Car sales remain in slow growth mode, OEMs look to January to jump-start numbers

Despite mouth-watering discounts on a number of popular cars and SUVs, passenger vehicle buyers refused to bite in December. Automakers look fervently at January and a gaggle of new models to jump-start sales growth.

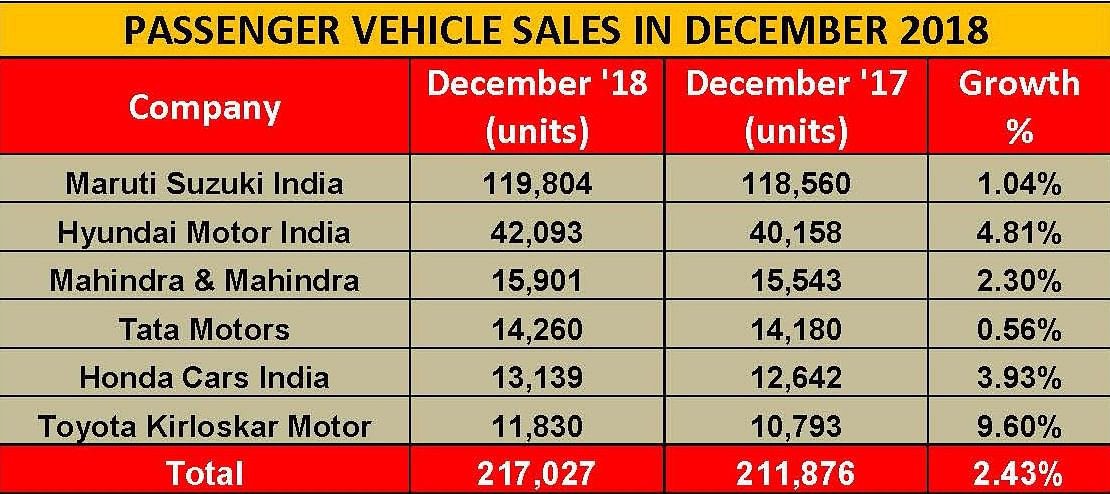

As passenger vehicle (PV) manufacturers revealed their monthly despatch details for the last month of 2018, it is amply clear that buyer sentiment is down and rather sharply at that. Given that the bellwether of the PV industry – Maruti Suzuki India – posted flat 1.0 percent growth in December 2018, expect overall PV industry numbers to mirror the leader’s performance.

The PV industry has been feeling the pace of slowing sales right from July, which went on to impact the festive season, much to the chagrin of automakers – July (290,960 / -2.71%), August (287,186 / -2.46%), September (292,658 / -5.61%), October (284,224 / +1.55%), November (266,000 / -3.43%).

As the festive months of October and November turned out to be anything but festive, December despatches have ranged from low to moderate as OEMs look to optimise leftover inventories at dealerships.

Maruti Suzuki India clocked overall domestic despatches of 119,804 units, registering marginal growth of 1 percent (December 2017: 118,560). A notable decline comes from its entry-level cars – down a sizeable 14 percent with the combined sales of Alto and Wagon R declining to 27,661 units (December 2017: 32,146). A big reason for this could be the minimal production of the current-generation Wagon R, which is nearing its end of life, and Maruti is all set to introduce the new model on January 23.

The quintet of Swift, Celerio, Ignis, Baleno and Dzire too saw a sales slump but relatively lower at 3.8 percent with cumulative sales of 51,334 units (December 2017: 53,336). Maruti's premium Ciaz sedan, on the other hand, registered smart 98.7 percent growth with 4,734 buyers choosing the car, as against 2,382 customers in December 2017. Mouth-watering discounts on an already value-for-money package did make sense for a lot of customers eyeing the C-segment.

While its vans Omni and Eeco sold 15,850 units and registered good 38.8 percent growth as well (December 2017: 11,420), Maruti’s compact crossovers including the Vitara Brezza, Gypsy and the S-Cross saw moderate growth of 4.9 percent with sales touching 20,255 units, marginally up from the 19,276 units sold in December 2017.

Hyundai Motor India registered cumulative domestic sales of 42,093 units last month to record marginal growth of 4.8 percent (December 2017: 40,158). Its Grand i10, Elite i20 hatchbacks, Verna sedan and Creta SUV remained key performers all through the year, and while the company revived the Santro brand in October, it is yet to be seen how the car has actually fared with the masses it's meant for, considering it has been slightly optimistically priced by Hyundai this time around.

Mahindra & Mahindra (M&M), which has recently launched the new flagship Alturas G4 and the Marazzo MPV, has reported PV despatches of 15,901 units in December 2018, down 3 percent on year-ago numbers (December 2017: 15,543). For the April-December 2018 period, cumulative PV sales total 177,074 units, flat YoY growth of zero percent (April-December 2017: 176,875).

Commenting on the performance, Rajan Wadhera, president, Automotive Sector, M&M, said, “We are happy to have ended the first nine months of the year on a positive growth of 13% (PVs and CVs, domestic and exports), and are particularly buoyed by our ongoing strong performance in exports. However in the domestic market, challenges relating to tight liquidity and low buying sentiment continue the de-growth for December. We hope to see good performance in Q4, owing to the anticipated rural demand because of the harvesting season and the launch of our new XUV300 in February 2019.”

Tata Motors, which has been having a good offtake at the showrooms for the past year, also saw numbers slow down. The company’s Passenger Vehicles (PV) division recorded flat growth of 1 percent, at 14,260 units (December 2017: 14,180) albeit demand continues for its new-generation PVs like the Tiago, Nexon, Tigor and Hexa. Nonetheless, Tata Motors has reported a robust sales performance for the April-December 2018 period: 156,397 units, up 21 percent YoY (April-December 2017: 129,229).

Commenting on the December sales, Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors, said, "In December 2018, we have strived to maintain our growth trajectory during what was a rather sluggish period for the entire auto industry. Despite the challenging environment last month, Tata Motors’ PV business outperformed the industry with a growth of 1 percent, fueled by the good performance of our new-generation products like the Nexon, Tiago, Hexa and the new Tigor. We are gearing up to introduce our much-awaited Harrier SUV on January 23. We will continue to work towards driving volumes and increasing our market share in 2019."

Honda Cars India, which is seeing strong demand for the new Amaze and CR-V, has reported a 4 percent growth in sales in December 2018. The company despatched a total of 13,139 units in December 2018 (December 2017: 12,642). In the first nine months of FY2019, it has cumulatively sold 134,797 units, which marks YoY growth of 3.7 percent (April-December 2017: 129,964).

Rajesh Goel, senior vice-president and director, Sales and Marketing, Honda Cars India, said, “The market continued to remain challenging in December. However, with lucrative year-end offers on many of our models and strong performance of new models like the Amaze and CR-V, Honda Cars India recorded 4 percent sales growth in December 2018.”

Toyota Kirloskar Motor has posted growth of 9.60 percent in December 2018 as compared to domestic sales in December 2017. The company sold a total of 11,830 units in the domestic market in December 2018 (December 2017: 10,793 units). In addition, the company exported 812 units of the Etios series.

Commenting on the monthly sales, N Raja, deputy managing director, Toyota Kirloskar Motor, said, “We are happy to close the year end with a series of positive milestones despite the dampening effect on consumer sentiment owing to hike in fuel prices, higher interest rates, increase in insurance premium."

"We have been able to record the highest ever IMV sales (Innova and Fortuner) this year. The buying sentiment had seen a slowdown in the last few months owing to adverse effects of macroeconomic factors, yet the industry hit back with a steady growth in sales. Toyota Kirloskar Motor' domestic sales in the January to December 2018 period have grown by around 9 percent compared to the same period in 2017. We have tried and maintained lean inventory at our dealerships. The Toyota Yaris sedan launched this year has been an important contributor to the positive annual sales growth. Additionally, other products like Etios Liva have also sustained the positive sales momentum," he added.

New year, new models as growth driver

Vehicle manufacturers across segments are looking to the new year and January to jump-start sales. With a gaggle of new SUVs all set for launch soon, starting with the Tata Harrier on January 23 and the Mahindra XUV300 compact SUV in February, OEMs are hopeful 2019 gets off on a strong note. Considering the SUV market was notching nearly 20 percent YoY growth a year ago, the 3.19 percent YoY growth in April-November 2018 is a stark pointer that growth has moderated sharply.

Meanwhile, Maruti Suzuki will be launching the new Wagon R on January 23. The popular entry level model should give a fillip to the company's sales and overall industry numbers.

Interestngly, the ongoing PV sales slowdown is also impacting sale of truck trailers which are used for the movement of these cars and SUVs across the country.

Also read: M&HCV sales skid for second month in a row

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

02 Jan 2019

02 Jan 2019

7445 Views

7445 Views

Autocar Professional Bureau

Autocar Professional Bureau