Tata Technologies' Steve Haywood: 'Our 5R rightweighting methodology has surpassed global standards of lightweighting.'

Tata Technologies' executive vice-president reveals the 5R Rightweighting technique used in the 'Tesla beater from China' — NIO ES8

Tata Technologies' executive vice-president of Engineering, Research and Development, Steve Haywood, explains the best way to substantially reduce vehicle weight while improving attributes such as car body stiffness, at a price the market is willing to pay.

Vehicle lightweighting is the No. 1 priority for automakers globally. OEMs are deploying lightweight materials for body, chassis, interior, powertrain and under-the-hood applications. What, in your opinion, are the key challenges faced by them?

As regulations call for higher emission standards, consumers demand for more fuel-efficient vehicles and the introduction of hybrid and electric vehicles in the marketplace, the requirement for and the overall impact of lightweighting is significantly changing the automotive industry.

For many automakers, getting the right mix of materials and appropriate joining technologies have proven challenging. With material options like advanced/ultra-high-strength steel (AHSS/UHSS), aluminium and carbon fibre, along with new design solutions, manufacturing and processing techniques, automakers have to determine the best route forward. The lighter the material the higher the costs, which will be ultimately passed on to the buyer or the sales price of the vehicle and therefore will dictate the types of materials the automaker has the ability to adopt.

In addition to cost restraints, safety performance is critical when embarking on a lightweighting development. In a collision, the object with the lighter weight tends to sustain most of the damage. Automakers must thoroughly evaluate the implications of material behaviour, energy absorption and control forces while advancing passive safety systems.

Experts from different teams across Tata Technologies’ Global Engineering Centres collaborated with NIO’s engineering team to make the NIO ES8, an all-aluminium SUV that broke lightweight index benchmarks.

The total cost of change is fundamental to determining the appropriate strategy for OEMs to determine future platform and product designs. Although material costs are an obvious and visible measure of unit margin, the turnaround costs of migrating to different materials can be onerous and limit the capability of companies to adopt change. These costs affect all aspects of product delivery from engineering expertise to manufacturing plant and supply chain infrastructure.

On the lightweighting front, and with megatrends like vehicle electrification, OEMs are looking to slash vehicle weight across all types of vehicles. What are the different materials and methods with which you are facilitating OEMs to shed vehicle weight without impacting safety?

Although electric vehicles are less sensitive to mass reduction for improving range, reducing vehicle weight still is the most efficient way and has the greatest impact to reduce CO2 emissions and improve fuel economy. Historically, steel has long been an industry norm for most applications; however, this is slowly being replaced with more weight-efficient materials. Aluminium, while more expensive, is a third of that of conventional mild steel. To continue to compete, steel manufacturers are creating improved, high-strength grades of steel. Reducing one pound of vehicle weight through advanced high-strength steel (AHSS) costs around 50 cents (around Rs 36) while the comparative cost of aluminium is four-fold that of AHSS.

For some OEMs, carbon fibre is a more attractive alternative material as it has unlimited potential for lightweighting applications and offers many design advantages. As the automobile industry shifts to electric vehicles, lightweight materials have become important and are more extensively used by OEMs.

The reality is, one solution will not fit all and hence there is a need for targeted analysis to maximise the contribution of lightweight materials. To help automakers understand the alternatives, navigate the market and make the best decision of the materials available, Tata Technologies has developed an innovative methodology towards the lightweighting process. Our 5R Rightweighting Methodology has proved to be significant in surpassing international standards of lightweighting. It is a tested formula that delivers the right performance at the right price by applying the right amount of the right material in the right place.

