India PV sales turn tepid in July, CVs and 2Ws continue growth momentum

Passenger vehicle sales decline 2.71 percent in July 2018, what with UV numbers, the main growth driver of the past year, down by a sizeable 9 percent YoY, and the bread-and-butter car segment seeing flat growth.

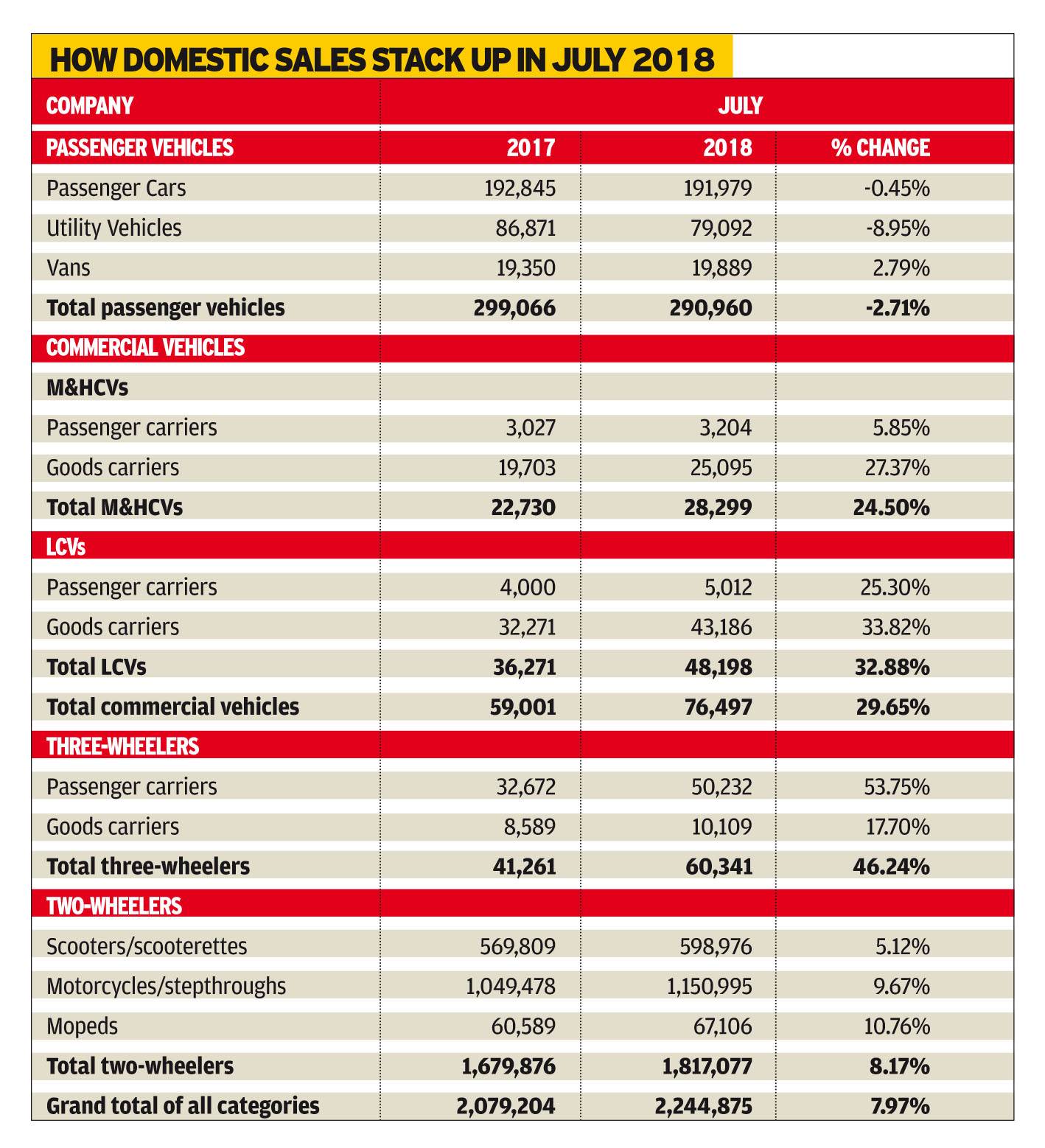

Apex industry body SIAM today released the India automobile sales numbers for July 2018. Following on the robust sales chart for Q1 FY2019, it was felt July would tick in the same direction but the PV sector seems to have received a reality check albeit to be seen in the perspective of GST being implemented from Last July. Overall domestic market sales were 2,244,875 units, a growth of 7.97 percent YoY.

The impact of GST, which kicked in last year in July, continues to cast its shadow over growth statistics this year. As OEMs reveal their sales numbers for July 2018, the bullishness stemming from a robust Q1 is warranted even though in actual numbers year-on-year sales growth in July 2018 seems tepid. That’s primarily because the industry witnessed a sales surge a year-ago when GST-led tax benefits brought a massive boost to overall industry numbers.

July 2017 had seen overall PV sales soar to 298,997 units (+15.12%), following substantial tax cuts, which had kept customers withholding their purchase decisions to only materialise once the GST kicked in. A relatively high year-ago base means that even though OEs have sold decent volumes last month, their performance is overshadowed by July 2017 numbers.

The industry clocked overall sales of 2,244,875 units in July, recording an 8 percent growth over last year (July 2017: 2,079,204). While the passenger vehicle segment garnered surplus volumes of 290,960 units, the overall category, however, witnessed a slump of 2.71 percent (July 2017: 299,066), owing to a relatively high year-ago base which was a resultant of the substantial tax cut on cars and SUVs brought in with implementation of the GST regime.

“In July 2017, PV sales had shot up and we had observed a significant spike due to benefits with implementation of the GST. Even still, when compared to June 2018’s PV sales, sales in July are higher. It is just that the relative growth on a year-on-year basis is down,” said Sugato Sen, deputy director general, SIAM.

“We expect August and September to remain slow as well, again owing to the prolonged effect of the GST where there was a boost in PV sales during the same period in FY2018,” he added.

July 2018's total PV sales at 290,960 units mark de-growth of 2.71 percent. Numbers are down mainly because growth in the bread-and-butter passenger car segment is flat at -0.45 percent with sale of 191,979 units. The bigger blow though has come from the utility vehicle (UV) segment, which has been the growth driver for the PV segment for some time now. At 79,092 units, the UV segment is down by a sizeable 8.95 percent. It's also likely that consumers are considering more fuel-efficient choices at the moment.

M&HCVs and LCVs power in growth lane

Commercial vehicle sales continue to notch healthy growth, which is amply reflected in the improved fortunes of the major players. M&HCV sales last month grew to 28,299 units (+24.5%), which comprise 25,095 goods carriers (+27.37%) and 3,204 passenger carriers (+5.85%). The LCV segment too reported robust sales of 48,198 units (+32.88%), which includes goods carriers at 43,186 units (+33.82%) and passenger carriers 5,012 units (+25.30%). The overall CV segment posted a healthy growth of 46.24 percent YoY with a total of 60,341 units. The strong results can be attributed towards the industry witnessing demand primarily on the back of infrastructure developments, e-commerce and last-mile delivery among others.

Two-wheeler industry growth moderates

The two-wheeler industry, which is the largest segment in terms of volumes, saw its growth moderating after a while, despite the industry posting a growth of 8.17 percent with sales of 1,817,077 units. The scooter segment, which is accustomed to seeing double-digit growth, grew at 5.12 percent in July 2018 with 598,976 units sold. While the motorcycle segment posted growth of 9.67 percent with 1,150,995 units, moped sales grew by 10.76 percent at 67,106 units.

The overall domestic automobile industry which has been in fast lane this fiscal after witnessing rocky sales last year due to policy changes (BS IV norms, GST) is looking forward to accelerated growth. It could be that the PV numbers for July could be just a momentary blip even as the industry gears up for the festive season.

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

10 Aug 2018

10 Aug 2018

4728 Views

4728 Views

Autocar Pro News Desk

Autocar Pro News Desk