R C Bhargava: ‘Industry will require several government policy initiatives to reach sustainable double-digit growth.’

In a comprehensive interview, industry veteran and Chairman of Maruti Suzuki India, R C Bhargava speaks on the industry’s role in propelling India ahead.

In a comprehensive interview, industry veteran and Chairman of Maruti Suzuki India, R C Bhargava speaks on the industry’s role in propelling India ahead, Maruti Suzuki’s strategies to remain successful, why electrification is not a strong case for India yet, and more.

Would you say the most important announcement in the 2021 Union Budget, as far as India Auto Inc is concerned, the scrappage policy, followed by allocation for infrastructure development are the most important ones?

No, I won't agree with that at all. I think the most important announcement was the Finance Minister saying that the government intends that manufacturing should grow in double digits. It’s the first time that I remember ever hearing a government formally announcing and on such an important occasion as the Budget, that it intends to grow manufacturing in double digits.

You cannot grow the automobile industry at lower rates and then expect manufacturing to grow in double digits. It’s too big a segment of the manufacturing sector. So, if the manufacturing sector is to grow in double digits, it's virtually certain that the automobile industry should grow in double digits. The automobile industry in the last decade particularly has been declining, and in the last five years it was down to a CAGR of 1.5 percent. So from that to reach double digits will require government to take several policy initiatives to ensure that the growth rate, on a sustained basis, gets to double digits

That, to my mind is far, far more important than the scrappage policy. Yes, the scrappage policy is good for various reasons, and not only for the growth of the industry. It will, of course, lead to the scrapping of unfit vehicles which will lead to growth, because today there are too many unfit vehicles on the road. But that's a byproduct. I think safety, environment and traffic management for the citizens are far more important.

You also talked about the importance of the focus on manufacturing. As the Finance Minister herself said, sustained growth of the manufacturing sector is key for really making the ‘Make in India’ vision succeed. At another level, it is also crucial for the realisation of the $5 trillion economy.

Absolutely, I don't think we can get to any of these targets without growing the automobile industry.

What is your take on the hike in customs duty of various components? One school of thought may oppose it saying it is protectionism, while another may say it is in line with the focus on ‘Atmanirbharta’ (self-reliance).

When any new industry starts now, with the global market being virtually open to everybody, the industry has a disadvantage because it’s still on a small scale and initial costs of operation are high. So some protection for a start-up industry is probably a good thing for creating industrial viability in the country.

Obviously, that should be for a very limited period till such time as the industry is able to establish and get to some size which let's say it takes three years or something like that. But it should not happen to an industry which doesn't exist at all. If there are some things which are not being manufactured in India and no factories coming up for it then raising customs duty on that is not going to bring ‘Atmanirbharta’.

Maruti Suzuki has built a lead which is almost unassailable at one level. How does it plan to grow and sustain this leadership in a market attracting more players, and where the customer preferences are also changing fast?

Well, Maruti has throughout focused on trying to best meet customer requirements, and to see that the customer gets the best aftersales service and best spare parts. This is so that the customer feels that when he buys a Maruti car, he's getting value for his money and his product is going to be something which can be used without much problems for a long time. I think we have to continue to do that.

Our biggest strength is that we have today about 4,000 service points in the country, and growing. They're growing every month. What does a customer want? He should want to get good quality aftersales service, as conveniently and as economically as possible

We are aware how the markets are changing and we are adjusting to meet customer requirements. We will of course need to do a lot of other things, in terms of expanding capacities and bringing in new technologies but the the basic approach is going to be the same — look after customer requirements as well as you possibly can.

With that philosophy in mind, how do you plan to tap the growing customer aspiration? Maruti Suzuki’s presence and performance is quite different in the segment of cars worth Rs 10 lakh and above than in the big-volume segment below.

The market for the bigger vehicles will certainly grow but that doesn't mean that the market for smaller vehicles will not grow. Currently in India, there are only around 30 cars per thousand people and there's a lot of scope for that growth to happen. Because, the number 30 I expect, in the first stage, will at least go up to about 100 vehicles per thousand and a bulk of those will be people at the lower end of the market.

There is a growing market and a growing demand for SUVs. So we will be in the SUV market also. Customers today want connected cars and they want all kinds of electronics in the cars and all of those, so we are giving that to them also. So, I don't think that is going to be a problem at all.

At a time when customer preferences are changing fast, do you think a 50 percent market share in the coming years is realistic or sustainable?

There are lots of people who believe that when the market becomes bigger, maintaining a 50 percent market share is not a thing which can happen. It has not happened anywhere in the world by the way, that any company has that kind of a market share. Even General Motors, at the height of its dominance, didn’t have that kind of market share.

The Indian market today is quite small but then it's going to become a 10 million-units-a-year market and may become a 15-million-a-year market possibly. At that stage, a 50 percent market share means 5 to 7.5 million cars a year. That's a lot of cars for a company to produce and sell in one country. I don't know what the future will be, so I'm not going to make a guess even as to whether we will be at 50 percent or something lower. It’s something that will keep evolving.

