GST Council to finalise 4-tier tax structure of 5-28 percent

The GST Council has decided on a four-tier GST tax structure of 5, 12, 18 and 28 percent, with lower rates for essential items and the highest for luxury and de-merits goods that would also attract an additional cess.

The Goods & Services Tax (GST) Council, which had the first of its two-day deliberations today, is likely to soon finalise a four-tier tax structure, according to PTI.

It is understood that the GST Council has decided on a four-tier GST tax structure of 5, 12, 18 and 28 percent, with lower rates for essential items and the highest for luxury and de-merits goods that would also attract an additional cess.

Essential items including food, which presently constitute roughly half of the consumer inflation basket, will be taxed at zero rate, with a view to keep inflation under control. While common use items will be taxed at the lowest rate of 5 percent, there will be two standard rates of 12 and 18 percent. The GST rates will become applicable from April 1, 2017.

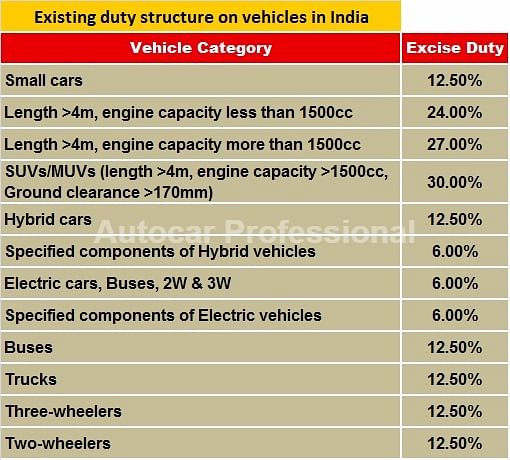

While this could mean that small cars could benefit from the new tax structure, larger or 'luxury' cars may turn more expensive. While it can be surmised that all luxury cars (along with aerated drinks and tobacco) will have to bear the highest slab of 28 percent tax, an additional cess is mostly likely to be imposed to items that are currently taxed at 30% (excise duty and VAT).

The final tax structure and greater clarity on the subject will be available only on November 20 when the GST Council concludes its meeting.

SIAM's recommendations

It may be recollected that the Society Of Indian Automobile Manufacturers (SIAM) had made rate recommendations to the government as regards GST. Indian automakers have been awaiting GST for long since in its present manufacturing process, the industry accumulates a lot of embedded taxes and duties which make manufacturing in India less competitive. A GST regime will help bring in transparency and predictability and also help streamline sourcing and logistics operations.

SIAM says that while earlier there were only two rates of excise duties on passenger cars, in recent years the excise duties on bigger cars have fragmented. Currently, the industry sees four rates for passenger cars excluding EVs and hybrid electrics for which lower rates are applicable. Therefore, SIAM argues, there is a need to take a closer look at the GST rate for automobiles. The Indian auto industry has four different slabs of excise duty based on dimensions and engine capacity ranging from 12.5 percent for small cars, CVs, 2- and three-wheelers to 30 percent for luxury cars and SUVs. In addition, the government has imposed an infrastructure cess ranging from 1-4 percent. Under the GST regime, SIAM expects these rates to be converged to a maximum of two rates, thereby making the tax structure on the automotive industry simpler and more structured.

SIAM has suggested that there be only two rates for conventional vehicles:

- A standard GST rate should be applicable on small cars, MUVs, two-wheelers, three-wheelers and commercial vehicles.

- Cars other than small cars should attract a GST rate that is 8 percent more than the standard rate.

- There should be a lower GST rate for electric vehicles, hybrid electric vehicles and other alternative fuel vehicles. This rate should be at least 8 percent less than the standard rate.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

03 Nov 2016

03 Nov 2016

9112 Views

9112 Views