Festive season auto volumes; strong season led by rural push in 2Ws: Emkay Global Financial Services

2W sales saw the highest festive sales volume since 2019 at 28,93,107 units.

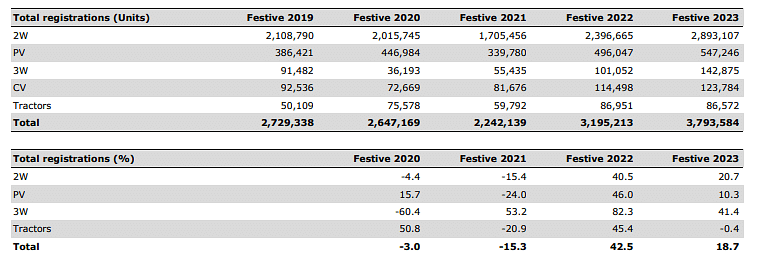

As per the Federation of Automobile Dealers Associations (FADA), auto industry retail volumes grew ~19% YoY in the 2023 festive season (42-day period, beginning on the 1st day of Navratri through to 15 days post Dhanteras). This was led by ~21% higher 2W sales. The 2W sales saw the highest festive sales volume since 2019 at 28,93,107 units. This was followed by PV at 5,47,246 units and 3W at 1,42,875 units. Emkay thinks that the 2W festive performance is not an anomaly, and that growth in this area is expected to continue over the next two to three years due to a record-high fleet age (as of FY23, industry volumes were still around 25% below their peak). This will likely lead to a replacement-led upturn.

Industry retails saw a YoY gain of 18.7% to reach around 3.8 million units during the 2023 festive season, according to FADA. Growth was driven by a 20.7% increase in volume in 2Ws and a 41.4% increase in 3Ws. Tractors were unchanged while CVs increased by 8.1% and PVs saw 10.3% growth.

Two-wheelers

FADA’s commentary highlighted strong rural support for 2W; HMCL had earlier reported its best-ever festive season with ~19% YoY rise in retail volumes, supported by rising rural demand. Emkay observes that demand for premium motorcycles has been strong (BJAUT's above-125cc retails increased by almost 50% year over year in October through November, and Royal Enfield's festive volumes increased by 13–14% year over year).

Passenger Vehicles

PVs underperformed during Navratri (up 6.5% YoY), but they significantly improved after (up 11.7% YoY), with overall increase coming in at about 10% YoY. Although the FADA reported that demand for SUVs remained high, the segment's stock levels are concerning because OEMs are still pushing for dispatches, pushing inventory levels to almost all-time highs.

Commercial Vehicles

CV retail growth for the festive period stood at ~8% YoY. Tractor retail sales momentum picked up towards the end of the festive season (~8% decline during Navratri vs ~2% YoY growth post Navratri), as rural consumers' purchasing power began to strengthen again.

Source: FADA. Note - 42 days festive period ranges from 1st day of Navratri to 15 days post Dhanteras

RELATED ARTICLES

Euler Motors, Jio-bp Partner to Expand Commercial EV Charging Infrastructure

The partnership aims to deploy charging stations at high-demand logistics hubs across India, supporting the adoption of ...

SWITCH Mobility Deploys 272 Electric Buses in Delhi as Part of 950-Unit Order

SWITCH Mobility has flagged off 272 electric buses in Delhi under a CESL tender, marking Phase 2 of a 950-bus deployment...

GreenCell Mobility Announces 570-Bus Electric Fleet Expansion in Delhi

GreenCell Mobility has announced the deployment of 570 electric buses in Delhi following an USD 89 million investment ro...

By Autocar Professional Bureau

By Autocar Professional Bureau

30 Nov 2023

30 Nov 2023

4074 Views

4074 Views

Sarthak Mahajan

Sarthak Mahajan