ACMA bullish on PLI scheme to improve supplier competitiveness in global markets

With India Auto Inc impacted by the pandemic, component sector feels the heat but there are positives too.

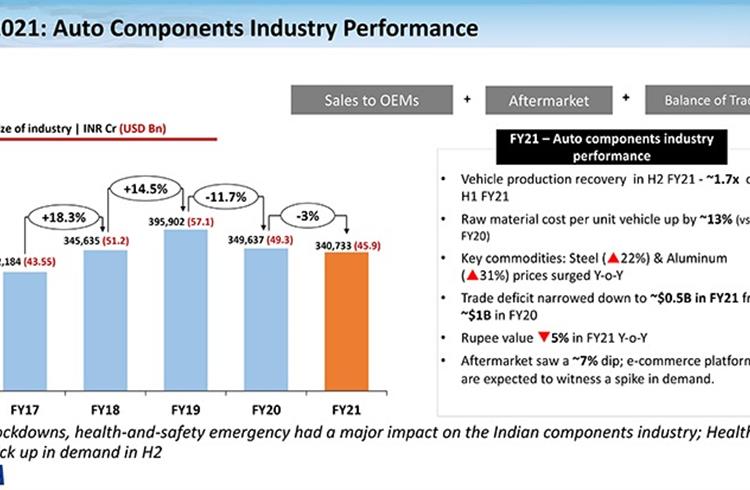

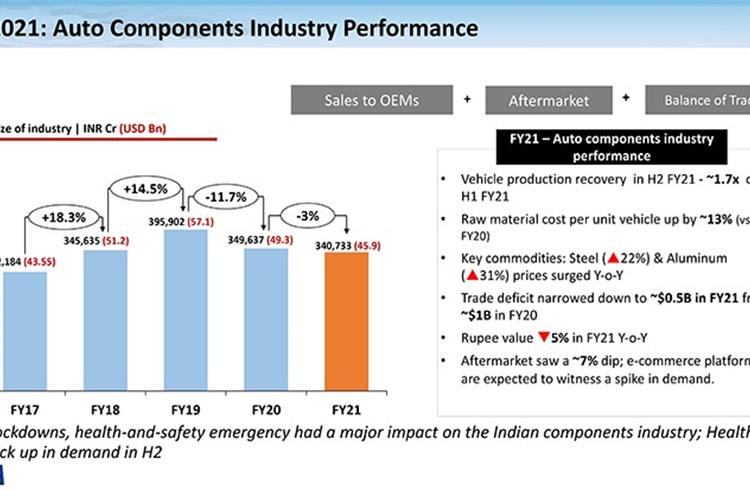

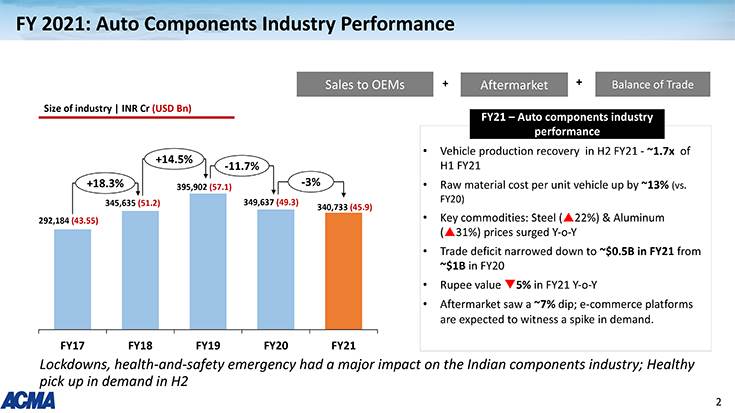

Automotive Component Manufacturers Association of India (ACMA), the apex body representing India’s component manufacturing industry today announced the findings of its industry performance review for FY2020-21. The turnover of the automotive component industry stood at Rs 3.40 lakh crore (US$ 45.9 billion), which is a year-on-year decline of 3 percent over the previous year.

