Vehicle R&D turns USP for Advanced Structures India

The company claims to offer its competencies in vehicle testing, performance benchmarking, teardown, value engineering, NVH, cost modeling, full vehicle development and turnkey projects. Notably, ASI has capitalised on the unique requirement of reducing product development time, which has now become a critical parameter that nearly defines the success of many a project, if not all.

Bangalore-based Advanced Structures India (ASI) is an independent automotive product development company with operations in India, China and USA. ASI, in its 3-4 years of operations, claims to have worked with major passenger vehicle (PV) and commercial vehicle (CV) manufacturers and also a few Tier 1 suppliers in India. This small company with 45 core engineers now plans to extend its business to China, Malaysia and Iran in the foreseeable future.

Talking to Autocar Professional recently, Vaibhav B Kumar, managing director, Advanced Structures India, says, “We have worked with two out of five PV manufacturers, four out of five largest CV OEMs, three out of five largest auto component suppliers, India’s largest engineering consultancy, one of the big three management consultancies in India and more.”

The company claims to offer its competencies in vehicle testing, performance benchmarking, teardown, value engineering, NVH, cost modeling, full vehicle development and turnkey projects. Notably, ASI has capitalised on the unique requirement of reducing product development time, which has now become a critical parameter that nearly defines the success of many a project, if not all.

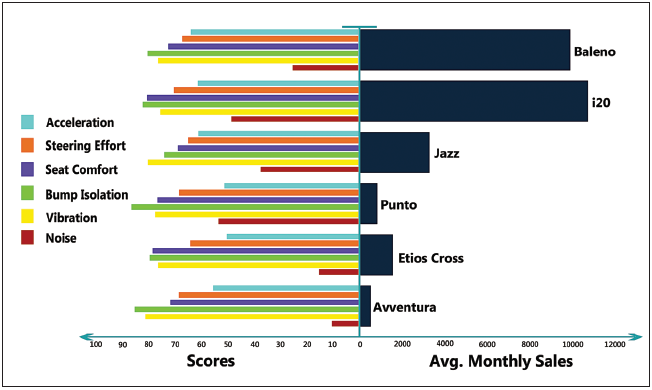

The company has created a database of engineering information on 50 passenger cars, mostly priced below Rs 15 lakh in India, and a few above that price range. This database of information is based on user experience of several engineering parameters.

“This database helps in terms of profiling the planned car and also guides in terms of positioning it in the market. Once it is positioned in its appropriate segment, we help the OEM in setting proper benchmarks for various sub-systems and parts. The profiling and positioning is subjective. It depends on what market segment the OEM wants to be in, what is its strategy, is the supply chain or manufacturing scale its strong point and other parameters. Although it is difficult to standardise all that, the user interface and the basic functions of the vehicle remain the same. That’s where we have the database. This doesn’t cover the data that we acquire for the customers,” explains Kumar, highlighting ASI’s key services.

“The deep digging of cars is done only on customer requirements. However, our focus remains on the engineering targets, cost mapping, product strategy and other similar areas.”

According to ASI representatives, generating database is an ongoing process. It soon plans to add engineering information of three new passenger cars to its pool. “Every quarter, we keep adding new vehicles to our database. We have multiple sources for procuring these cars. We have now increased our sourcing capabilities to China and Malaysia. So we are also studying the cars that are not available in India currently,” adds Kumar.

According to Kumar, three Chinese OEMs have approached ASI for understanding the Indian automobile market. “Three Chinese automobile manufacturers have approached us. They found and identified us through word of mouth and the technical information that we have hosted on our website. We take the project on a turnkey basis and we deliver on time. We have worked a lot on our operations, logistics and automation. About 20 percent of our team works on software, which is designed to reduce our project time. We automate our projects to a large extent; that helps us beat a team of 50-100 engineers with a 10-man team,” he says proudly.

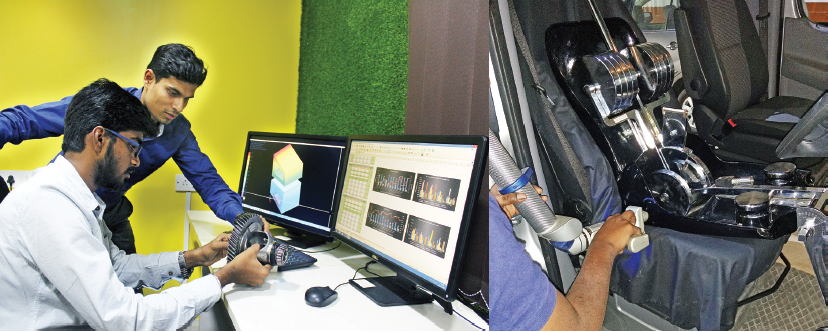

Above left: ASI offers engineering inputs, advanced analytics and simulation for automotive components. Right: Ergonomics study with H-point machine and scanning job in progress.

PREPARING FOR FUTURE TECH

To address requirements from incoming new safety and emission norms, the company is working on the cost implications involved in embracing BS VI standards. It is known that automakers will be required to adapt several new technologies to control emissions, which will lead to addition of several new components on the car.

“These developments are going to add to the weight of the car(s). So we are studying the impact of these new technologies (EGR, DPFs, SCR) on the vehicle architecture. We extensively work on weight reduction areas too. Although, we do not work on the powertrain development, we do provide services covering the powertrain durability and testing,” he mentions.

ASI has worked on a few projects trouble-shooting issues for the OEMs as well as Tier 1 suppliers. According to company official, ASI has helped a major component supplier of steering systems in troubleshooting the issues in its products. These glitches can arise either in the validation stages or as a result of in-the-field failure.

THE EV CONNECT

ASI has also begun working on electric vehicles. Kumar is counting on the recent India mobility report (2017-2032) released by NITI Aayog. He says that his team is working on the architecture and the technologies underlying EVs. He believes that most of the EV manufacturers (globally) have focused only on the powertrain area.

“If you map all the EVs that are developed in the world, you will find out that powertrain is good and the performance of the rest of the car is unsatisfactory. The first company that got its vehicle architecture right, you know it is selling well. We are working on those areas. We work a lot on electronic and software tools that are used to reduce EV development time,” states Kumar.

“We are already preparing our database for the EVs. The OEMs from China are keen to understand the potential of the EV segment in India,” he reveals.

ASI’s ideal clients also include the new companies which do not have significant experience in vehicle development and the heavily funded start-ups looking to make vehicles that must look, feel and cost just like the other vehicles seen on the road.

“Running range is a big issue. Weight, aerodynamic drag and rolling resistance are the three key parameters for running range in both – cars with internal combustion engines and with batteries and electric motors. In the ones with internal combustion engines these parameters can be matched easily. However, they leave a much larger impact on the EVs. Therefore, to solve such tech issues we work on the vehicle structure,” Kumar says, explaining the technical challenges.

According to him, EVs have a fresh bundle of problems. Explaining the same, he says, “In EVs, the motor makes noise, which is not similar to the grunting noise made by the engines. This noise is annoying and screeching. There are various methods required to identify the source and curb this noise, identify the type of failures that EV powertrains typically run into. We have been working on all these type of technical capabilities for the past 18 months.”

The team at ASI is working on these benchmarking solutions to address these fundamental challenges. These benchmarks will be refined every time when the company takes up a new EV project. It aims to accumulate a large pool of engineering information and benchmarks on EVs by the time they become mainstream in India. Weight reduction techniques in EVs around the chassis and body structure are among one of the areas engineers at ASI are currently working on.

The company, which is focusing on Chinese clients on a priority basis, aims to cover Malaysia next year and Iran in 2019.

SELECT TEAM TO DRIVE GROWTH

Given the confidential nature of this business, the founders of ASI carefully chose their team of core engineers, comprising people they have known for years. Vaibhav B Kumar and Rahul Ramola teamed up in late 2013 to start this venture. Prior to that, both worked in the R&D division at one of the largest CV manufacturers in India.

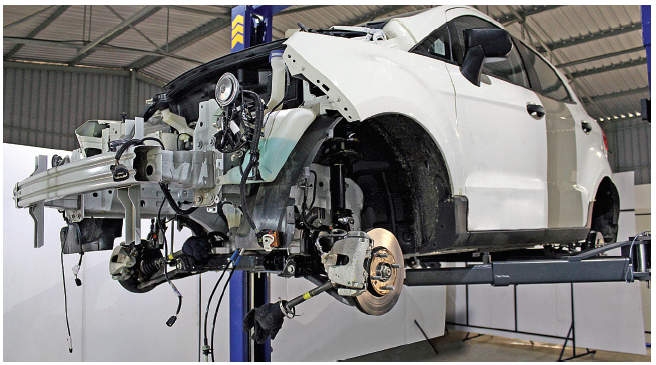

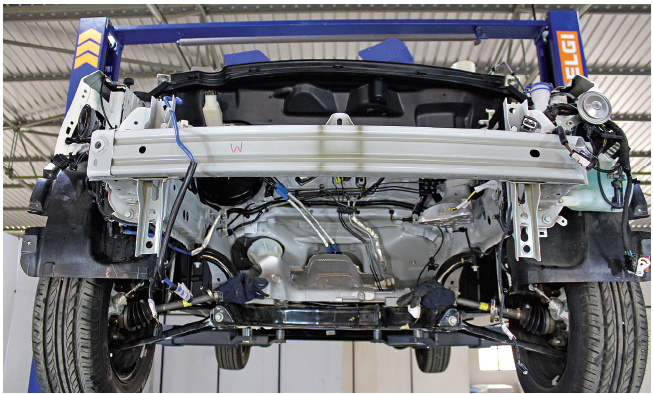

ASI executes detailed benchmarking at systems level for gathering critical engineering data.

“We are a closely knit team with technically sound engineers. We all have worked on the project management of several vehicles that are currently sold in the market. When we started our careers about eight years ago, all the automotive companies were working on several R&D projects across many domains. At ASI, we all have worked on several areas including NVH, interiors, testing, body architecture, CNG conversion, project management and others,” he reveals.

Later Prateek Shukla, Kumar’s friend from college, where both worked on racecar prototypes together, came on board. Shukla brought in the experience of working in the R&D division of one of India’s top two passenger car companies.

He further adds that the founders at ASI realised that there is a requirement of an independent automotive R&D company that is not aligned with any larger group. “We understood that we need an independent vehicle R&D unit that should cater to the business requirements and not the outsourced cost-based functions. This is what is helping us get projects from India and overseas. We are very good at timely execution, which is a difficult job to do in this domain. Nevertheless, that is the reason behind the several projects that we have bagged from large corporations,” Kumar cites, explaining the intent.

To finance the capital intensive equipment required in this business, the founders initially raised a loan from Canara Bank under some scheme for small enterprises. Later in 2015, Jaipur-based Girnarsoft Group made strategic investments in ASI.

“We work with complete independence without any interference from our investors. We are going to be a profitable company this year and last year too we had a positive cash flow,” signs off Kumar. Given the expected smart uptick in India's automotive market, ASI should be well placed even before that.

(This article was first published in the August 1, 2017 print edition of Autocar Professional)

RELATED ARTICLES

BRANDED CONTENT: Serving India’s EV ecosystem

Shimnit Integrated Solutions Pvt. Ltd. (SISPL), a subsidiary of Mumbai's leading high-security number plate supplier, Sh...

Driving EV business with agility and flexibility

CEOs from the EV startup ecosystem met in Bengaluru and Pune to discuss the challenges and business opportunities.

BRANDED CONTENT: SM Auto and Gotech energy inaugurate their first battery pack assembly plant in Pune

Pune-based SM Auto Engineering (SMA), a leading automotive component system manufacturer and its partner Gotech Energy (...

26 Aug 2017

26 Aug 2017

15027 Views

15027 Views

Autocar Pro News Desk

Autocar Pro News Desk