‘By 2025, 100 percent of vehicles sold will be connected.’

Digital technologies, supported through increased vehicle connectivity, are enabling consumers to access car status, history, service estimates, scheduling and control using smart devices such as mobile phones.

Ashish Pandey, managing director, Automotive — Products, Accenture India, speaks to Amit Panday on the increasing role of electronics and software in vehicle development, changing consumer preferences, and how digital platforms are set to disrupt the way the auto industry functions.

How would you define the digital transformation in the automotive industry?

The automotive industry is experiencing digital transformation on two fronts: consumer and enterprise. Globally, the industry is witnessing aggressive transformation from the consumer’s perspective where OEMs are using an omni-channel approach to enhance customer experience across their channels, leverage advanced analytics to spruce up sales and provide better service. Digital technologies, supported through increased vehicle connectivity, are enabling consumers to access car status, history, service estimates, scheduling and control using smart devices such as mobile phones.

There is also disruption on the go-to-market front. Dealerships, for instance, are getting disrupted – with digital dealerships that provide the perfect mix of offline and online experiences to customers increasingly shopping online. A London-based company is striving to create experience centres while the entire selling process is digitised. While a physical experience centre exists, all the micro-moments are delivered to a customer using digital capabilities.

The second aspect is the use of digital for enabling better enterprise performance by digitising the value chain. While digital manufacturing is enabling better visibility and control in quality, digital product lifecycle management has taken PLM out from R&D’s functional domain to a core enterprise wide cross-functional process. Here again, digital technologies, harnessing the power of connected telematics devices, are generating significant usage behaviour and vehicle performance data to enable OEMs in improving vehicle design, quality and serviceability.

However, the consumer and enterprise aspects of digital transformation are currently disconnected within organisations. If automakers are to truly transform themselves by leveraging digital platforms, they need to create new digital business models for their consumers.

Accenture research shows that by 2020, for an OEM with US$55 billion in annual net revenues, digitisation could be unlocking more than US$2.3 billion in new value — with both top-and bottom-line impact.

How far has digitisation penetrated in the Indian automotive industry?

There is a fair amount of usage of the digital platforms in the auto industry from an enterprise perspective. However, there is a significant scope for improvement. The value chain is only partially digitally enabled.

Automotive sub-industries such as tyres have a significant business case for embracing digital platforms and have therefore digitised manufacturing processes for better visibility of raw materials and work-in-progress inventory along with driving better quality of output. In the farm equipment sector, one of the leading companies is experimenting with uberisation of tractors. While these developments are yet in their nascent stage, they are creating shared economy for tractors as well as auto ancillary products.

One of our clients in the CV segment is using the power of analytics to improve its on-ground decision making. The company has a central analytics engine, which provides regular insights on buyer propensity – sieving information about customers who have bought or have a probability of buying. These insights are then fed to the dealers at the point of sale to drive performance improvements. Use of digital platform(s) in the auto industry is evolving and there is still a large part of the industry which is at a very early stage of adoption.

On the consumer side, Indian auto companies are yet to truly harvest the power of digital platforms and are lagging significantly behind industries such as FMCG and retail.

How sharp would the impact be on the costs of developing vehicles, given that they are being increasingly equipped with several digital and electronic features?

Globally, cars are increasingly becoming computers on wheels, or in case of OTA updating Tesla – software on wheels. The software in a high-end vehicle consists of approximately 100 million lines of codes, and electronics will soon account for half of the total vehicle costs. As the Indian automotive industry evolves, these trends will eventually trickle down to the local markets as well.

On the other hand, if you look at the price trend of entry and mid-segment cars, several models have seen negligible increase in the prices, which, in some cases, are lower than the inflation and excise duty increases despite addition of safety and infotainment features.

Apart from the strong focus on value engineering, this trend is also explained by relatively low ‘propensity to pay premium’ for such features by Indian consumers. Accenture research done on car consumers in 2016 shows that electronic features for comfort and convenience still lag significantly behind exterior looks and styling, mileage and even the electronic features for safety. Hence, the impact on final retail prices will be gradual and will depend on the pace of evolution of Indian consumers’ buyer value hierarchy.

