India set to surpass Japan as world’s No. 3 auto market by 2021

As per the latest findings from 57 markets, vehicle sales have grown in six of the global Top 10 markets, and within them India has recorded the highest growth of 18 percent.

As India celebrates Independence Day, the other good news is that the country's booming auto industry is swiftly headed to the world No. 3 spot, sooner rather than later. With the passenger vehicle industry firing on all cylinders, like other vehicle segments, India is where all major global automakers – and their suppliers – want to be.

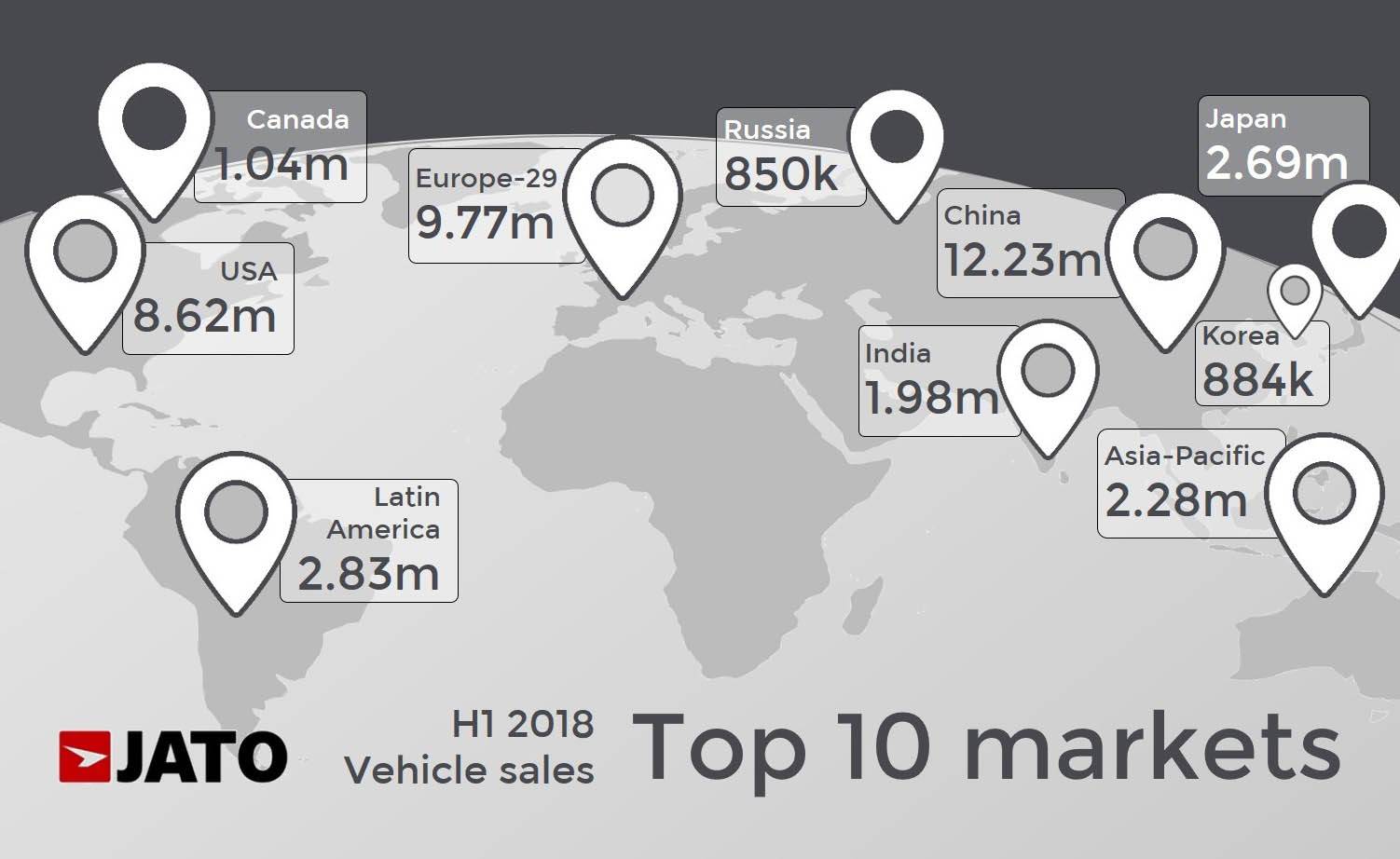

Worldwide too, vehicle sales are on the upswing and the trend has continued to in the first half of the year (January-June 2018). As per the latest findings from 57 markets by market intelligence provider JATO Dynamics, vehicle sales have grown in six of the global Top 10 markets, and within them India has recorded the highest growth of 18 percent. As per the research, a total of 44 million units were sold in H1 2018, up 3.6 percent year on year.

The positive results coincided with a global economy threatened by the uncertainty of a potential trade war between its largest economies. However, the good economic mood in the USA along with improved indicators in Europe, and the continuous expansion of the Chinese economy, are three key factors that have boosted the vehicle market. Despite the importance of these three markets, there is one overarching winner – India has finally emerged as a key market for the auto industry as its sales growth was confirmed during the first six months of 2018.

India sales data saw increases in 29 states and four union territories, with double-digit growth in 27 states. India outsold Germany and became the world’s fourth largest vehicle market behind China, USA and Japan. As per JATO’s partner LMC Automotive, India vehicle sales are expected to outsell Japan in 2021.

Sales slowdown in China, turn moderate in USA

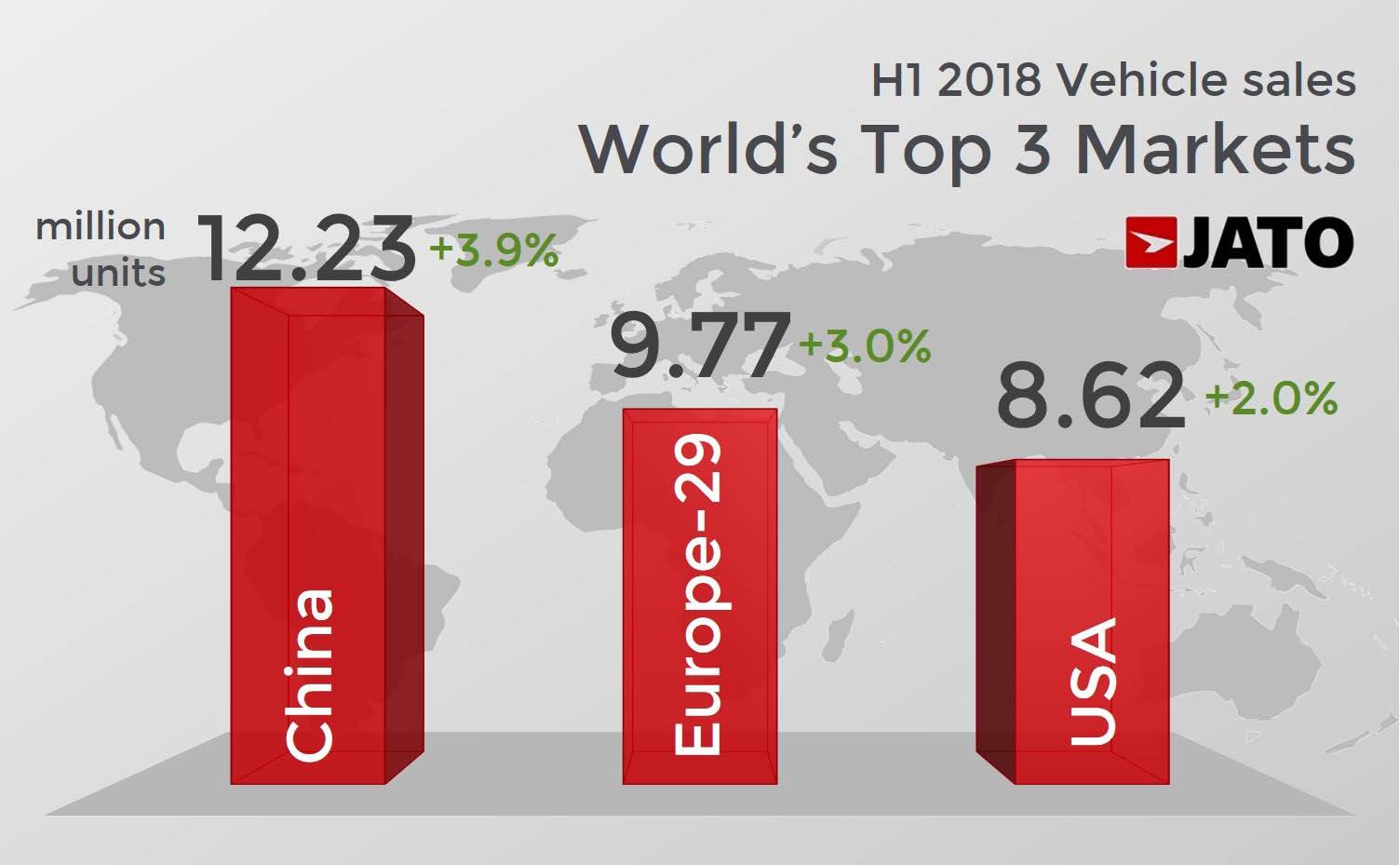

China remains the global market leader by far with 12.23 million units sold (excluding some LCVs), and grew by 3.9 percent, albeit the growth was the second slowest in the region for H1 since 2009. The latest figures for June saw vehicle sales in China remained stable as the gains posted by sedans (+8%) were offset by lower sales of SUVs and MPVs (-7%).

JATO says China is facing tougher times due to the uncertainty over the trade war with the USA, as well as the government’s tightened controls on bank lending to curb surging debt, however, SUVs acounted for 42 percent of total car sales. Nonetheless, Chinese car makers controlled almost 11 percent of total sales in the 57 markets.

Growth in the USA has been more moderate, despite the economy performing above expectations, and registered the second highest first half of its history this year. The volume was boosted by more SUVs (+13%) and trucks (+6%), which counted for 60 percent of total sales, in contrast to the decline posted by cars, down by 10 percent counting for 33 percent of total.

