July sees sales speed for two-wheeler OEMs

Monthly sales numbers from six OEMs reveals pent-up pre-GST demand coming to the fore even as buyers benefit from GST-driven price cuts.

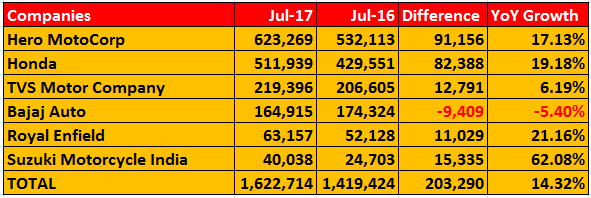

Like it has for the passenger vehicle segment, July 2017 has turned out to be a good month for the two-wheeler industry. Monthly sales data from six OEMs (Hero MotoCorp, Honda, TVS Motor, Bajaj Auto, Royal Enfield and Suzuki Motorcycle India) show cumulative sales at 16,22,714 units for the month. The year-on-year growth different amounts to 203,290 units, which accounts for an impressive YoY growth of 14.32 percent.

Hero MotoCorp stands out as the biggest volume gainer (91,156 units) followed by Honda Motorcycle & Scooter India (HMSI) which added 82,388 units to its July 2016’s performance. The good performance can be attributed to the revival in rural demand backed by above average rainfall, positive market sentiment, GST-driven price cuts and low channel inventory.

Hero MotoCorp: July is the third consecutive month for Hero MotoCorp reporting robust sales of over 600,000 units. The company recorded total sales of 623,269 units (including exports) last month, increasing its year-on-year sales by 91,156 units and clocking impressive YoY growth of 17.13 percent (July 2016: 532,113). According to the company, these numbers are despite the sluggish demand the market witnessed for the first few days of the month due to the transition to GST.

The company says it is confident of carrying forward this growth momentum into the upcoming festive season. As such, it has planned multiple product launches across motorcycles and scooters and is also aiming for the top spot in the 125cc executive commuter motorcycle segment with its popular Glamour model, which was beaten by Honda’s CB Shine in Q1 FY2018.

Senior company officials have attributed the subdued growth in the sales of its Glamour model (during Q1 this fiscal) to supply constraints. “With the supply constraints taken care of, we expect the Glamour to perform better in the market in the second quarter,” said a top company official.

Honda: The Hero Glamour’s arch-rival Honda CB Shine is also getting some marketing boost as HMSI has recently rolled out new campaigns promoting its 125cc bestseller. Honda reported total domestic sales of 511,939 units, recording YoY growth of 19.18 percent (July 2016: 429,551). This number comprises 343,878 scooters (up 40 percent YoY) and 168,061 motorcycles (up 11 percent YoY).

HMSI, which is aggressively chasing Hero MotoCorp, claims to have gained critical market share in July 2017 and in its year-to-date (YTD – April – July) sales. “Honda2Wheelers is the only manufacturer to gain 2 percent market share to 28.8 percent (domestic + exports), making Honda the highest market share gainer in July 2017. Interestingly, Honda is the only company to have gained 3 percent market share during April-July (YTD). With each passing month, Honda2Wheelers has sustained a market share of over 30 percent in the current financial year,” quotes the HMSI press release.

Notably, HMSI has also recorded its highest ever exports in a single month with shipment of 32,569 units (up by 34 percent YoY) in July 2017.

Commenting on the performance, Yadvinder Singh Guleria, senior vice-president – Sales & Marketing, HMSI, said, “Honda’s commitment to the market and its customers has helped us achieve double-digit growth. With aggressive network expansion and introduction of new products, we have not only created a lot of excitement among our consumers but also succeeded in reaching closer to the customers.”

Honda’s most affordable scooter model, the 110cc Cliq is expected to garner good numbers in the coming months.

TVS Motor Company: TVS reported total domestic sales of 219,396 units last month, registering conservative YoY growth of 6.19 percent. The company is riding high on the surging demand for its popular 110cc Jupiter scooter model, which is also the second bestselling scooter in India after the popular Activa.

For TVS, scooter sales rose 35.8 percent to 92,378 units and its motorcycle sales grew 15.1 percent to 109,427 units in July 2017.

Bajaj Auto: The Pune-based Bajaj Auto sold 164,915 motorcycles in July 2017, down 5.40 percent YoY (July 2016: 174,324). The company plans to add new models / variants to its existing brands to give a new fillip to its declining domestic sales. It is also betting on its recently launched model – NS160 – to its top-selling Pulsar umbrella.

Market analysts from HDFC Securities though remain optimistic on Bajaj Auto. “Although the company has shown a dismal performance in July 2017, we expect volumes to improve in H2, FY2018 led by festive demand. We are positive on Bajaj Auto based on its strong product portfolio and increasing portion of premium segment models (KTM, Pulsar, Avenger, Dominar) in overall volumes, and revival in export volumes. The management is confident of achieving double-digit growth in FY2018,” highlights one report.

Royal Enfield: Continuing its dream run, Royal Enfield has reported domestic sales of 63,157 motorcycles, up by 21.16 percent YoY (July 2016: 52,128). Recent news reports highlight that Royal Enfield has now surpassed Bajaj Auto and Hero MotoCorp in terms of its market capitalisation, which as of today stands more than Rs 83,939 crore (Eicher Motors is the parent company of the Royal Enfield brand). The company is known to be working on new motorcycle platforms and is aggressively gunning for several lucrative export markets.

Suzuki Motorcycle India: This subsidiary of two-wheeler manufacturer, Suzuki Motor Corporation, Japan, has reported sales of 40,038 units, a growth of 62.08 percent (July 2016: 24,703). Suzuki, which aims to sell 500,000 units this year, has also recorded a YoY growth of 40.6 percent for the YTD period of April-July in 2017. It has sold 166,456 units including the retail numbers of its big-bikes.

The company is working to expand its existing product portfolio, dealership networks and is also planning to boost its exports from India.

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

03 Aug 2017

03 Aug 2017

6249 Views

6249 Views

Autocar Pro News Desk

Autocar Pro News Desk