Globally as well, companies are betting on setting off cost pressures from increased electronics and connectivity in vehicles through additional value potential of data monetisation, service fee, third party access and cross-selling instead of passing this cost entirely to the consumer.

What are the potential challenges that are possibly obstructing smooth transformation of digital features in vehicles across segments in India?

Accenture uses a framework feature familiarity, interest and premium value to ascertain the importance of each feature in the car. Accenture research shows that a number of electronic features, especially regarding safety and driving comfort, have low familiarity but high interest once the consumer is made familiar with the features.

On the other hand, there are a number of electronic features which fall into the low familiarity, low interest and low feature premium. OEMs need to be careful about choosing electronic features where they depend on the consumer to pay that premium.

This is where the importance of thinking about the digital business model comes into play. A number of digital features can be made viable and generate value for the OEM when backed by a strong business model.

Digital features, which enable a customer to access a car using biometric / smart card or mobile device, can significantly enable the business model of car sharing / rental businesses for self-driving.

Similarly, the digital features focused on safety and driving habits can truly disrupt the way we understand car service and insurance.

U.S. government research predicts that increased autonomous vehicle features will lead to an 80 percent drop in car accidents, which will result in a drop of US$ 20 billion of insurance premiums in the 14 largest car markets in the world.

How would you define the trend of the increasing role of electronics in vehicle development and packaging worldwide, and in the Indian context? What percentage of electronic content currently goes in the overall car composition compared to future projections?

As mentioned earlier, electronics will soon account for half of the total vehicle costs from the current 10-20 percent, depending on the car segments. Globally, cars are increasingly becoming computers on wheels and with increased progress on the front of autonomous technologies and mobile integration, the passenger car will soon be software on wheels.

Along with this trend, the expected increase in electric car penetration will also disrupt the entire value chain and the cost structures of the automotive industry with fewer components, lower cost of mechanical components and higher share of software. Vehicles, as we understand them, are set to change completely.

Historically, India has been following the global car industry trends with a lag of at least a decade. Whether this lag disappears in the coming decade will depend on infrastructure growth, government policies on safety, emission and electric vehicles and the initiative of the auto industry to completely rethink the way vehicles are sold and serviced.

Does the increasing role of electronics pose a threat for the survival of the conventional ecosystem engaged in supplying mechanical components for vehicle development?

Auto companies have traditionally been hiring mechanical engineering talent and the new hires comprising electronic and software engineers are a completely different talent pool. This talent pool needs to be nurtured very differently and their capabilities need to be developed to make sure they grow within the organisation. This is something that the OEMs have to work on.

The companies will have deep expertise in R&D on the mechanical side but are in a process of developing expertise in newer areas like electronics, software, digital, and mobility. They are increasingly facing competition from the likes of Google and Apple who are eroding the boundaries separating automotive and software companies. These companies have the talent and the right capabilities to be able to add value to the auto industry as well. They have a strong focus on developing these capabilities in-house.

In India that gap can be bridged by open innovation where a company taps a curated ecosystem of start-ups. Accenture already has a strong open innovation network to connect our clients with these new-age start-ups. Auto companies are also tying up with core software companies for building joint capabilities. The trend of collaboration between auto and software companies is going to increase and disrupt the ecosystem. This disruption will have a more significant impact on the current automotive supplier ecosystem.

What are the possible threats that come along with the increasing role of software in operating vehicles? How are these threats being addressed by the stakeholders worldwide?

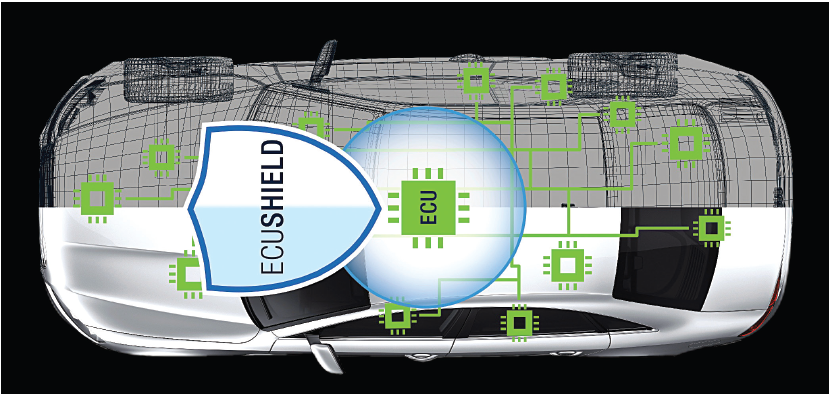

There are three key aspects to address here. First is the issue of cyber security – increased use of software and connectivity will need a robust security layer to protect vehicles from software security breaches and avoid hackers taking control of your vehicle.

Secondly, there is the issue of consumer privacy. A truly connected car is going to generate 15 gigabytes of data on your drive from Mumbai to Pune, maintaining privacy of this data is going to be an imperative.

Lastly, there is the standard question of where does the liability rest when a software makes the decision for the car. An extreme example is the choice of who lives and who dies in case an autonomous vehicle recognises that accident is inevitable. While autonomous vehicles are still under experiments, the question of liability is as relevant for any other software-enabled feature in the car.

By when, do you think, a substantial share of the vehicle fleet in India will embrace connected car technologies?

Globally, it is expected that by 2025, 100 percent of vehicles sold will be connected. Sixty percent of these vehicles are expected to have embedded connectivity while a third of cars will be connected via smartphone integrated with the on-board systems.

Availability of low-cost aftermarket OBD and telematics devices will accelerate the connected vehicles penetration in India as well. The CV industry is already aggressively pursuing the use of telematics in vehicles and potential to use data from these devices for better vehicle performance and fleet management solutions.

The business case of connected cars, however, is still shaping up and the evolution of Indian consumers’ buyer value hierarchy and propensity to pay premium for connected services along with the progress on smart cities and smart infrastructure such as tolling stations, fuel pumps will drive advances in connected car technologies.

Given India’s propensity to rapidly adopt digital technologies, while the vision of autonomous vehicle may still be far, a 100 percent share of connected vehicles in new vehicle sale may not be an unrealistic scenario.

Do you think connectivity and similar features are becoming prime USP for models in the market?

In recent years, Accenture has done extensive research on both passenger car and commercial vehicle consumers preferences. Our research shows that the connected features are slowly but steadily increasing their rankings in the Indian consumer’s buyer value hierarchy, though it is still low on the scale of ‘propensity to pay premium’.

As OEMs rethink these features in the context of overall business model innovation and redefining customer experience, these features will become the driving force in the market. The adoption rate will be higher in vehicle applications where connectivity provides a clear business case through increased efficiencies instead of increased price to the customer. With the time spent behind the wheel in Indian traffic conditions, Indian consumers are bound to adopt connected mobility services if OEMs can develop a compelling value proposition for the same.

(This interview was first published in the August 15, 2017 print edition of Autocar Professional)

RELATED ARTICLES

BRANDED CONTENT: 'We aspire to be among the leading sensors and electro-mechanical products manufacturer'

P. Parthasarathy, Founder & Managing Director, Rotary Electronics Pvt Ltd shares the company's commitment and vision to ...

‘Big opportunity for startups lies in products in India’: Detlev Reicheneder

As electrification levels the playing field, the focus on tech and R&D to bring innovative products is the mantra for st...

'I hope my journey makes people say — I can do this too'

Ranjita Ravi, Co-founder of Orxa Energies — the maker of Mantis e-bikes — shares the challenges of building a startup an...

14 Sep 2017

14 Sep 2017

11394 Views

11394 Views

Autocar Pro News Desk

Autocar Pro News Desk