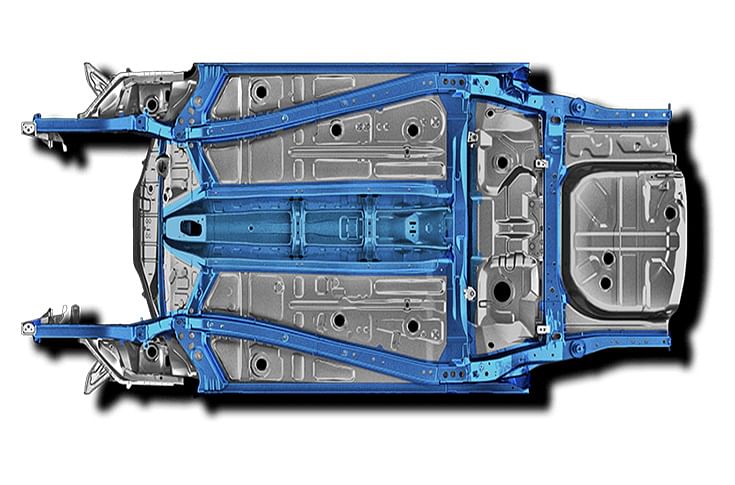

The Heartect platform by Maruti Suzuki, built with advanced and high-tensile steel, is designed with core focus on safety. The platform has a smooth continuous design for better impact absorption in case of a collision, along with better stability and fuel efficiency.

Will the focus be stronger on profitability and sustainable growth?

No, it's not that. The whole logistics and the whole complications of running a company which is making that number of cars. No single company does it, making 5, 6, 7 million cars a year. What will it mean in terms of management, what will it mean in terms of organisation? It's very very difficult to predict at this point of time. It is one thing to make and sell 2 million cars a year in a company, which is big enough by the way. If you make that 2 million to 5 million, what will it entail? I don't think anybody has applied their minds to this. If you are going to run a company, then you can't just talk of numbers. You have to look at all the implications of what it will be to produce and sell that number of cars.

The Suzuki and Toyota global alliance has seen some action in India. How do you think the alliance in India will evolve?

The alliance is an alliance in Japan, and here in India Maruti Suzuki India is not involved in that alliance directly. The alliance in Japan is of course having its impact in India also as you said, in terms of technology, vehicle sharing, capacity sharing. I think that will continue to grow and it's something which is good for all of us, I think. This kind of an alliance between Suzuki and Toyota, with the enormous capabilities which Toyota has, plus the very specialised skills which Suzuki has, I think that combination is going to do a lot of good to the Indian market.

As the technology evolution happens in the automotive marketplace, would you source more technology from Toyota?

Technology comes to us through Suzuki, and it's Suzuki which will keep working with Toyota on new technologies and things like that. But certainly if some new technologies are evolved in Japan between the two of them, and they have applications in India, it will certainly come here because the market here is big. Both Toyota and Suzuki will benefit if any new technology becomes available and it's used on a large volume of vehicles.

Maruti Suzuki’s original plan was to enter the EV space in 2020. What are the hurdles on the way?Unfortunately so far, the expected development in global battery technology have not apparently moved as fast as was expected. There were expectations that the battery cost would come down in the next 2-3 yearsand that the $200 kWh would come down to maybe 60-70-80 dollars a kWh. I think that one of the biggest impediments to the growth of electric vehicles in India is this high cost of technology.

Along with this is the fact that again technology has not developed to find materials other than lithium as the main ingredient for batteries. And lithium is not easily available. The bulk of it in the world is controlled by one country and that also becomes an issue — do you want to substitute your existing imports of oil with the import of material which is essentially controlled by a single country? There are other questions of infrastructure, availability of energy and source of energy. If it is clean energy, then you need storage. Again it becomes a question of battery technology.

Everybody talks of EVs, but if you look globally the growth of EVs is very, very slow. In most countries it’s just 2- 3 percent. China has the biggest EV population, and they control the lithium supply also, but in all other countries the progress of EVs is very slow. And remember, India's per capita income is way below those of America, Europe and Japan. A $2,000 to $3,000-income individual and a $50,000-60,000-income individual buying a vehicle at the same cost is a different proposition.

We are quite close to the new financial year. Would it see Maruti Suzuki taking some new steps to appeal more to the Indian consumer, and in terms of new products maybe?

We don't talk about new products in advance, but I think next year is still going to be a year when we will be catching up with the sales. You know this year the sales of the automobile industry as a whole will be almost 25 percent lower than what they were in FY2019.

In FY2020, we lost 18 percent in the automobile industry. This year probably will see losses close to 7-8 percent. So, in FY2022, the industry would do well to get close to FY2019 sales. It’s not that there's going to be some great revival of the industry at all.

This interviews was first published in Autocar Professional's March 15, 2021 issue.

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

02 Apr 2021

02 Apr 2021

16595 Views

16595 Views

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa