Tata Motors and Mahindra battle for LCV leadership

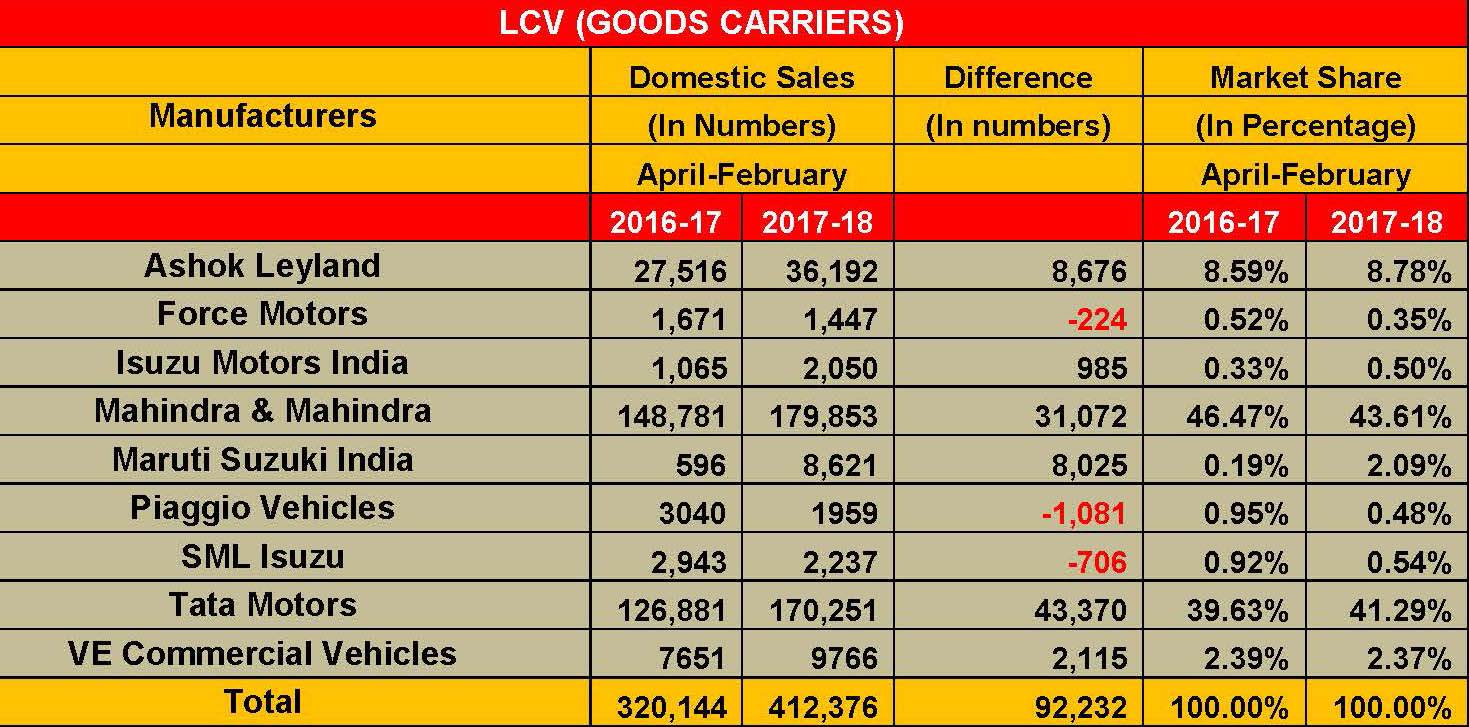

The big battle is being fought in the LCV goods carrier segment. While Mahindra & Mahindra’s market share has dropped to 43.61% from 46.47%, Tata Motors has expanded its share to 41.29% from 39.63% a year ago.

Even as the overall commercial vehicle industry is headed for a bumper year in 2017-18 and set to drive past all-time high of 2011-12 with consummate ease, there is a pitched battle underway in one of the key segments – light commercial vehicles (LCVs).

While Tata Motors with sales of 183,229 units (+31%) has emerged as the largest player in the overall LCV segment, M&M with sales of 182,121 units (+20%), is hot on Tata’s heels. Together, these two OEMs control 81 percent of the overall LCV market. The other key players include Ashok Leyland, Force Motors, VE Commercial Vehicles and SML Isuzu.

The LCV segment has in the first 11 months of FY2018 sold a total of 453,221 units (+24.64%) comprising of 40,845 (-6.03%) passenger carriers/buses and 412,376 goods carriers (+24.64%). Force Motors, with sales of 17,365 units is the market share leader here with 42.51 percent, followed by Tata Motors with sales of 12,978 units and a 31.77 percent market share, and Eicher Trucks and Buses with sales of 4,725 units and a 11.57 percent market share. But with State Transport Undertakings not confirming new orders for buses, the LCV passenger carrier business is currently in the slow lane.

The real action though is in the goods carrier LCV sub-segment, which is all about last-mile transportation given the growing constraints of big trucks entering metro/city limits, where OEMs are looking to make headway.

Of the nine players in this segment, only three – Mahindra & Mahindra, Tata Motors and Ashok Leyland – have sales of substance. Of the total sales of 412,376 goods carriers, M&M has contributed the major portion – 179,853 units or 43.61 percent – followed by Tata Motors with 170,251 units or 41.28 percent. Between these two OEMs, 85 percent of the total sales are covered. Then, there’s Ashok Leyland which has sold 36,192 units, accounting for 8.77 percent of total sales in the April 2017 to February 2018 period.

Tata Motors, which is the clear market leader in M&HCV goods carriers with a 51.23 percent share, has a strong competitor in Mahindra & Mahindra in LCV goods carriers. M&M edged out Tata Motors in this segment in 2016 but Tata is fighting back. For the April-February 2018 period, both companies have clocked double-digit growth, as a result of which the LCV segment is speedily driving towards its all-time high.

The two arch rivals are fighting it out for market share. While leader M&M’s market share has dropped to 43.61 percent from 46.47 percent, Tata Motors has increased its share to 41.29 percent from 39.63 percent.

Pickup segment sees intense competition

As mentioned before, in the overall LCV segment, the goods carrier segment accounts for the lion’s share as demand for last-mile connectivity and transportation in rural India increases rapidly. It is in this segment that M&M has an edge with its popular pickup range of trucks.

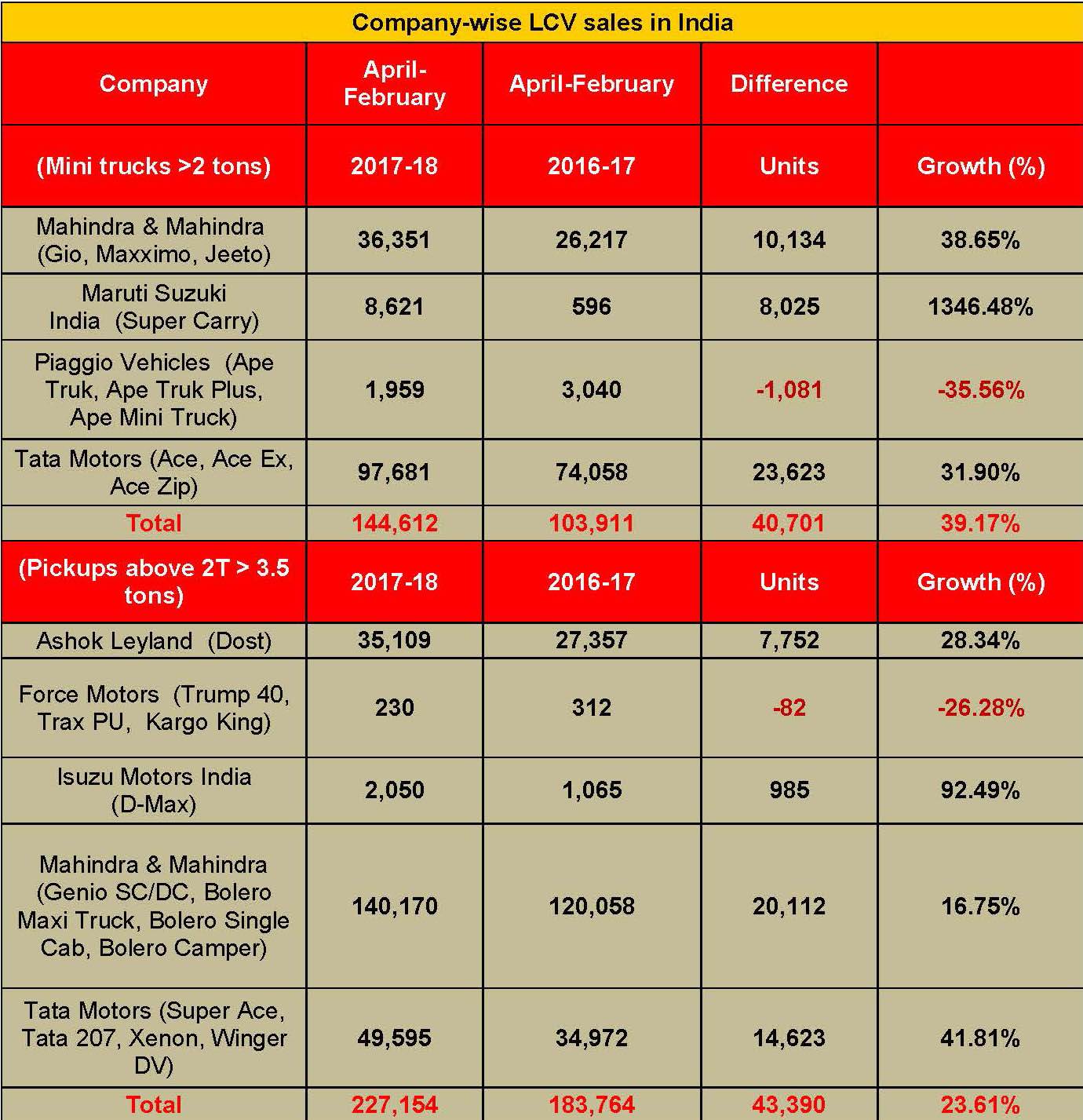

Between April-February 2017-18 in the 2-3.5T pickup segments, M&M with its Bolero Maxi Truck and Bolero Camper continues its strong grip with 62 percent market share. The company has sold 140,170 units but this period has seen the company cede five percent market share to its rivals.

Tata Motors is taking on the market leader with a clutch of new products and the promise of better aftersales service. The company sold 49,595 units for a market share of 21 percent, gaining 3 percent compared to the year-ago period. With products like the Super Ace, the 207 and the new Xenon Yodha, Tata has gained market share but from the looks of it, the company is game to further accelerate its offensive.

In February 2018 at the Auto Expo, Tata Motors showcased its new Intra LCV platform, which reveals the company’s intent to expand its SCV product portfolio. In fact, it is likely to introduce a product on this new platform in FY19.

Ashok Leyland is another ambitious player, eyeing greater volumes in the segments. The Chennai-based manufacturer, which sells the Dost LCV in this segment, has expanded its range with the Dost+ and already chalked out a plan to further increase its LCV portfolio. Between April-February 2018, Ashok Leyland sold 36,351 units of the Dost and Dost+ for a market share of 15 percent, it has managed to gain market share in the category. In the coming months, expect both Tata Motors and Ashok Leyland to come up with new products and strategies to achieve better traction in this segment but M&M at present has a comfortable lead.

Tata Motors leads the 2T mini truck segment

Where M&M doesn’t have a lead is the 2-tonne mini-truck segment, the largest category in the LCV goods carrier segment. Tata Motors has managed to hold on its leadership position and over 67 percent market share thanks to continuing demand for the Ace range of small trucks. In April-February 2017-18, the company sold 97,681 units, registering YoY growth of 32 percent.

Maruti Suzuki, which entered the SCV market in September 2016 with its Super Carry, has grabbed nearly 6% market share in the 2T mini-truck segment by selling 8,621 units in April-January 2018.

M&M, which is the second largest player with a market share of 25 percent, is doing its best to wrest new market share in the segment and sold 36,351 units in the 11-month period under view. Interestingly, Maruti Suzuki which entered the CV market in September 2016 with its Super Carry SCV, has grabbed nearly 6 percent market share in the 2T mini-truck segment by selling 8,621 units. It appears that the company is slowly but steadily looking to expanding its presence in the segment by entering new markets across the country.

Tata Motors also dominates in the 3.5-6T category with 70 percent market where the company is sells its popular 407 range of trucks. M&M, which retails the Load King and CRX range, has a market share of 12 percent.

Force Motors scores high in passenger carriers

The passenger carrier segment, which accounts for a smaller chunk of the overall LCV segment, is where Pune-based Force Motors has a stranglehold. Force Motors maintains its leadership with a range of products including the Cruiser, Citiline, Traveller and Toofan and in the April-February 2018 period sold 17,365 units to have a market share of 42.51 percent. The others in the fray in this segment are Tata Motors, VE Commercial Vehicles, SML Isuzu and M&M with market shares of 32, 12, 7 and 5.55 percent respectively.

Future outlook

Going forward, and with the CV market booming, expect both Tata Motors and M&M to come with aggressive growth strategies to corner higher market share in the growing LCV goods carrier segments. This will be by not just offering better products but more of a value proposition to the customer in this segment, most of whom are vehicle owners themselves.

Meanwhile, Ashok Leyland has also revealed an intent to dig deeper into this segment with a new product offensive in the LCV segment. Similarly, with its initial success with the Super Carry, Maruti Suzuki India will also want to up the ante in the 2T mini-truck segment albeit the carmaker will be more driven by the surging demand in the SUV market.

Clearly, the battle in the LCV goods carrier segment will continue to be a hard-fought one, and will also draw new entrants. Stay tuned for further updates.

RELATED ARTICLES

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

SCOOP! TVS Motor begins exporting made-in-India BMW CE 02 e-scooter

TVS Motor Co, which has a longstanding strategic partnership with BMW Motorrad since April 2013 for manufacture of the 3...

21 Mar 2018

21 Mar 2018

63280 Views

63280 Views

Autocar Pro News Desk

Autocar Pro News Desk