Karl-Heinz Steinmetz & Ravneet Kotwal: 'The global demand for EV and HEV will rise by 210% in 2021'

Texas instruments on how ADAS and self-driving architecture, connectivity and electrification are increasing the electronics content in vehicles, thus resulting in a sharp spike in demand.

Semiconductor design and manufacturing company Texas Instruments’ India HQ is in Bangalore where it has an R&D lab that caters to global requirements. Karl-Heinz Steinmetz, General Manager, Automotive Systems, HEV / EV & Powertrain, Texas Instruments Deutschland and Ravneet Kotwal, Director — Sales and Marketing, Texas Instruments India, spoke to Autocar Professional on how ADAS and self-driving architecture, connectivity and electrification are increasing the electronics content in vehicles, thus resulting in a sharp spike in demand.

How big is the automotive business for Texas Instruments globally and where does India as a growing market stand in TI’s global growth plans?

Ravneet Kotwal: TI is a global semiconductor design and manufacturing organisation. We operate in more than 30 countries and have more than 100,000 customers worldwide (across several industries including automotive). We have been doing this for more than 85 years now.

We have a very broad portfolio of products essentially in the analog and integrated processing domains. Industrial and automotive are the two key focus areas that we operate in. While the automotive domain has grown from 13 percent of overall revenues to 19 percent globally, industrial contributes about 35 percent.

The company has been present in India for more than 30 years now. Pune is essentially a sales and support location for us, while Bangalore is the headquarters, where we have a large R&D centre. We also have a footprint in Delhi.

In the automotive domain, TI is focussing on four broad areas – ADAS (advanced driver assist systems), body electronics and lighting, EVs and HEVs (electric and hybrid electric vehicles) and infotainment and cluster solutions. We have systems solutions around these broad areas to support our customers.

How has the semiconductors and IC business evolved over the past 10 years, particularly in the context of the automotive sector?

Karl-Heinz Steinmetz: The semiconductor content is rapidly growing. Back in the 1990s, the average semiconductor content in a car used to be about US $60. In 2017, this was $324 per car. It is predicted to go in the range of $360 by 2021. Through these estimates, we are only talking about an average car.

What drives the increased semiconductor content in the car? In the 1990s, probably a good percentage of cars were already equipped with airbags and other critical systems. TI was one of the first semiconductor suppliers (globally) who were active in that area. We were doing dedicated ICs for that market, which is an area we now call passive safety.

The image above is of a reference design for complete solution for a 76 to 81 GHz radar sensor module.

From there, we quickly evolved into areas like infotainment and cluster, starting with all the lights inside the car, the dashboard and the car stereo. Now with the adaption of multimedia and mobile phones, we are looking at connectivity inside the car making things more desirable and convenient. We have other areas like the body and lighting.

In the 1990s, all cars had manual window systems. Today I think it is difficult to find a car with manual window lifters. They all have small motors for window lifters, motors for the sunroof, mirrors, seats, there is a lot of electronics coming in here on the lighting side, you have mood lighting to daytime runing lamps (DRLs). There are mandates all over the world for always-on headlights (DRLs). Developments like that are massively increasing the semiconductor content in passenger vehicles.

Now advanced driver assist systems (ADAS) are coming in with park assist, lane assist features – all these functionalities are coming on top, which is a massive amount of data. All that data needs to be first captured. So let’s say technology via camera, Lidar and radar systems helps data to be captured and communicated towards the intelligence, which is basically a specific processor that needs to process all the data and take proper action.

There are a lot of areas from a signal chain to power management, embedded processing for core connectivity – all this is resulting in the overall semiconductor content to increase.

The latest trends will be the domains which I am responsible for – HEVs/EVs and the powertrain sector. In the past, basically in the 1990s, there was a transmission control unit, engine control unit, some activators, some sensors and probably a power steering hydraulic assist. Nowadays we are talking about, let’s say a 9-10 gear automatic shift, engines with four, six, eight-cylinder configurations, and electrification.

Electrification begins with the start-stop system. This is the entry-level of electrification wherein you shut down the engine when there is no need for torque. The mild hybrid system is the second level of electrification, which is the fastest growing segment (globally). In most cases, this deploys a 48-volt power system.

Next step is the full hybrid, where you have a larger battery; we have a series traction motor and followed by a plug-in hybrid where you add on top an on-board charger.

Then you have the pure electric vehicle so you remove the combustion engine but you have a huge battery, you have an inverter, on-board charger, you have a DC/DC converter – all these are the four main equipment which add a lot of semiconductor content to the overall car.

Just to be specific, a 400-Volt battery for a pure electric car is normally around 96-108 cells in a series, and each of these series needs to be monitored. So you need to have accurate voltage sensing, you need to have a current sensing for the entire battery pack and it needs to have individual temperature sensing and all this needs to fulfill high safety standards.

The cells, power management, connectivity and the processing unit to capture all that data, process that data and to take the appropriate action – that’s basically where a lot of this semiconductor content is coming from.

TI has been heavily investing since quite some time into these areas and has dedicated solutions for battery management and for motors. It’s all about increasing the overall efficiency, achieving higher accuracy of sensors which allow you to have tighter control. That results in increased efficiency, lower weight, less mechanical components – this is all what is driving the market.

Electrification is not something that is happening only in Europe but not in China, only China but not in the US – it’s happening everywhere.

Ravneet: Just to give you a couple of data points, I will quote from one strategy analytics report of 2017, which says that by 2020 LED headlights will be installed in about 20 percent of all new cars in the global market.

On the ADAS side, the market will go to US$ 37 billion (Rs 255,105 crore) by 2021. In 2016, this was US$ 16 billion (Rs 110,316 crore).

On the automotive sensors front, global demand will go from 3.39 billion units in 2016 to 4.64 billion units in 2021 (volumes).

Between 2016 and 2021, the global demand for electric and hybrid powertrains will increase by 210 percent.

With BS VI norms scheduled to kick in from April 2020, there would be much more electronics in vehicles such as ECUs, sensors, actuators and others. All that — vehicle electronic architecture — will run on ICs and semiconductors. How are you geared up to cater to this demand?

Ravneet: We are engaged with the top OEMs and Tier 1 suppliers in India for BS VI norms. Some of these have technologies, which they have already developed. We provide the subsystems and sockets that Karl mentioned. I agree with you that it offers huge potential for the semiconductor companies and we are prepared on the backend because we are focussing on automotive, and we are supporting the automotive industry across the globe. India happens to be a part of that story. In the other parts of the world, EVs are rapidly gaining attention and several programs are under development.

Of course, we are preparing as we take these market trends and try to put them into our planning systems so that we can support our customers both on the technical side and on the delivery and commercial side when the time comes. So I agree with you that this represents a big opportunity for the semiconductor companies and we will have to obviously watch whether this goes as per the estimates that we see today.

Karl: To add to that, being more automotive-specific, from about 1,000 parts in our portfolio we now have more than 6,000 qualified automotive (semiconductor) parts in our portfolio. We add parts to it daily.

So new developments dedicated to the automotive market, for example, industrial-grade parts which were originally sought for the industrial applications and we qualify them according to the automotive requirements so that we can offer customers a broader range of parts. From 2015 to 2017, we have increased the number of parts for automotive by four times.

With growing complexities in the design and manufacture of vehicles, how does that impact TI in terms of the products that you supply to your customers? TI would not be making the same piece of semiconductor products that it was making 10 years ago.

Karl: Of course not. We have automotive qualifications, for example, ‘Safe TI’ trademark. The ‘Safe TI’ trademark is what we use for parts, which are developed specifically for the automotive markets. What we do is basically we help customers with our design packages to make it easier for them to meet the regulatory and functional safety requirements. This includes, for example, safety development processes, where we are delivering all of the documentation, which is needed down to the last level of details customers need. But the architectural decision is up to the product manufacturer, whether it is the OEM or the Tier 1, we are just helping them with the type of qualification they require.

Do you have a manufacturing plant or a test / R&D lab in India? How do you provide support to your customers?

Ravneet: No, we do not have a manufacturing footprint in India. But when it comes to supporting our regional customers, we have footprints in Delhi, Pune and Ahmedabad. We have a big support team based out of Bangalore as well. We have labs in all of these locations. Essentially, we provide support via field applications. We work very closely with the customers who are designing all these sub-systems or electronics, wherever they are doing it in automotive. We have deployed people locally and these are all application engineers who can work with the design engineers to provide support on TI parts.

The Bangalore-based R&D is a large facility dedicated not just to India but to R&D requirements worldwide.

What is TI design library?

Ravneet: We have about 2,000 reference designs, which we call as TI designs. This is essentially a repository or library of designs, which our teams have done internally and these designs are meant to help customers jump-start their designs. These designs are fed into the global library from multiple locations including India.

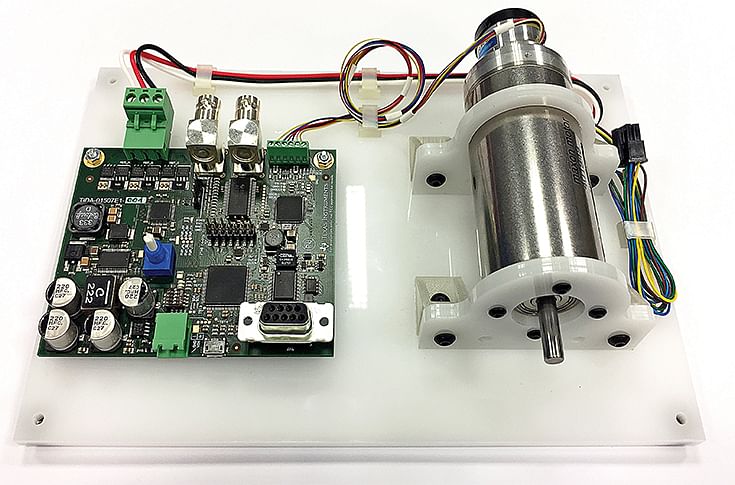

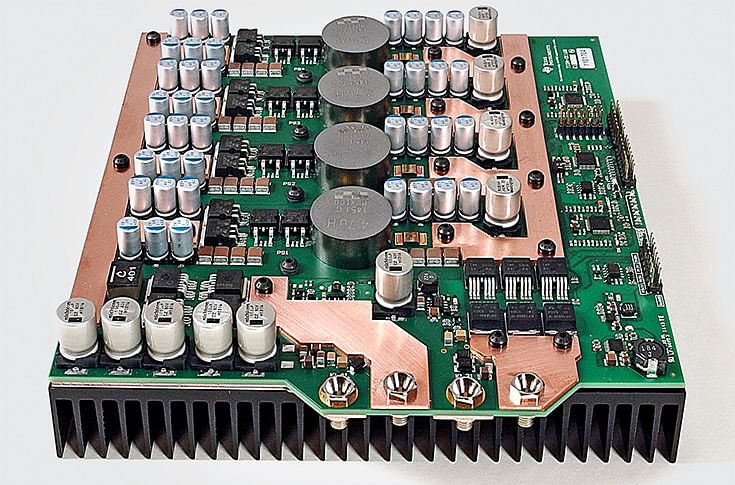

This reference design is a four-phase, bi-directional DC-DC converter development platform for 12V/48V automotive systems.

If somebody wants to design a new product, some of those subsystems in his/her product is what we have already done. I mean something similar and we supply schematics, norm, test data and in some areas hardware and software too. So this helps the customer visualise the product quickly and then probably use that (designs from TI design library) as a reference to jump-start and finish the design on the planned product within the deadline.

Does TI also have a separate unit on automotive lighting?

Ravneet: There are some internal structures within TI which I would not want to divulge. Suffice it to say it is one of the four main focus areas within automotive. We combine body electronics and lighting into one but definitely there are focussed efforts going on in that direction.

Do you borrow some expertise from, say, the consumer electronics domain for automotive?

Karl: Yes, of course. As mentioned earlier, we have 6,000 automotive parts and we add to this pool daily. Some are probably from the industrial space, some from consumer electronics where we do a re-qualification for the automotive market.

Ravneet: I think being in the industrial space for such a long time, TI has some advantages when it comes to automotive because design cycles and requirements are roughly similar. We have a huge portfolio – about having over 100,000 parts and probably 6,000 automotive qualified parts right now.

That’s a huge potential there. We can qualify many more parts as we have the expertise and get them to adhere to automotive standards. When it comes to connectivity, for instance, connecting the vehicle with a smartphone means a lot of these technologies are getting enabled with semiconductors that we supply.

(This interview was first published in the 1 August 2018 issue of Autocar Professional)

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

16 Oct 2018

16 Oct 2018

22102 Views

22102 Views

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa