GST: The Central Govt abolishes cess on Rubber and Automobiles

The Central Government has taken this step in stages by abolishing various cesses so that it is easier to fit in various goods and services in different tax slabs for GST.

Goods and Services Tax (GST) rollout has been further eased with the government abolishing additional cess on goods and services that were included in the last three General Budgets – 2015-16, 2016-17 and 2017-18, as per a notification by the Finance ministry on 7th June 2017.

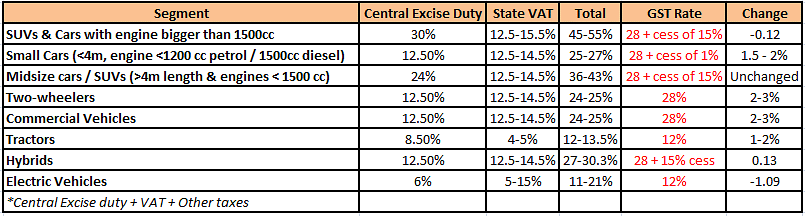

Through the Taxation Law Amendment Act 2017, The Industries (Development and Regulation) Act 151 – cess on automobiles (cars and motorcycles) will no longer be applicable. This comes at a stage when the industry has started to gear up for the new tax regime, further strengthening the 1st July, 2017 rollout of GST.

While Cess on Rubber last amended in The Rubber Act, 1947 empowered Central Government to levy cess at a rate not exceeding Rs 2 per kg is abolished and will no longer be applicable under GST.

Speaking to Autocar Professional, Binaifer F. Jehani, director, Industry & Customised Research, CRISIL Research says, “Cess on rubber is currently levied at Rs 2 per kg which amounts to 1.5 percent of rubber price, Tyre industry is the major consumer of rubber accounting for 40 percent of raw material consisting of natural rubber. Removal of the cess will help reduce the cost for tyre companies by ~40bps.”

The Central Government in its General Budget 2015-16 had abolished Education Cess, including Secondary and Higher Education Cess on taxable services, and exempted Education Cess on excisable goods as well as Secondary and Higher Education Cess on excisable goods.

In its General Budget 2016-17, the Central Government abolished cess on cement, strawboard, three cesses including cess on Iron Ore Mines, Manganese Ore Mines and Chrome Ore Mines by amending Labour Welfare Cess Act, 1976, Tobacco cess by amending the Tobacco Cess Act 1975, and Cine Workers Welfare Cess by amending the Cine Workers’ Welfare Cess Act 1981 among others.

For the General Budget 2017-18, the Central Government abolished Research and Development cess by amending the Research and Development Cess Act.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

08 Jun 2017

08 Jun 2017

15772 Views

15772 Views

Autocar Professional Bureau

Autocar Professional Bureau