We Aim To Regain 50% Market Share In EVs In The Long-Term Focus: Tata Motors’ Shailesh Chandra

The company is focusing on micro-segments, enhancing product value propositions, and investing in charging infrastructure to drive long-term growth.

Tata Motors has come up with a robust strategy to bounce back to a 50% market share in the EV segment in the longer term, Shailesh Chandra, Managing Director of Tata Motors Passenger Vehicles Ltd, told Autocar Professional. The company reported a 13% year-on-year decline in EV sales in FY25, with volumes falling from 73,833 units to 64,276 units, yielding to rivals like JSW MG Motor India and Mahindra & Mahindra (M&M).

“In the short term, I expect some impact but I’m not overly perturbed by it. My focus is on whether we’re preparing ourselves well for the long term. A lot of foundational work is underway to mainstream EVs. We're focusing on micro-segments across different markets to sustain growth beyond the next 18–24 months. We have a robust strategy in place to sustain our market share,” he added.

Chandra acknowledged that while a decline in market share was anticipated, the drop in volumes came as a surprise. “Market share decline was expected. Volume de-growth was not expected,” he said.

Chandra explained that demand was impacted by the discontinuation of certain platforms, pullback from fleet buyers, particularly in employee transport and e-hailing services like BluSmart and discontinuation of FAME II policy.

“The volume de-growth of about 7000-8000 that we had was completely because of the lack of fleet…In the personal segment, however, we have been sustaining the volumes where they were. It should have grown actually, but there was negativity around EVs and confusion around hybrids,” he said.

Explaining his view of the evolving EV market, Chandra broke it down into four distinct segments: ₹8–12 lakhs, ₹12–20 lakhs, ₹20 lakh and above and the fleet segments.

In the first segment–the space currently dominated by the Tiago and Punch, Tata Motors holds a 75% market share. “However, the overall size of this segment still needs to grow. That means we must strengthen the value proposition of our products. We are actively working on the right price-feature combination and looking to expand the segment itself,” he said.

According to Chandra, the competition has intensified in the ₹12–20 lakh segment.

The segment has seen the launch of MG Windsor, which has emerged as India's largest selling electric car within weeks of launch.

“Some players have gone super aggressive on pricing, which has impacted our market share. It currently stands at around 33%, largely due to crowding in this space. We need to enhance our value proposition here, and models like the Nexon EV and the Curvv EV will play a key role in doing that,” he said.

While Tata Motors is not present in the ₹20 lakh and above segment yet, Chandra feels that the launch of the Harrier EV and the Sierra EV will help them tap into this segment and it will be important for the company’s “premiumising EV strategy”.

He added that so far, fleet applications haven't opened up widely because the total cost of ownership (TCO) advantage was only against diesel, as opposed to CNG. “Since CNG is the larger fleet market, we are now working on making EVs more competitive on a TCO basis compared to CNG. Once we achieve that, this segment will also open up for us,” he adds.

He added that there’s a lot of disciplined work happening across the ecosystem. “We’re actively investing in the charging infrastructure — including the deployment of 120-kilowatt chargers — and we’re putting skin in the game alongside several charge point operators (CPOs). We've also aggregated the efforts of various CPOs to ensure better network coverage,” he said.

RELATED ARTICLES

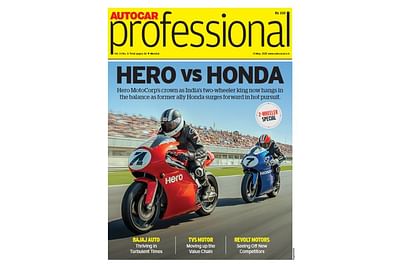

Honda Launches CB750 Hornet and CB1000 Hornet SP in India

The CB750 Hornet is priced at Rs. 8,59,500 while the CB1000 Hornet SP costs Rs. 12,35,900 (ex-showroom Gurugram).

Honda’s Slow but Steady EV Play: Japanese Giant Watches India’s First-Gen E2W Battery Cycles Before Accelerating Push

"We are keenly watching consumers' decisions once battery performance starts dropping—will they swap batteries, replace ...

See Margin Under Pressure in Q1 Due to Steel Price Spike: Ashok Leyland CEO

CEO Shenu Agarwal says safeguard duty on steel will affect short-term margins but expects prices to stabilise by Q2

23 May 2025

23 May 2025

1936 Views

1936 Views

Arunima Pal

Arunima Pal

Kiran Murali

Kiran Murali

Yukta Mudgal

Yukta Mudgal