14,565 units in the month (February 2018: 12,425). Maruti is likely to pull a plug on both of these models as stringent vehicle safety regulations kick in later in the year from October, and that it would need to invest heavily towards making them compliant.

In FY2018-19, Maruti Suzuki India sold a total of 1,643,467 units in the domestic market (+13.84%) and 123,903 units in the export market (+1.53%). In the April 2018 to February 2019 period, the carmaker has sold a total of 1,584,795 units (+5.9%) and exported 114,058 units (-13.8%). Given the current market trends and slow customer offtake, expect Maruti Suzuki to record single-digit YoY growth in FY2019.

Mahindra & Mahindra: M&M’s PV division sold 26,109 vehicles in February 2019 as against 22,389 vehicles in February 2018, registering YoY growth of 17 percent. Commenting on the performance, Rajan Wadhera, president, Automotive Sector, M&M, said, “We have witnessed a strong double-digit growth of 16 percent in our UV portfolio, on the back of our newly launched XUV300 model.”

Tata Motors: Despite the slowdown in the domestic market, the company sold 18,110 vehicles, reporting marginal growth of 2 percent (February 2018: 17,771 units). The company says the sales were on the back of good demand for its new-generation vehicles. The company says the feature-laden Harrier SUV, which was launched last month has received a good response in the market and is expected to see an increase in volume sales in the coming months on the back of production ramp-up. In terms of cumulative sales during the fiscal (April 2018-February 2019) Tata Motors has sold 192,333 units, a growth of 15 percent, compared to 167,055 units, in the same period, last fiscal.

Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors said, "In February 2019, we have strived to maintain our growth trajectory at a time when the market is under stress. Despite the challenging environment last month, we witnessed a growth of 2 percent, fuelled by the good performance of our new generation products. The Harrier has been very well accepted by our consumers and we are expecting higher volumes in the coming months as the production ramps up. Our UV portfolio has grown from strength to strength, with a growth of 26 percent. We will continue to deliver the best of products and services to our customers and work towards driving volumes in the months to come.”

Honda Cars India: The Japanese carmaker was another one to be bringing cheerfulness with a notable 16 percent growth rate in the month. Honda sold 13,527 units in the domestic market, coming majorly on the back of the Amaze, City and the WR-V (February 2018: 11,650). The company has also initiated its new nationwide brand theme update process, to be introduced at all of its authorised dealership outlets across the country. The company is now gearing up to the launch of the latest generation of the Civic D-segment sedan, production of which has already begun at the company’s Greater Noida plant.

According to Rajesh Goel, senior vice president and director, Sales and Marketing, Honda Cars India, “Our on-ground efforts and sustained sales momentum for models, specially the Amaze, City and WR-V have fuelled our growth in February. The overall market sentiment is not overtly buoyant at this stage, however we hope the market will revive soon.”

Toyota Kirloskar Motor: The Bangalore-based carmaker has reported total sales of 11,760 units in the domestic market, down 0.8 percent (February 2018: 11,864). According to N Raja, deputy managing director, Toyota Kirloskar Motor, “We have seen improvement in consumer sentiments as compared to January leading to a growth in demand. However, the auto sales are witnessing a temporary slowdown in the pre-election phase in addition to factors like tight liquidity condition impacting the buying behavior. We are happy that the Innova Crysta continues to maintain the positive growth momentum in sales as compared to the same period last year. We are delighted with the overwhelming response that the new Camry Hybrid Electric Vehicle or self-charging EV has received from customers across India. It is encouraging for us to see that the customers have recognized the enhanced product with advanced Hybrid technology with smart intuitive features unparalleled drive experience, luxury, quality, reliability and safety. We have more than 400 bookings already. We have sold more than 130 units since launch on January 18, 2018. We believe customers will understand and appreciate the benefits of clean and green-friendly self-charging electric vehicles. We are capitalising all our efficiency to reduce the current waiting period for the Camry HEV. We expect a positive outlook in domestic sales in the month of March, which is generally a good demand month for the industry.”

Also read: Slower M&HCVs offtake a drag on overall CV sales in February

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

01 Mar 2019

01 Mar 2019

8861 Views

8861 Views

Autocar Professional Bureau

Autocar Professional Bureau