Honda, TVS top gainers in India’s booming scooter market

Honda Motorcycle & Scooter India (HMSI) and TVS Motor Company are the two biggest gainers in the domestic fast-growing scooter segment

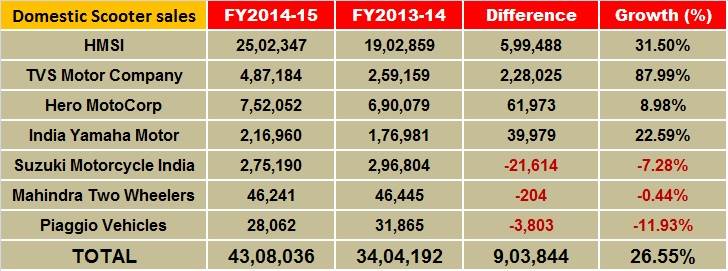

Honda Motorcycle & Scooter India (HMSI) and TVS Motor Company are the two biggest gainers in the domestic fast-growing scooter segment (with an engine displacement range of 90cc-125cc), which has grown by 26.55 percent during FY2014-15. This, as experts point out, can be attributed to the success of the Activa 125 for HMSI and the Jupiter model for TVS Motor Co.

HMSI, which added a volume of 599,488 scooters to its FY2013-14’s sales, sold a total of 25,02,347 scooters during FY2014-15, marking an impressive growth of 31.5 percent.

Honda’s first ever model in the 125cc scooter category, the Activa 125, has yielded good results for the Japanese manufacturer. While the scooter was first unveiled at the 2014 Auto Expo, it was commercially launched in April last year. The largest scooter player has a five-model portfolio which spans through the Activa i, Aviator, Dio, Activa 3G and Activa 125 models.

TVS Motor Co was the second biggest gainer in terms of adding volumes to its previous year’s sales. The Chennai-based company sold an additional 228,025 scooters over its FY2013-14’s sales of 259,159 units. This helped it record substantial growth of 87.99 percent in the domestic scooter market.

TVS sells three scooter models in the 110cc category – the Wego, Jupiter and the Scooty Zest 110 – all powered by the same single-cylinder, air-cooled, four-stroke, 109.7cc engine. The company currently does not have any model in the 125cc scooter category.

Two-wheeler major Hero MotoCorp added 61,973 units to its FY2013-14 scooter sales of 690,079 units, totalling 752,052 units in FY2014-15. This marks a YoY growth of 8.98 percent. The company, which has been dealing with scooter capacity constraints, currently sells only two models – the 102cc Pleasure and the 109cc Maestro scooter, which is understood to garner monthly sales of close to 45,000 units.

Sources say that India’s second largest scooter maker has started rolling out its upcoming 110cc Dash scooter model at its facility in Gurgaon. In the near future, Hero will take on Honda with two models in the 110cc segment (Dash and Maestro) and one in the 125cc segment with its another upcoming scooter model named Dare. The company is also boosting its scooter production capacity to 100,000 units per month, followed by 125,000-150,000 units per month by mid-2015.

India Yamaha Motor’s scooter sales have grown by 22.59 percent by selling 216,960 units during FY2014-15. The company had sold 176,981 scooters in FY2013-14. It sells two variants of the Ray and an Alpha model, all using the same single-cylinder, 113cc engine.

Suzuki Motorcycle India, on the other hand, has not performed in-line with the market growth. The company sold 275,190 scooters during FY2014-15, down by 21,614 units or 7.28 percent over its previous fiscal’s sales. Suzuki sells four models including two variants of its 125cc Access scooter. The company, which launched its first ever 112.8cc scooter model Let’s last year, saw falling sales of its Swish and Access models.

Mahindra Two Wheelers and Piaggio Vehicles’ Vespa brands were the other marginal losers for the last financial year.

It is to be noted that scooters and scooterettees, which recorded a total domestic sales of 45,05,529 units during FY2014-15, currently stand at 28.15 percent of the overall Indian two wheeler market. The total domestic two wheeler sales recorded for the last fiscal was 1,60,04,581 units.

In a recent interview to Autocar Professional, YS Guleria, vice president – sales and marketing, HMSI, who believes that the scooter market is far from saturation in India, had said that “the latent demand of automatic scooter is rapidly increasing as a result of improving infrastructure in rural and urban India. We believe that the automatic scooters have potential to reach 35-40 percent of the overall two-wheeler sales in five to ten year horizon.”

Also read how Hero MotoCorp surpassed Honda to become India’s largest scooter exporter

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

16 Apr 2015

16 Apr 2015

14008 Views

14008 Views

Autocar Pro News Desk

Autocar Pro News Desk