Europe was once again the world’s second largest market with 9.77 million cars and LCVs. The good economic mood among consumers in most of the markets, and a bigger range of choices led to an increase in registrations by 3 percent and resulted in the highest first half result of the last decade. Following the trend in the USA and China, the whole economic bloc continues to be fuelled by more SUVs (+24%) and fewer cars (-4%), counting for 30 percent and 50 percent of total cars and LCV sales respectively.

Other key markets include Japan, which is still the world’s third largest car market despite the 2 percent decline in H1. The popular kei-cars couldn’t offset the big declines posted by other segments, which counted for two-thirds of the market. Japan is one of the few remaining markets where SUVs don’t play a key role. Latin America also had a positive half thanks to the outstanding performance of Brazilian car sales and improvements in Chile and Ecuador. The Latin American car market is now bigger than the Japanese.

With data for 8 markets in the Asia-Pacific region, JATO says vehicle sales totalled 2.28 million units, up by 5 percent. Most of the growth is due to the 11 percent increase recorded by SUVs, the top-selling segment in the region. Canada, Korea and Russia are the other three big markets in the Top 10, with only the latter showing positive results.

VW Group top-seller, Hyundai-Kia, Suzuki, Geely and Tata record smart sales

As per the market study by JATO, the Volkswagen Group is the top-seller in H1 2018 with 5.45 million units, growing faster than its two closest competitors – Toyota and Renault-Nissan. In fact, VW grew by almost 7 percent in H1, compared to the 4 percent posted by Renault-Nissan in second place and 2 percent registered by Toyota. However, the analysis excludes key markets for Renault-Nissan and Toyota, like Iran, some African markets, the Philippines and the Gulf Cooperation Council.

There are also strong performances from Hyundai-Kia (+8%) and Suzuki, which was able to post a double-digit growth and confirmed its place in the Top 10 biggest car makers in the world. Outside the Top 10, Geely registered an impressive 35 percent increase, exceeding the 1-million mark for the first time at 1.09 million units. It was also a good first half for India’s Tata Motors, which sold 517,000 units, up by 18 percent YoY.