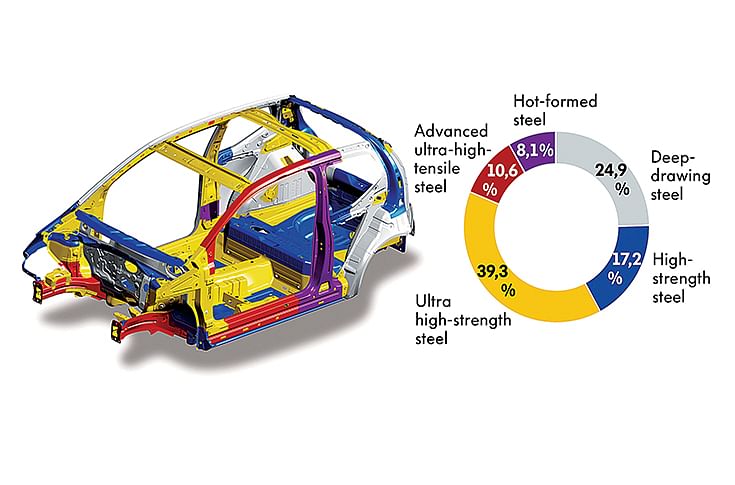

The functions of materials optimise component performance, design, convenience and customer safety. This is the materials management in the VW Up.

By evaluating a series of material configurations against a wide range of attributes and benchmarks, Tata Technologies helps companies to optimise their vehicle designs to deliver the right mix of performance and economy for their market segment.

Tata Technologies has helped Chinese start-up NIO with complete production of the all-aluminIum, electric ES8 SUV. Can you detail the contribution in terms of lightweighting of the electric SUV?

Tata Technologies was NIO’s engineering partner of choice in their ambitious goal of delivering a new premium user experience with their electric vehicles that would set benchmarks globally. Experts from different teams across Tata Technologies’ Global Engineering Centres collaborated with NIO’s engineering team to deliver the final product, which adhered to the highest standards in safety and finesse. The first finished product, the ES8, is an all-aluminium SUV that broke lightweight index benchmarks.

With the goal of creating a product-development process that would establish an industry benchmark, NIO and Tata Technologies have worked on a range of concepts on weight optimisation using a variety of advanced materials. The team has worked on creating a process that would pioneer the way for more advanced material-based vehicles in China. The result of implementing such expertise is that the ES8 is currently achieving Body Weight Efficiency targets better than most of the European auto OEMs.

Tata Technologies is currently developing more than 13 EV projects around the world. Can you detail them?

Tata Technologies is developing 13 EV (Electric Vehicle) projects globally, mainly in South East Asia and Europe with active discussions with leading automakers in India. Since inception, Tata Technologies has enabled its customers to build great products and with time we have reinvented ourselves to be ready for the electric vehicles (EV) market. We have already demonstrated, as with NIO, that we can deliver a fully-built electric SUV into production and have a global footprint in this market. Many more Tata Technologies-developed products will be rolled out into production over the coming years.

There is a huge opportunity for organisations which can help OEMs and component makers to reduce vehicle weight. How does Tata Technologies stand out in terms of competition?

When it comes to lightweighting of a vehicle, there is a well-defined approach and product strategy that goes right at the early stages of product design. Tata Technologies has played a key role in how manufacturers around the world have approached lightweighting with the help of our 5R Rightweighting Methodology mentioned earlier.

Tata Technologies developed a scientific process to reduce weight based on cost, attribute and company strategic targets. This process uses a selection process that chooses materials from a range of available options. The process enables design flexibility that meets a wide variety of customer requirements.

- Mass Market— steel intensive: Depending on the pricing of the vehicle, a design is constructed from a range of high strength steels (HSS), Advanced High Strength steels (AHSS) and ultra high strength steels (UHSS) with minimal use of conventional steel.

- Premium Market— mixed materials: In the past, the class-leading products in this range were aluminium intensive. Although with some OEMs, the vehicles are still aluminium intensive, more manufacturers are migrating to mixed materials that provide greater efficiencies in performance.

- Niche — composite intensive: For the high end of the market and for low production volumes, composites are becoming a major player. Carbon fibre reinforced polymers (CFRP) are used along with other composites such as resin transfer moulded (RTM) and glass fibre to achieve ultra-low weight products commensurate for their pricing position and attribute targets.

Intensive use of aluminium is considered as the ideal option for lightweight body structures. This is the Jaguar Land Rover manufacturing plant at Halewood, UK

None of these approaches are necessarily designed as one-size-fits-all solutions. The choice of specific materials and combinations is dependent on the market segment of the vehicle and target cost. Additionally, the vehicle’s attributes will have an impact on the technology choice, both in terms of material and manufacturing processing.

There is an upcoming trend of 3D printed parts for small production runs. How do you foresee this trend and do you believe this method will change the scope of manufacturing?