Commenting on the industry’s performance, Vinnie Mehta, Director General, ACMA said, “The vehicle industry in India witnessed two successive years of de-growth of 14.6 percent in FY2020 and thereafter of 13.6 percent in FY2021. The economic slowdown of FY2020 was compounded by the challenges of a pandemic-led national lockdown in FY2021 resulting in decline in vehicle production and consumption. While the first quarter of FY2021 was a complete washout, the industry regained significant ground second quarter onwards.”

Mehta added, “The component industry, in tandem, posted a subdued performance in FY2021 with de-growth of 3 percent over the previous year, registering a turnover of Rs 3.4 lakh crore (US$ 45.9 billion). In the domestic market, component sales to OEMs at Rs 2.79 lakh crore (US$ 37.7 billion) declined by 3 percent while the aftermarket at Rs 64,524 crore (US$ 8.7 billion) declined by 7 percent. Exports and imports stood at Rs 0.98 lakh crore (US$ 13.3 billion) and Rs 1.02 lakh crore (US$ 13.8 billion) respectively, thus reducing the trade balance to US$ 500 million, the lowest ever; exports declined by 8 percent while imports by 11 percent.

Managing supply chain disruptions

Sharing his insights on performance of the industry and how it managed the supply-chain disruptions, Deepak Jain, President, ACMA said, “The automotive value-chain faced significant disruptions in FY20-21. The nationwide lock-down in wake of the pandemic, one of the severest in the world, put the entire supply chain in disarray. The entire industry took a significant time to stabilise again post the gradual unlocking of the economy. While vehicle sales and production improved quarter-on-quarter from second quarter of FY20-21 onwards, however the first quarter of FY2022 was once again confronted with another round of disruptions due to the second wave of the pandemic. While this wave was a much severe humanitarian crisis, the lockdowns, however were regional, in line with the government’s ethos of ‘Lives and Livelihoods’, resulting in lesser adverse impact on economy and production.”

“In this environment of volatility, despite disruption of production in supply chain, the industry displayed remarkable resilience and evolved in a spirit of collaboration. Whilst the OEMs gave consistent direction and visibility, the component industry supported well in ensuring smooth ramp-up and business continuity. It is also noteworthy that despite several challenges, many ACMA members undertook relief measures by setting up hospitals and oxygen camps, donating ventilators and concentrators, and contributing generously towards community service,” added Jain.

Speaking about the headwinds being faced by the industry, Jain elaborated, “With economy progressively returning to normal and as vehicular demand picks-ups, we are cautiously optimistic about the performance of the industry for this year. The challenges on the front of availability of semiconductors, escalating prices as also availability of raw materials, challenges on the front of logistics including non-availability and high prices of containers, among others, continue to hinder a smooth recovery. We are also wary of a third wave of pandemic and hope that the current revival in demand will be a sustained one. We are optimistic that the lessons learnt in managing the first two will stand us in good stead in managing the third one as well.”

ACMA lauds PLI scheme for ACC battery storage

On the policy front, ACMA is grateful to the government for the recent announcement of the Production Linked Incentive (PLI) scheme for the ACC Battery Storage, which is a right step towards creating a holistic ecosystem for manufacturing and sustaining of electric mobility in the country. That apart, while the PLI scheme for auto and auto component industry has been announced, the industry awaits its finer details.

The PLI scheme for auto and auto components is expected to create an export competitive auto component industry as also give a thrust to its localisation. The industry is also keen on an early announcement of the details of the RODEPT (Remission of Duties and Taxes on Export Products) scheme, that will refund embedded taxes and duties, previously non-recoverable, to make component exports price competitive.

Key findings of FY2021 performance

Sales to OEMs: Component sales to OEMs, in the domestic market, at Rs.2.79 lakh crore (US$ 37.7 billion), declined 3 percent YoY. Sales to OEMs in H1 2021 had declined by 31 percent over the first-half of the previous year but saw a healthy recovery in H2 2021.