SUVs increase their stranglehold, MPVs continue to lose ground

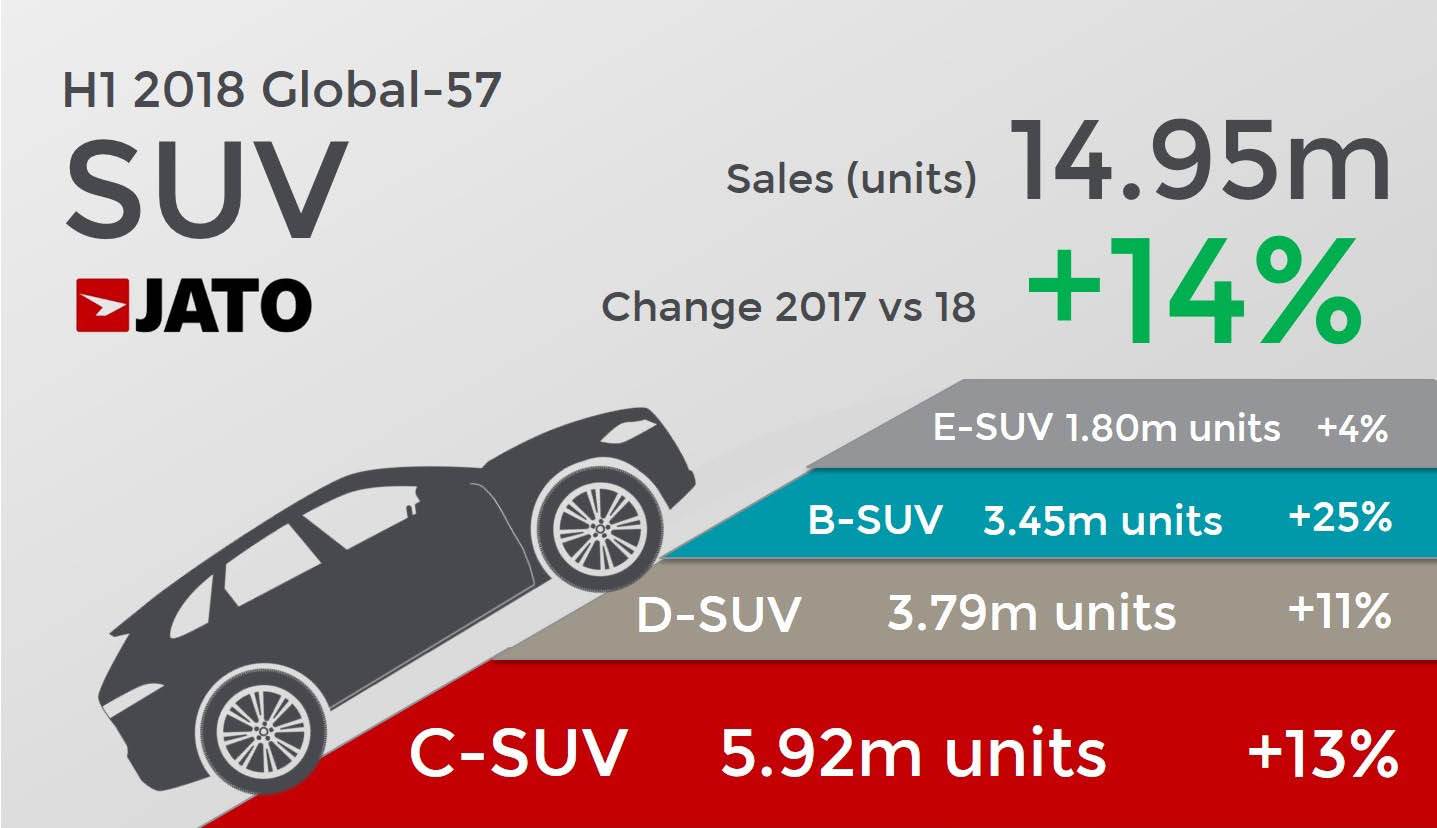

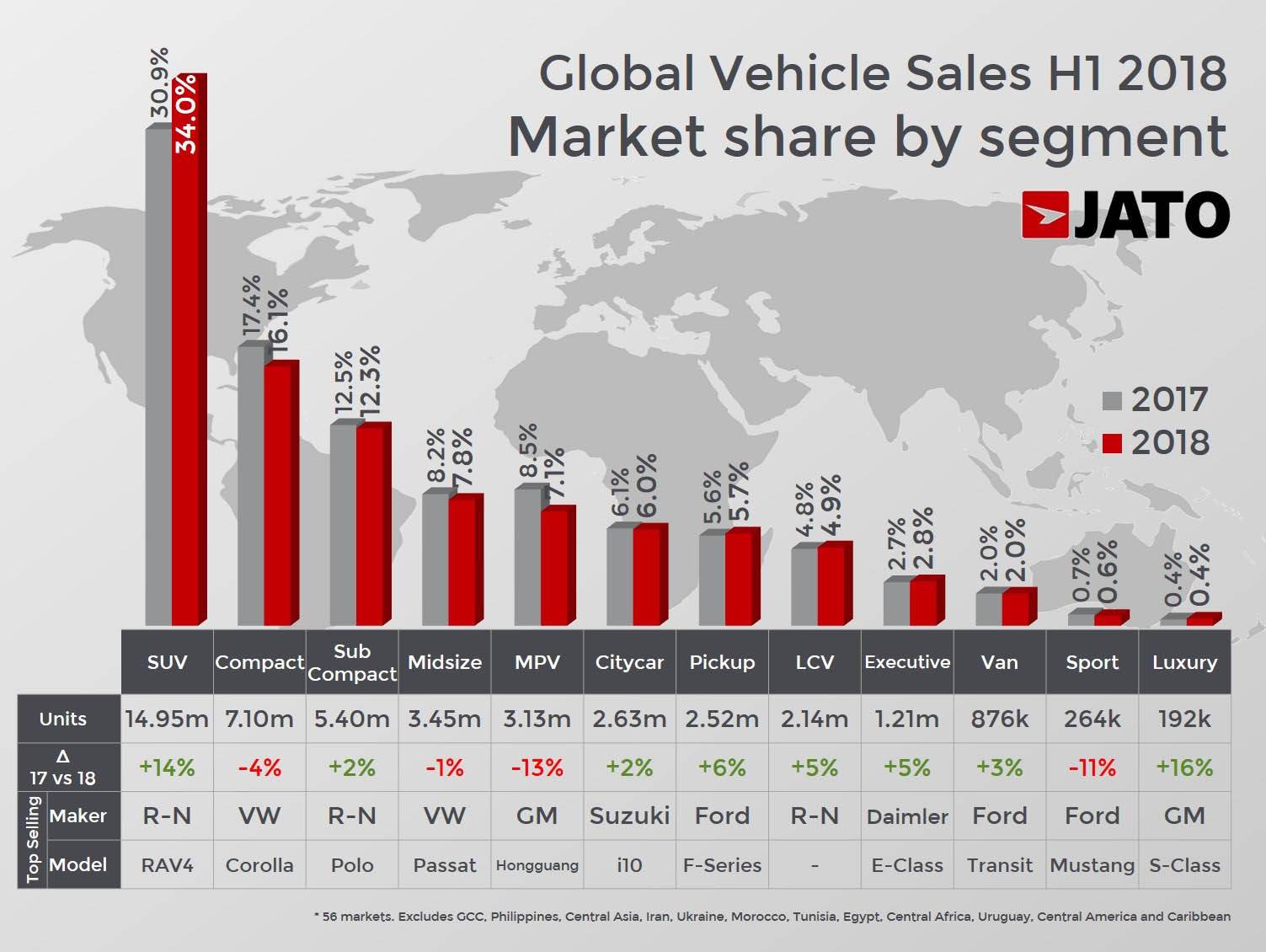

In terms of vehicle demand, SUVs now account for around 37 percent of total PV sales –in H1 2018, around 15 million SUVs were sold, up 14 percent YoY. The volumes grew in 10 of the 11 key regions, with double-digit growth in 8, and a drop of 4 percent in Japan. According to JATO, SUVs continue to be popular in the USA, China, Canada and Russia, but are still lagging behind other segments in Latin America, Japan and India. Which means it’s good news for automakers as it shows that SUVs still have growth potential in these key markets.

The findings indicate that compact cars have remained the second popular choice followed by SUVs in the segment rankings, but the volumes came down by 4 percent to 7.1 million units. The timid growth posted in China (+0.4%) wasn’t enough to offset the declines coming from Europe (-5%) and USA (-8%). China is still their biggest market in both volume and market share. The subcompacts remained the most popular cars in Latin America and India, but their volume increased by only 2 percent to 5.4 million units.

Meanwhile, MPVs continued to lose ground as their sales volume fell by 13 percent to 3.13 million units. Their demand shrank in China (-19%) and Europe (-23%), their biggest markets. MPVs are still popular in Japan and Asia-Pacific, with a double-digit market share. In contrast, they are a rarity in Russia and Latin America.

RELATED ARTICLES

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

Hyundai and Kia partner Exide Energy to produce LFP batteries in India

Partnership with Exide Energy enables Hyundai Motor and Kia to equip future EVs in the Indian market with locally produc...

By Autocar Pro News Desk

By Autocar Pro News Desk

15 Aug 2018

15 Aug 2018

26840 Views

26840 Views