The developments in 3D printing technology have had a real benefit in the manufacture of rapid prototypes, reducing the delivery time and reducing the wastage and consumption in the various stages of manufacturing. It is cost effective when it comes to building complex or rare parts that traditional manufacturing methods could only produce at high costs (for low volumes).

With additive manufacturing, there is further focus on building capable machines and extending the range of new materials. However, the true potential of 3D printing can’t be leveraged by just building these machines. It is by understanding which applications benefit most from additive manufacturing. With time, machines and software supported by new technologies will be more capable to meet specific customer and industry demands.

One of the most recent trends is metal 3D printing. It significantly helps in lowering costs and increased adoption. However, metal 3D printing is unlikely to replace traditional manufacturing, it will act as complementary manufacturing technology. A real advantage today with metal 3D printing is the reduction in overall manufacturing time which can be utilised by manufacturers for accelerating research, innovation and to develop new technologies and niche product solutions.

In terms of alternate lightweight materials, what do you think will be an ideal replacement for aluminium for the automotive industry?

When we talk about alternate lightweight materials and possible replacements for aluminium, it absolutely depends on the requirements of the product and the weight reduction that is required for the same. Some of the favoured materials that are used are Advanced and Ultra High Strength Steels (AHSS/UHSS), magnesium, advanced high strength aluminium alloys and composites.

AHSS/UHSS can reduce the weight of a typical body system by 20-30 percent when compared to conventional steel. Aluminium alloys weigh approximately one-third of conventional steel whilst CFRP is five times lighter than steel and about 1.5 times lighter than aluminium.

Intensive use of aluminium has for some time been considered as the ideal option for lightweight body structures, with the development and availability of new AHSS and UHSS material the balance is swinging back in favour of steels. Or at least a smart combination of steel and aluminium. For example, the generation 1 Audi A8 was virtually 100 percent aluminium whereas the latest generation 4 product has approximately 40 percent steel content.

Tata Technologies’ experience through working closely with OEMs across the globe is that this balance will become the industry norm for premium vehicles and mass-market products will deliver lightweighting through the smart selection of the increasingly broader grades of new steels and the use of non-metal materials.

The automotive industry in India is different from that in developed countries. Affordable products constitute the majority share. How do you think India Auto Inc will progress and do you see any ‘Jugaad’ or frugal innovation helping the cause of lightweighting?

The Indian automotive industry is poised for exponential growth. The industry registered almost double-digit growth during the last fiscal year and overtook Germany as the fourth largest automotive market. Total vehicle sales in India during FY2018 grew by 9.2 percent with total sales of 4.02 million units, showcasing the giant strides this industry is taking.

The legacy has been towards optimising cost and hence mass through frugal engineering. Having said that, ‘Jugaad’ itself will not be the single driver as stricter CO2 emissions and other government regulations demand a focus on the use of the correct technologies and materials. That’s where companies like Tata Technologies with proven engineering and manufacturing capabilities can support OEMs by bringing in new lightweighting solutions and skilled talent to bear.

The automotive industry in India is experiencing an unprecedented change; OEMs, technology partners and the government must collaborate extensively to succeed and leverage the opportunity.

Can you share some data/statistical study of a client case study showing the impact of lightweighting method and solutions?

I have mentioned our collaboration with NIO earlier, but I will bring it up again as it is a great example of collaborative engineering between two companies. We used our extensive lightweighting experience and our 5R methodology to provide the right weight-cost-performance balance.

Nio worked proactively with us to develop and tune their cost and attribute targets. The result was a vehicle body with one of the best Lightweighting Indices (LWI) as recognised by global industry standards.

The NIO product was the first all-aluminium seven-seater SUV, developed in China, which broke lightweight and safety benchmarks of products from established European OEMs. In just 24 months, the team advanced from a simple sketch on paper to a production-launch ready vehicle, setting new industry benchmarks for product development. The product, christened 'ES8', received rave reviews globally and was also termed as the “Tesla-beater from China”.

(This interview was first published in the November 15, 2018 issue of Autocar Professional)

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

By Autocar Professional Bureau

By Autocar Professional Bureau

01 Jan 2019

01 Jan 2019

30127 Views

30127 Views

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa