'Our survey in rural India has revealed key insights about the mindset of the two-wheeler buyer there.'

Whenever any segment gains popularity, it gives rise to many sub-segments that further drive growth.

How to win over buyers and influence purchase decisions is what automakers are always working hard at. YS Guleria, Honda Motorcycle & Scooter India’s senior vice-president (Sales & Marketing) reveals what it takes to click in the two-wheeler market. An interview by Amit Panday.

India is riding a wave of scooterisation and Honda has been a key driver of this trend. What are the marketing and retail strategies HMSI has adopted to succeed in the market?

As a market leader in scooters with an almost 60 percent share in India, there are a lot of expectations from brand Honda from existing users and potential buyers. It is a known fact that the scooterisation is driving the overall two-wheeler industry in India.

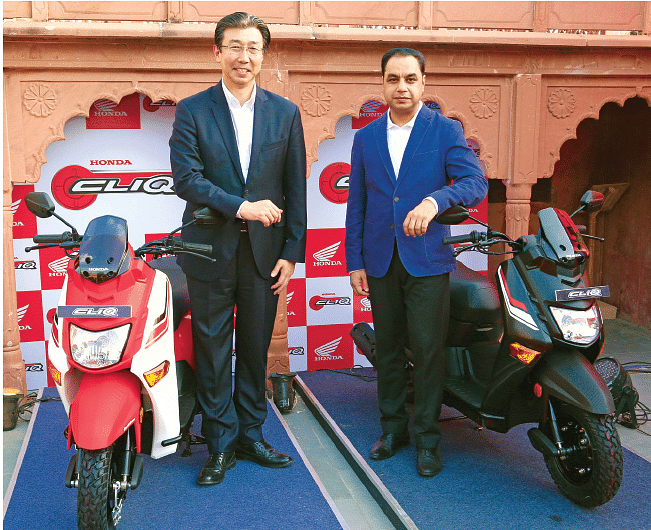

In 2001, we had only one scooter model – the Activa. After the launch of the Cliq last month, we now have six. We have evolved a lot, both in terms of product specifications and product attributes, over the years.

There is a lot of difference in what the Activa launched 16-17 years ago offered to customers to what we are now offering to new-generation buyers across many parameters – style, comfort, safety, quality, features and others.

Whenever any segment gains popularity, it gives rise to many sub-segments that further drive growth. In the scooter market today, the largest set of customers is the family. While the scooter as a rider-friendly concept is here to stay, young customers always want to look a little different in terms of style and appeal. This led to the rollout of the Dio. While the Activa remains at the core, we were successful in creating the sub-segment within the scooter segment with the Dio.

When we launched the Dio, we called it the moto-scooter due to its trendy design and young appeal. It was way ahead of its time in India (in 2002) and it is now the second-largest selling scooter for us. Currently, you see many trendy looking moto-scooters in the market, a sub-segment originally started by the Dio.

Similarly, when we gauged demand for premium features (disc brakes, telescopic forks, bigger alloy wheels, more comfort) in scooters, we rolled out the Aviator for a very limited class among urban commuters. And when we figured a new emerging need for a lightweight scooter for female commuters and scooters with slightly more power, we launched the Activa-i and Activa 125 respectively.

What went into devising the sales strategy for the recently launched Cliq scooter?

We want to create another sub-segment with the all-new 110cc Cliq because scooterisation has already achieved acceptance in the urban and semi-urban markets as a preferred mode for daily commuting.

We are already seeing the signs of penetration in rural territories. However, this speed of scooter penetration was very slow. We conducted a market survey to gain insights into the same, which brought three to four points to focus.

l The price barrier. The weighted average of all commuter motorcycles available in rural markets is about Rs 45,000. The same for scooters is Rs 48,000.

l The infrastructure in rural India limits usage of scooters due to the smaller wheel size they offer.

l We figured that the mentality of the running population is also at work. Although the technology for scooters has evolved tremendously over the years and the fuel efficiency gap between scooters and motorcycles has reduced dramatically, the confidence among rural buyers to purchase a scooter remains low. This is so because they do not see many commuters riding scooters daily.

l Another challenge exists in the form of a rural mindset, which believes that anything automatic is always expensive.

Honda is well placed to roll out an automatic scooter at a price lower than the weighted average price of motorcycles for rural buyers, thanks to the benefits accruing from large economies of scale. Moreover, thanks to the GST regime, the price of the Cliq has been further reduced to Rs 41,780 (ex-showroom, Jaipur post-GST).

I can now confidently say that the new Cliq scooter will address these challenges and the rural customers will certainly look to acquire it.

How are you communicating the Cliq's features, which may help Honda overcome these challenges, to your potential rural customers?

We have launched the Cliq only in Rajasthan because of two reasons – it is made in the Rajasthan-based factory and, secondly, the state is a large market for the 100cc-110cc motorcycle market.

