India's Best-Selling Scooters – May 2019 | Slowing Activa stays on top, TVS Jupiter and Suzuki Access eat into Honda, Hero market share

TVS Jupiter and Suzuki Access make gains at the expense of the longstanding scooter market leader, which is currently seeing its monthly number slowing down. Hero MotoCorp too feels the pressure.

The sea of red, which was the report card for the Indian automobile industry in May 2019, swamped all vehicle segments what with floundering consumer sentiment, a slowing GDP, a continuing liquidity crunch and a monsoon which is playing hide and seek. The scooter segment, not very long ago a 20 percent growth bagger along with the UV segment, has been among those hugely impacted.

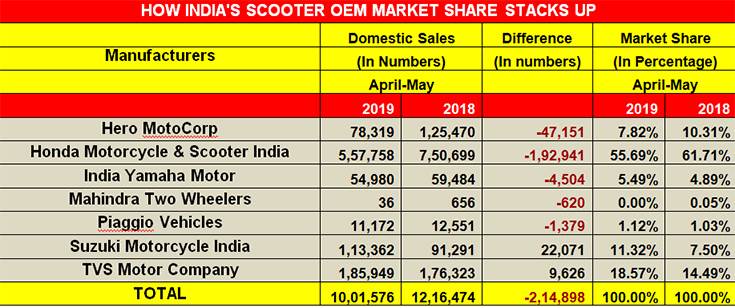

The overall scooter market, which closed FY2019 with flat YoY growth of 67,01,469 units (-0.27%) and in negative territory for the first time in a decade, has begun FY2020 on a downward growth trajectory. Sales slumped 26 percent in April 2019 to 489,852 units (April 2018: 661,007 units / +12.63%) and now in May, total despatches to dealers were 511,724 units (-7.87%). Do the math and the cumulative April-May 2019 numbers of 1,001,576 units are down a substantial 17.67 percent YoY (April-May 2018: 1,216,474).

Scooters are to the overall two-wheeler market what SUVs are to the PV segment, both accounting for around a fourth of overall sales. The ball is now in the OEMs' court to restrategise product and marketing plans and draw the customer back into showrooms.

Honda Activa numbers still large but in slow-growth mode

They say if Honda sneezes, the entire scooter industry catches a cold. The popular Honda Activa family of scooters, which has been the unassailable leader for years and likely to continue in the same vein in future unless another OEM moves ahead in the scooter game, is under pressure from current dampened market conditions.

The sharp fall in demand for the country’s best-selling scooter – the Activa – is impacting overall scooter industry numbers and how. The Activa sold over 3 million units for the first time in FY2018 (3,154,030 units) but failed to accelerate on that in FY2019 (3,008,334 units / -4.6%).

In the opening month of FY2020, Honda's best-seller sold 210,961 units, a far cry from the year-ago sales (April 2018: 339,878) and down 38 percent YoY. And in May 2019, it has seen 218,734 units go out to showrooms, down 19.7 percent (May 2018: 272,475). Clearly, the ball is in the Honda's court to do something quickly to arrest the fall in the Activa's sales. The Japanese major, which is readying for the BS VI era, recently unveiled its first BS VI-compliant product, not surprisingly, the Activa.

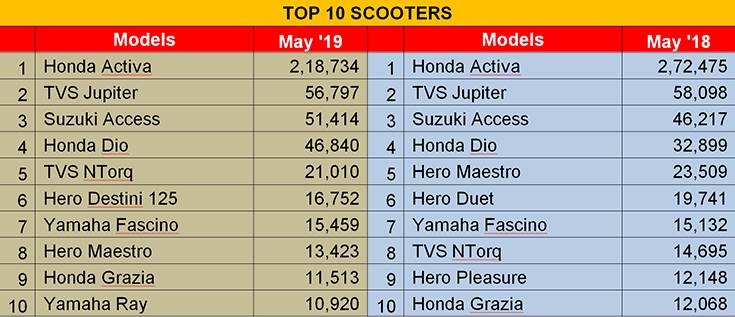

The No. 2 scooter in the country remains the TVS Jupiter, which continues to be a strong contributor to the company every month. But the Jupiter is not gaining speedier traction in the market, as much as the company would be hoping for, always staying in the 50,000-60,000 unit monthly sales bracket. TVS has introduced variants like the Jupiter Grande to help rev up demand.

Meanwhile, the Suzuki Access 125, which is fast becoming a popular buy, seems to be closing the gap with the Jupiter and is at No. 3. In May 2019, with sales of 51,414 units, it was just 5,383 units behind the Jupiter. Suzuki's turnaround efforts are finally visible as it continues to work not only on its product portfolio but also on the dealer development side.

At No. 4 is the Honda Dio, which saw despatches of 46,840 units in May, a tad better than the 46,501 units in April. The Dio has strong brand equity among young college-going buyers, with Jharkhand, Karnataka and Maharashtra being strong markets.

A consistent No. 5 is the TVS NTorq with 21,010 units. The snazzy-looking scooter has a lot going for it including its youthful appeal. Monthly volumes for the latest TVS 125cc scooter have stabilised at around 15,000 to 17,000 units . The scooter is riding the growing wave of demand for 125cc scooters, so expect better numbers to come its way later in the year.

The Hero Destini 125 rides in at No 6. The scooter’s aggressive pricing (sub-Rs 55,000 ex-showroom) appears to be working for Hero MotoCorp. The youngest Hero scooter sold a total of 16,752 units, a few units more than the 16,301 units in April. The Destini has been positioned as a family scooter for a more mass market appeal and the increasing sales have proved that this has worked.

At No. 7 is the Yamaha Fascino with 15,479 units, up on the 14,873 units in April 2019, and better than the 15,132 units of April 2018. It is one of the few scooters which have seen an uptick in demand in the current downturn which has impacted nearly all scooters. However, Yamaha needs to do more if the uptick in demand is to be maintained, especially when you consider that it now has direct rival from Hero in form of the new 110cc Pleasure Plus.

The Hero Maestro rides in at No. 8, with 13,423 units despatched to dealers last month. Hero MotoCorp is looking to cash in on the growing demand for 125cc scooters. Last month, the company launched the Maestro Edge 125 offering it in three variants – a carburettor drum brake variant priced at Rs 58,500, a carburettor disc brake variant at Rs 60,000 and a fuel-injected variant at Rs 62,700 (prices ex-showroom, Delhi). Hero’s second offering in the 125cc segment, after the Destini 125, will go face competition from other similarly conceptualised scooters like the TVS Ntorq (Rs 59,900) and the Honda Grazia, for which prices start from Rs 60,723.

Honda’s Grazia, with 11,513 units, takes No 9 position with 11,823 units. Much was expected of this scooter when it was launched but clearly the big numbers have yet to come.

Closing the Top 10 listing is the Yamaha Ray with 10,920 units. This scooter recently made the news when it got updated with a combined braking system and got a new blacked-out colour scheme.

HMSI and Hero lose scooter market share

With domestic market sales of the Honda Activa, the scooter industry's bellwether, slowing down, rivals are making gains albeit they are nowhere near challenging the market leader's crown. But the fact is that the best-performing scooters from the TVS and Suzuki stable are helping their companies grow their market share. At the expense of Honda and Hero.

TVS Motor and Suzuki were the two OEMs which, due to their Jupiter and Access scooters respectively, made smart gains in scooter market share in what was a tough FY2019. Bajaj Auto though, despite not being in the scooter market, was the biggest market share gainer last fiscal.

As per the latest sales stats for the Indian scooter market, TVS Motor Co has expanded its share to 18.57 percent from 14.49 percent a year ago, while Suzuki India has likewise grown its share to 11.50 percent from 7.50 percent in April-May 2018.

Honda, the Maruti of the scooter market, has seen its market share reduce by around 6 percentage points: from 61.71 percent in April-May 2018 to 55.69 percent in April-May 2019. Hero MotoCorp too sees its share drop, from 10.31 percent to 7.82 percent.

Expect the impacted OEMs to take corrective action to safeguard their turf as well as chalk out new products plans for the era of BS VI which opens in less than 9 months from now, But, at the present moment, market share growth in fossil fueled two-wheelers would be somewhat less on their minds. That's because in less than 2 weeks, they have to deliver a roadmap to NITI Aayog as to their plans for two-wheeler electrification.

RELATED ARTICLES

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

SCOOP! TVS Motor begins exporting made-in-India BMW CE 02 e-scooter

TVS Motor Co, which has a longstanding strategic partnership with BMW Motorrad since April 2013 for manufacture of the 3...

Maruti Suzuki tops PV exports for third fiscal in a row, VW, Honda and Toyota shine in FY2024

With its best-ever exports of 280,712 units, Maruti Suzuki retains PV exporter crown in FY2024; Hyundai with 163,155 uni...

23 Jun 2019

23 Jun 2019

47684 Views

47684 Views

Autocar Pro News Desk

Autocar Pro News Desk