TVS beats Hero MotoCorp to become No. 2 scooter player in India market

Riding on the Jupiter, TVS sold a total of 826,291 scooters in FY2016-17 compared to Hero MotoCorp's 789,974 scooters. This year, it looks like their rivalry is set to spread into the 125cc arena.

Chennai-based TVS Motor Company has now officially become the second largest player in the Indian scooter market for a complete financial year. The company has achieved this milestone for the first time in FY2016-17, surpassing Hero MotoCorp by a close margin.

Honda Motorcycle & Scooter India (HMSI), however, continues to be the top performer in the scooter space, thanks to the humungous demand enjoyed by the Activa brand.

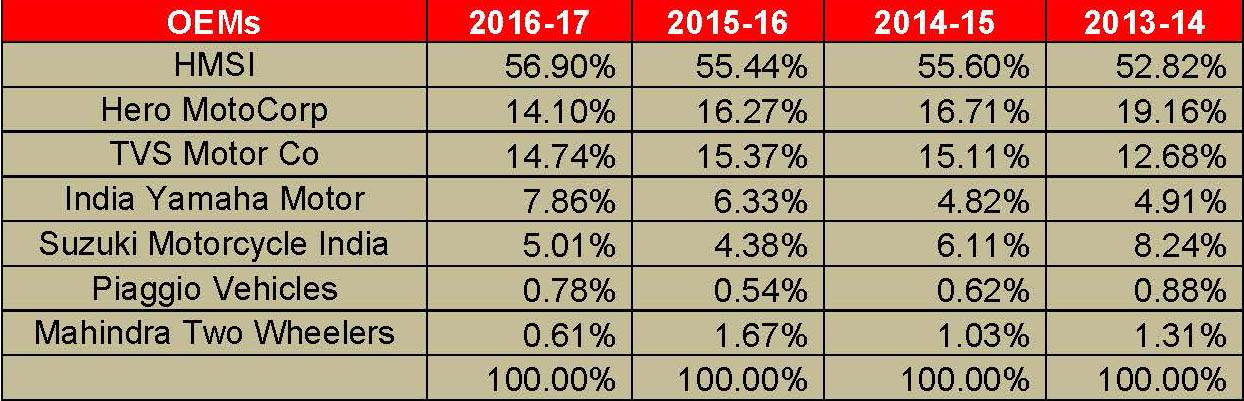

As per SIAM’s industry sales data, TVS Motor now has 14.74 percent market share in the domestic scooter market. The company sold a total of 826,291 scooters in FY2016-17, up 6.81 percent on FY2015-16 sales of 773,597 units.

Nevertheless, despite growing domestic sales YoY, the company has lost a few percentage points from its previous scooter market share of 15.37 percent, recorded in FY2015-16.

Hero and TVS battle for scooter market share

Hero MotoCorp, which had a 16.27 percent market share in FY2015-16, saw a fall to 14.10 percent in FY2016-17 with sales of 789,974 scooters, just 36,317 units behind TVS Motor. In FY2015-16, Hero had sold 818,777 scooters, about 45,180 units more than TVS.

The rivalry between the two companies in the domestic scooter segment came to the fore in FY2014-15, when TVS had aggressively begun closing the gap with Hero MotoCorp. FY2014-15 industry data highlights that Hero MotoCorp had a 16.69 percent market share (down from 19.15 percent in FY2013-14) and TVS Motor had expanded its market share to 15.19 percent (from 12.68 percent in FY2013-14).

Jupiter spins rings around the competition

The Jupiter scooter brand has played an instrumental role in helping TVS Motor grab the second largest position. The model was first launched in Q2 FY2013-14 and went on to sell more than a million units in 30-31 months.

An Autocar Professional study of the Indian scooter market estimates that the TVS Jupiter has sold close to 1.6 million units (if not more) since its launch. The model, which has become the closest competition for the Honda Activa in the domestic market, sealed its position of becoming the second largest selling scooter in India in FY2015-16, beating Hero’s Maestro for the third spot. It repeated the same performance in FY2016-17 too but with bigger margin.

With annual sales of 613,817 units, the TVS Jupiter has outsold the Hero Maestro, its conventional rival in the domestic scooter market, by a notable 235,470 units in FY2016-17.

Commenting on TVS becoming the No. 2 scooter player in India, Aniruddha Haldar, vice-president – Marketing (Scooters), TVS Motor Company, told Autocar Professional: "At TVS Motor Company, we are committed to understanding our customers and championing mobility providing products high on innovation, technology, usability and style. This recent milestone is a testimony to the range and depth of our product range, truly there is one for everyone. The TVS Jupiter has found favour with people across the country and demographics. In just 30 months, there were over a million TVS Jupiters’ on Indian roads. The iconic Scooty Pep+ and Zest 110 have championed the female rider, including being the first scooter to conquer the highest motorable road in the world, up in the Himalayas. Also, the TVS Wego has come out on top in the JD Power Satisfaction Survey. We are deeply humbled and delighted by the faith that our consumers have reposed in us.”

With the Jupiter outplaying the Hero Maestro in the domestic market, TVS Motor is expected to soon foray into the 125cc scooter category to take on the likes of Honda Activa 125 and Suzuki Access 125. Hero MotoCorp also is understood to be working on its new product pipeline that includes 125cc scooter model(s). It would be interesting to see how the two companies compete in the domestic scooter market in FY2017-18 as Honda too has lined up two new scooter models for the ongoing year. Watch this space.

Recommended read: Top 10 scooters in 2016-17

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

20 Apr 2017

20 Apr 2017

11347 Views

11347 Views

Autocar Pro News Desk

Autocar Pro News Desk