Passenger cars bounce back in May, Maruti, Tata Motors and Mahindra increase PV market share

Passenger cars, within the PV segment, are slowly showing signs of recovery and making their way back into buyers’ consideration, which has seen strong pull from UVs in recent times.

May 2018 has seen the Indian automobile industry post a strong sales performance, with all segments other than two-wheelers, posting year-on-year growth in double digits.

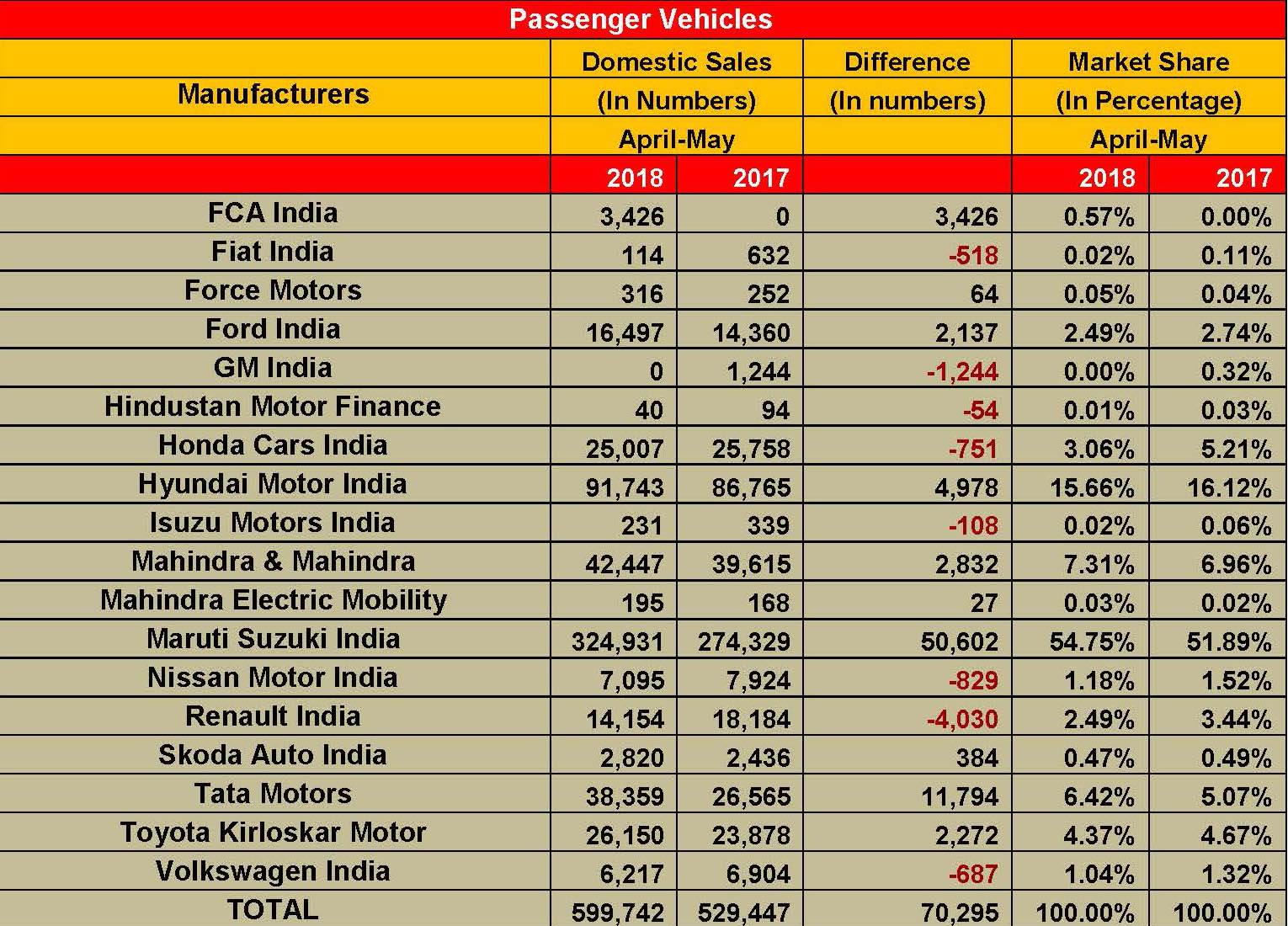

While the passenger vehicle segment grew at a significant 13.28 percent with sales of 599,742 units last month (May 2017: 529,447), it was the passenger car category which reported YoY growth of 11.77 percent, selling 399,662 units (May 2017: 357,586).

