Europe’s love affair with SUVs continues; biggest sales driver in March

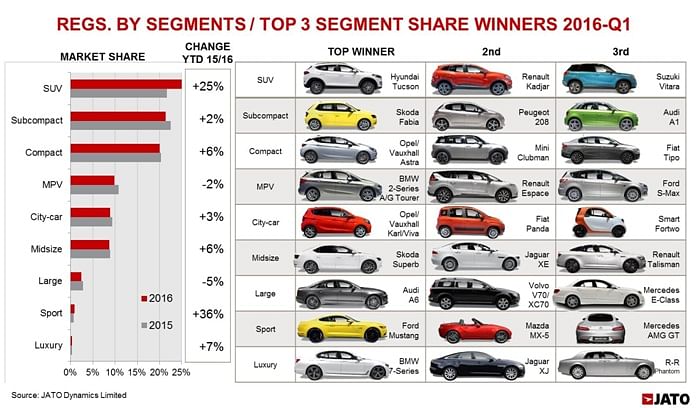

Continuing the recent trend, the SUV segment was the biggest growth driver, accounting for 25% of sales in March Q1 2016, an improvement on the 21.7% share year-on-year (YoY).

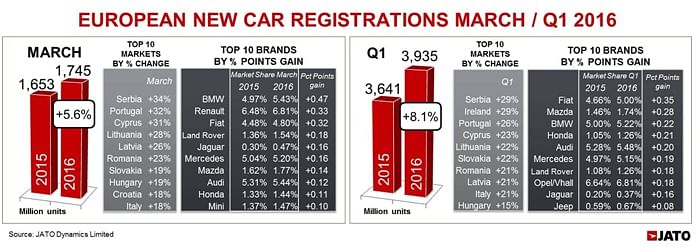

March 2016 was another positive month for European new car sales, ending a strong Q1 which saw sales of 3.93 million units, up by 8.1% over the first three months of 2015. Although volumes grew at a slower rate (+5.6%) than recorded in February 2016 (+13.8%), positive results in 23 of the 29 markets analysed meant growth continued. The year-to-date (YTD) figures showed gains in 26 markets, with 16 of them posting double-digit growth. The March SAAR came in at 14.98 million units.

Continuing the recent trend, the SUV segment was the biggest growth driver, accounting for 25% of sales in March Q1 2016, an improvement on the 21.7% share year-on-year (YoY). Meanwhile, B-Segment (subcompact cars) and MPVs suffered most, posting the highest market share loss.

The emissions scandal has failed to dislodge Volkswagen from its pole position as the best-selling brand. The German carmaker leads the rankings in Austria, Belgium, Croatia, Denmark, Germany, Latvia, Netherlands, Norway, Slovenia and Switzerland during the first quarter. However, it was also the brand to post the highest market share drop, with its March share reaching its lowest since September 2015 at 10.29% (11.10% in March 2015), and 11.02% for Q1 (11.97% in Q1 2015). In contrast, the biggest market share winners during the first three months of the year were BMW, Renault and Fiat, with the last two benefiting from strong SUV demand growth.

“Overall, we have seen a trend of positive growth so far this year. Consumers are consistently responding well to the brands’ latest launches, despite the problems faced by Europe’s largest car maker” commented Felipe Munoz, global automotive analyst at JATO Dynamics.

With almost 56,000 units sold in March, the Volkswagen Golf topped the ranking by models, though its market share dropped from 3.39% in March 2015 to 3.21% last month. The European best-seller did not post any change in March, a more positive result than the falls in demand experienced by other leaders such as the Ford Fiesta (-11%) and the Opel/Vauxhall Corsa (-11%). These two subcompacts both experienced challenging times in the UK and Germany, where their sales posted double-digit falls. This was, however, not unusual - of the top 10 models, only three posted positive changes: Peugeot 208 (+4%), Opel/Vauxhall Astra (+18%) and Fiat 500 (+12%), which re-entered the top 10 thanks to the usual sales peak coming from the UK.

The Year-to-date data revealed that sales dipped for four of the top five best-selling models, with the Golf experiencing a 2% drop from Q1 2015, to 130,400 units. Similarly, the Ford Fiesta’s volumes dropped by 4%, the Renault Clio 3%, and the Opel/Vauxhall Corsa 6%. The Volkswagen Polo was the only model in the top 5 with a volume rise (+3%). All of these subcompacts were outpaced by the Peugeot 208, at sixth place, with registrations up by 13%, gaining 0.08 percentage points of share. Nissan’s Qashqai placed 7th, maintaining its position as the best-selling SUV in Europe with 66,200 units, though it only saw a 1% rise in volumes compared to the first quarter of 2015. This loss of market share was due to tougher competition. These models were followed by the new Opel/Vauxhall Astra, which jumped from 16th place in Q1 2015 to 8th place this quarter, posting a 30% volume increase, thanks mostly to strong growth in the German market (+46%), which offset the loss seen in the UK (-2%).

Seven of the ten biggest market share winners were SUVs, with the new Hyundai Tucson controlling almost 1% of the market, following strong demand in the UK, Germany, Italy and Ireland. The Tucson was the third best-selling compact SUV, outselling other important players such as the Volkswagen Tiguan and Ford Kuga. The Hyundai was followed by its rival from Renault – the Kadjar – with 0.84% market share, and France counting for 30% of its European volume. The Suzuki Vitara, Fiat 500X, Mecedes GLC, Mazda CX-3 and BMW X1 were the other SUVs to gain more market share, along with the Opel/Vauxhall Karl/Viva and Astra, and the Skoda Superb.

“SUVs continue to post strong growth at the expense of the traditional segments. The first quarter results reveal a clear trend of European consumers shifting their interest from subcompact and compact cars, and from MPVs to small and compact SUVs”, concluded Munoz.

Recommended:

RELATED ARTICLES

Nissan reinvents Leaf as a sleek electric SUV with 600km range

First launched as a hatchback in 2010, the third-generation Leaf is unrecognisable compared with its predecessors. The n...

Volvo Cars signs recycled steel supply pact with SSAB

The recycled steel will be used in selected components of the forthcoming, fully electric EX60 SUV, as well as other car...

Schaeffler and NVIDIA ink technology collaboration to advance digital manufacturing

Using NVIDIA Omniverse, Schaeffler is expanding its production elements, which will be integrated and simulated as digit...

By Autocar Professional Bureau

By Autocar Professional Bureau

27 Apr 2016

27 Apr 2016

5208 Views

5208 Views