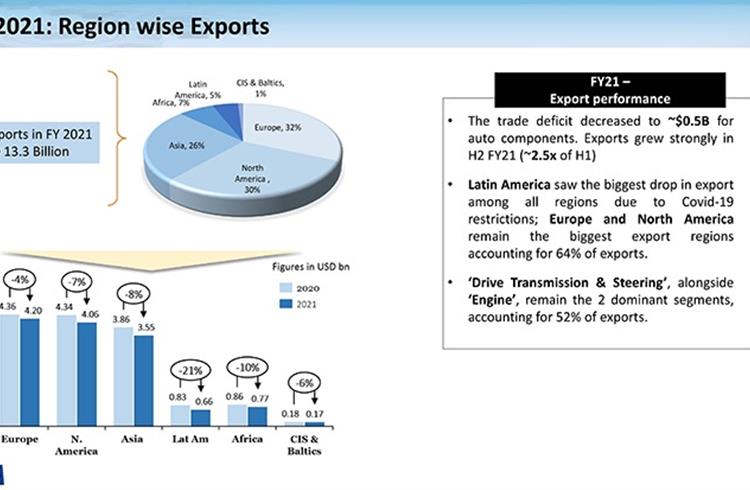

Exports: Exports were down 8 percent to Rs.0.98 lakh crore (US$ 13.3 billion) in 2020-21 from Rs 1.02 lakh crore (US$ 14.5 billion) in 2019-20. Europe, accounting for 32 percent of exports, saw a decline of 4 percent, while North America and Asia, accounting for 30 percent and 26 percent declined 7 percent and 8 percent respectively.

The key export items included drive transmission and steering, engine components, body/chassis, suspension and braking.

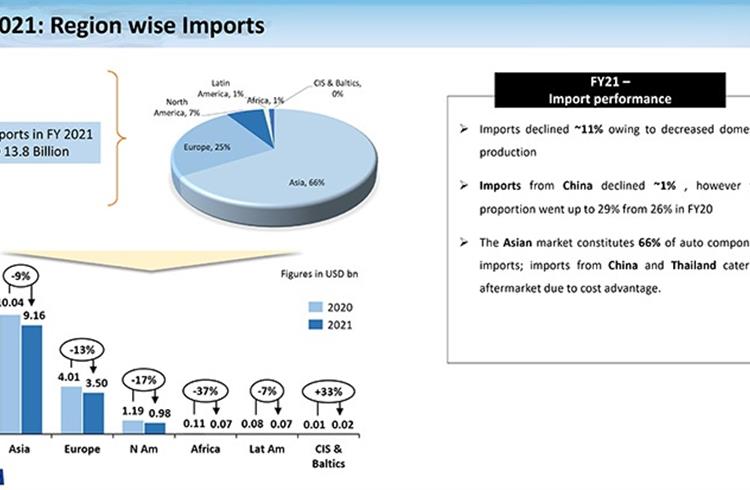

Imports: The slowdown in the domestic market also reflected on imports of components into India. Component imports fell by 11 percent to Rs 1.02 lakh crore (US$ 13.8 billion) in 2020-21 from Rs 1.09 lakh crore (US$ 15.4 billion) in 2019-20. Asia accounted for 66 percent of imports followed by Europe and North America at 25 percent and 7 percent respectively. Imports from Asia declined by 9 percent, while those from Europe by 13 percent and from North America by 17 percent.

Aftermarket: While the two-wheelers and passenger vehicles segments of the aftermarket witnessed strong recovery, revival in the commercial vehicles aftermarket was less than expected leading to an overall decline of 7 per cent in the aftermarket. The turnover of the aftermarket in FY20-21 stood at Rs.64,524 crore (USD 8.7 billion) compared to Rs 69.381 crore (USD 9.8 billion) in the previous year.

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

By Autocar Pro News Desk

By Autocar Pro News Desk

03 Aug 2021

03 Aug 2021

7540 Views

7540 Views