While the growth is sound, what is to be noticed is the dramatic recovery in their sales which was pegged at a mere 3.3 percent until the end of FY2018, with overall sales standing at 2,173,950 units between April-March 2018.

The resurgence could be attributed to two factors – a low year-ago base when sales in May 2017 (357,586 units) were down due to buyer anticipation of lower pricing of cars amongst with the upcoming GST regime from July 2017, and a slew of new car models in the sedan and hatchback space getting launched amidst sharply rising fuel prices over the past few months.

High fuel prices have been a dampener and have clearly affected UV sales in the country which, rather than accelerating hard as they did until the end of FY2018 with overall sales of 921,780 units (+20.97%), have moderated to around 14.7 percent, selling 161,222 units over the first two months of FY2019 between April and May 2018.

While most carmakers have recorded positive sales, market leader Maruti Suzuki and an aggressive Tata Motors have seen saw a notable rise in their respective market shares in the PV space, driven by a strong uptick in their passenger car sales.

Maruti Suzuki sold 161,497 units in the month, growing at a substantial 23.99 percent, with the major chunk of its volumes coming in from sales of its compact cars, and that too, primarily from the Swift and the Dzire siblings. As a result of the strong performance of its models, the company registered cumulative sales of 245,895 passenger cars between April and May 2018, and posted a substantial growth of its market share in the passenger car category to 61.53 percent, noticeably up from what was pegged at 57.20 percent between April-May 2017, with overall sales of 204,552 units. Its UV market share, however, declined to 28.80 percent, even with sales rising to 46,433 units from the 43,246 units sold a year ago and market share pegged at 30.77 percent.

Maruti’s growth of passenger cars has also given a boost to its overall PV market share, which today stands at a commanding 54.18 percent with cumulative sales of 324,931 units sold during April-May 2018 period, up from the 274,329 units sold during the same period in 2017.

Tata Motors ups the ante

With sales of 19,202 units in May, homegrown automaker Tata Motors registered strong growth of 53.63 percent, and saw its overall PV market share rise to 6.40 percent, with sales of 38,359 units between April and May 2018 and growing from the 5.02 percent share during the same period last year when sales stood at 26,565 units.

Unlike Maruti, in Tata Motors’ case, however, the sale of its UVs has been the key driving factor of its overall growth, where its new Nexon compact SUV has helped it gain 7.78 percent market share with overall sales of 12,551 units between April-May 2018; a year-ago, Tata had sold 2,668 units for a 1.90 percent share of the UV market. Tata’s passenger car sales stood almost flat in this period, leading to the company maintaining its passenger car market share at 5.55 percent between April and May 2018, with overall sales of 22,173 units, where they stood at 21,014 units in 2017, giving a hold of 5.88 percent market share.

Mahindra & Mahindra to benefit from rural market uptick

With consumer sentiment up and demand returning from the rural India market, UV major Mahindra & Mahindra is in for a good run this year.

In May 2018, M&M sold a total of 20,621 units, which marks 1.63 percent YoY growth. For the April-May 2018 period, cumulative sales are 42,447, which is 7.15 percent YoY growth. This has helped the company increase its PV market share to 7.48 percent from 7.08 in Apil-May 2017.

ith young buyers cross-shopping between sedans and compact crossovers, and buyers taking cognizance of fuel-efficient vehicles, the PV segment bids fair to be an exciting but hugely competitive one.

RELATED ARTICLES

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

Kia Carens gets 3-star Global NCAP rating in fresh tests

The Carens MPV, which was tested twice under the new protocol, scored zero stars for adult occupancy in the first test.

13 Jun 2018

13 Jun 2018

7619 Views

7619 Views

Autocar Pro News Desk

Autocar Pro News Desk