Bajaj Auto records highest-ever monthly exports in November, buffers India bike market downturn

Growing demand for Bajaj motorcycles in overseas markets sees the company ship 167,109 units (18%), helping buffer its 14% downturn in the domestic market.

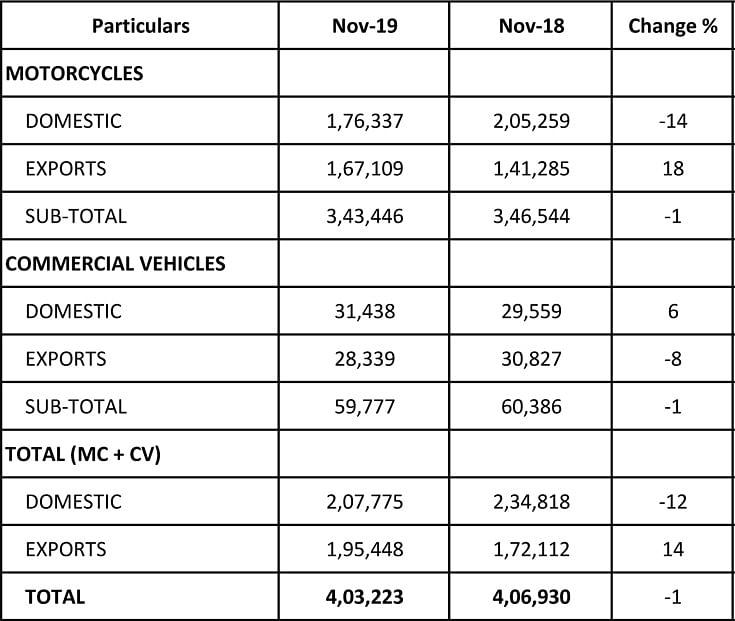

Pune-based Bajaj Auto has registered its highest-ever monthly export sales in November 2019 – 167,109 units, an 18.27% year-on-year growth (November 2018: 141,285). This robust export performance will help buffer the company’s 14% sales decline in the domestic market last month – 176,337 units (November 2018: 205,259). Domestic and export sales together – 343,446 units – make for a 1% YoY decline (November 2018: 346,544).

If there is one company, on two wheels only, which seems to be not so ruffled by the ongoing carnage in the Indian automobile market, then it is Bajaj Auto. Even as the motorcycle manufacturer rides out the storm in the domestic market, it stands secure in the fact that it is well buttressed by its strong export market performance.

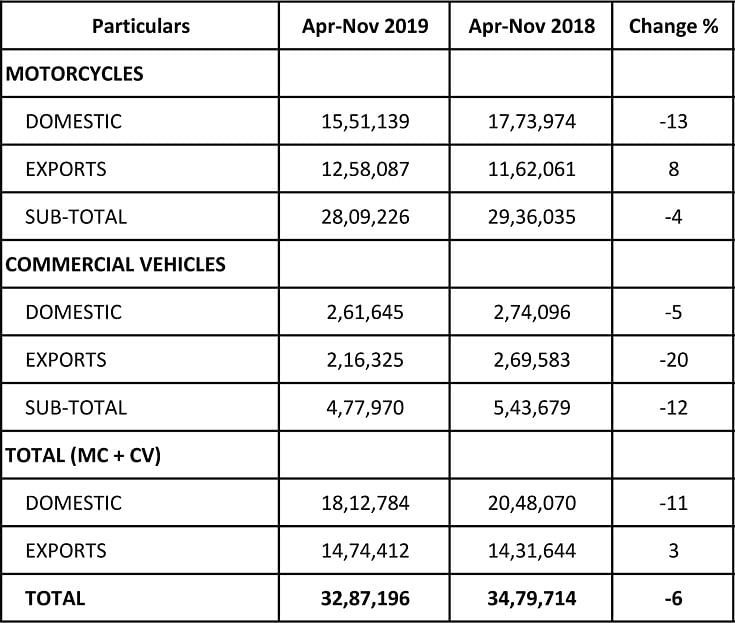

For the year to date (April-November 2019), Bajaj Auto has shipped a total of 1,258,087 motorcycles overseas, which constitutes 8.26% YoY growth (April-November 2018: 1,162,061). In the domestic market, cumulative sales for the eight-month period (April-November 2019) are 1,551,139, which is a 12.56% YoY decline (April-November 2018: 1,773,974). Cumulative domestic and exports mark a decline of 4% YoY (see data table below).

How Bajaj Auto has fared in November 2019

The April to November 2019 performance

Earlier this year, managing director Rajiv Bajaj, had attributed the company's outperformance, compared to its rivals, to a carefully thought-out strategy – segment innovation, a sharp focus on exports, and a tight control on costs. This is helping the company to ride out the domestic storm which continues to blow fiercely in the face of the industry. Low-cost innovation has richly paid off handsomely, particularly in the 100-110cc commuter bike segment where the CT100 and the Platina have won favour with buyers.

On the domestic motorcycle segment front, Bajaj Auto, which is targeting a 25% market share, the company closed FY2019 with a market share of 18.69 percent (2,541,320 units), having notched 28.7 percent growth. The bike maker had a 15.69 percent market share in FY2018 (1,974,577 units). In the first seven months of the ongoing fiscal (April-October 2019 period), the company has an 18.67% motorcycle market share. Will the remaining four months see speedier product-led action from Bajaj Auto to help it get closer to that target? Watch this space.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

02 Dec 2019

02 Dec 2019

18639 Views

18639 Views

Autocar Professional Bureau

Autocar Professional Bureau