Based on these two prime reasons, Rajasthan will become a case study defining how to penetrate scooters into a state that is dominated by a large rural motorcycle market.

The scooter was test ridden by experts on the patchy village lanes to examine how its block-pattern tyres perform. It received an encouraging response from everyone.

The marketing strategy included the selection of the venue, product packaging and communication to the audience in their local language. We hired a local folk singer, who sang in the local language. The lyrics of the composition spoke about all the unique features of the Honda Cliq.

We ran teaser campaigns that said Honda to bring ‘Bade kaam ki cheez’ in the outdoor media to generate curiosity around the product before launch. The slogan was later replaced with – ‘Bade kaam ki Cliq’, which was released on the day of the launch.

We ran campaigns across mediums including print, radio and outdoor media. We organised roadshows with vans displaying the Cliq and offering test rides to the local people. One of the biggest challenges in the rural areas is to make people ride the scooter. We managed to give 400-500 test rides a day at the taluka level.

Furthermore, we had set up a special call centre where people interested in the Cliq were supposed to give only missed calls. We got 11,000 missed calls on the day of the launch (Rajasthan alone). Now we are in the process of reaching out to these callers and answering their queries on the product.

Going forward, as we roll out the scooter in other states, we would like to replicate these marketing strategies there too. The concept of these strategies will remain the same but will be tailored suiting the respective regions best.

At what stage are these marketing strategies conceived? Are they born when the product is under development or when it is on the design board?

The marketing efforts typically begin very early and we have representation of people at the appropriate time during the various stages of the product development.

The involvement of inputs from the marketing team and the product planning teams depends upon the product and segment type. Therefore, at various stages, professionals from each of these core areas become a part of the core team and they start working on their respective deliverables.

Even a good product, if not communicated in the right manner and at the right time to its target audience, may not be able to do justice. You need to have a fair mix of all stakeholders involved in the various stages of the product development.

The product in question can be a facelift or it can be a totally new product. For example with the Navi, since it was a unique concept, we had to bring the marketing and communication team early into the product development. Even internally, nobody knew whether the Navi was a scooter or a motorcycle. The team finally suggested that we must carry forward this curiosity as an integral part of our communication to the target audiences.

We also came up with a Navi app, which was aimed at youngsters. With the app, we got a lot of inputs in the form of preferred colour schemes, accessories and features.

So, the marketing strategies depend upon the product category. If it is about venturing into a totally new segment, then the number of stakeholders is high. In case of a minor modification or cosmetic changes to an existing product, such high involvement may not be required.

How different are the marketing and retail strategies for Honda’s big bikes, which constitute the other end of the product portfolio?

This is one unique feature of Honda as a brand. This also becomes very challenging for us as we have to work on different strategies for products from the top end to the bottom end of the spectrum. We also make aeroplanes and other power products. We have a big product portfolio, all of them linked to mobility. So, one core characteristic that connects all these products is the DNA of Honda.

The brand’s unique DNA is defined by what always comes to our consumers’ minds because of our long history. These attributes are trust, reliability, innovation and technology.

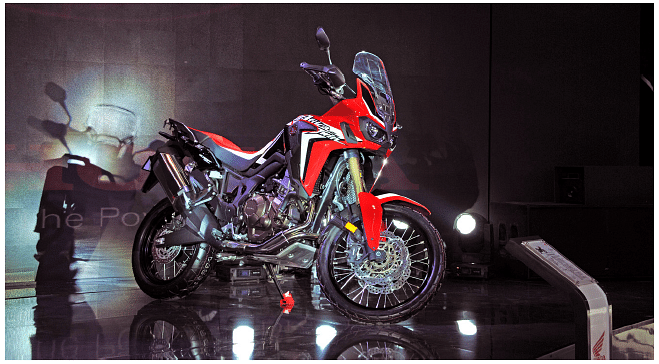

Specifically to answer your question, when our target customers are limited and very niche, then ideally we need a very different team to handle them. Within Honda we have a team, which we call as the Wing World team. They are designated to exclusively handle the premium product sales and services for owners of superbike models starting from the CBR650F, FireBlade, CB1000R, Goldwing and now the Africa Twin. They are trained differently, based on the special requirements and needs from the customer point of view. The expectations of premium customers are very different from time to time.

This is the reason why we have a different vertical to handle any query of such customers. We need to limit the hierarchy to reduce the time taken in decision-making concerning the premium customers.

Therefore, we have divided the team wherein one leader heads the southern and western regions while the other heads the northern and central regions. They are directly in touch with the sales team, the dealerships and even the premium Honda customers.

We have a network of 22 dealerships across India which are currently involved in the retail sales of our big motorcycles.

Also read : Honda adds new scooter to its portfolio, its most affordable yet

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

29 Jul 2017

29 Jul 2017

22927 Views

22927 Views

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa