INDIA SALES ANALYSIS: JANUARY 2015

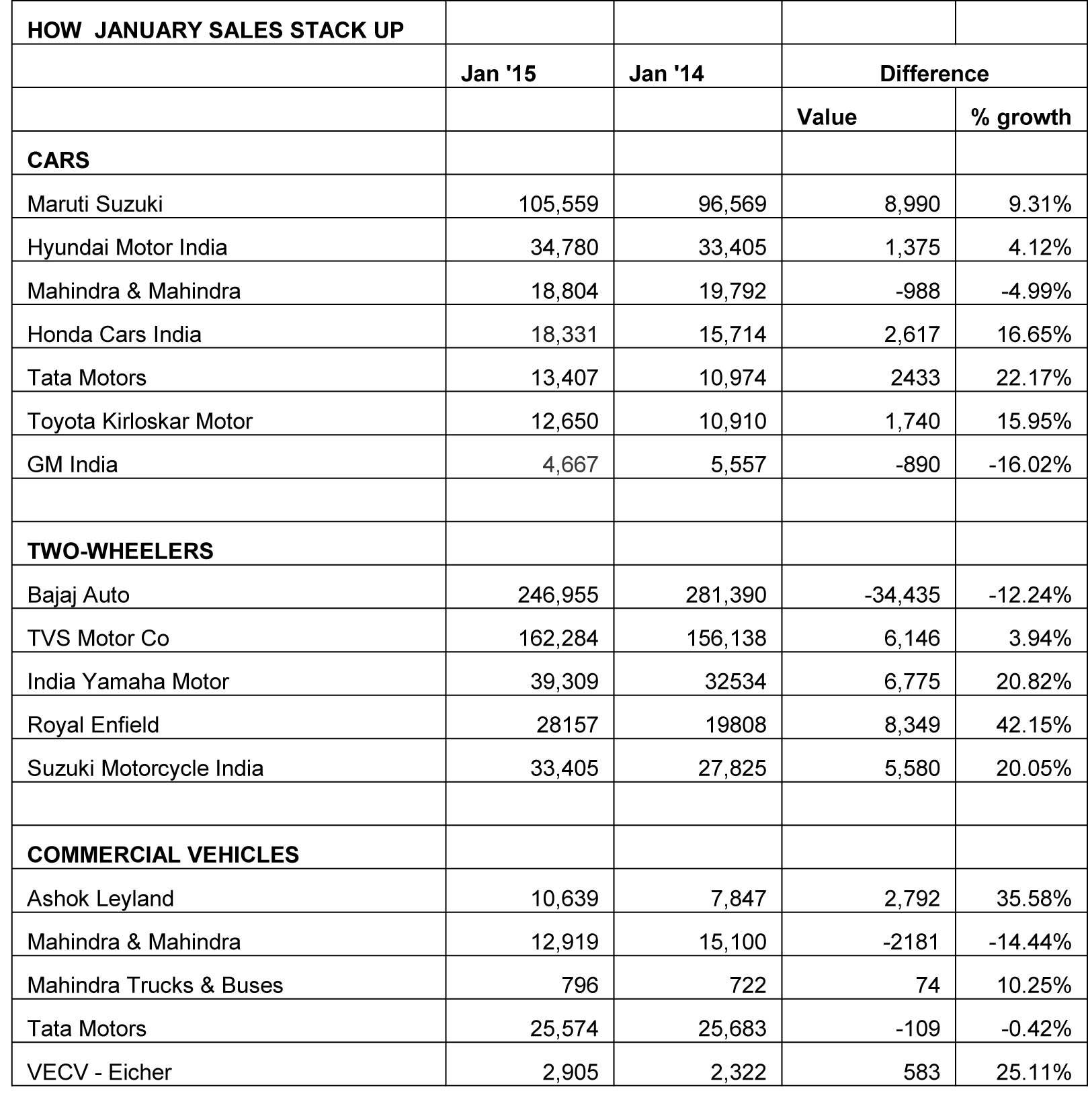

As OEMs started revealing their sales numbers for January 2015, what’s becoming apparent is that market sentiment seems to be giving a fillip to sales.

After the government decided not to continue the excise sops offered in the 2014 interim Budget, there were fears that sales in January would be lacklustre. However, going by the numbers that individual companies have put out, sales have not been too bad.

Maruti Suzuki India led the January tally with close to a 10 percent increase in sales. While Hyundai recorded a modest 4 percent, M&M saw a dip of 5 percent. Honda Cars India said it recorded its best ever sales in the fiscal, combining export numbers with domestic. The City and Amaze led the Honda charge while cars like the Elite and Grand helped Hyundai. For Maruti, the Ciaz totted up 6,005 units.

Clearly, the more recent models have done well for their manufacturers. With two more months for this fiscal year to come to a close, all eyes are on the Union Budget to be unveiled four weeks from now. OEMs are hoping for lower interest rates and big-ticket reforms to boost sentiments.

Maruti Suzuki India has recorded a 9.3 percent increase in its January 2015 sales to 105,559 units, up 9.3 percent (January 2014: 96,569. While the company’s bread-and-butter models which include the Alto and Wagon R saw a 7.3 percent decline to 35,750 units (January 2014: 38,565), the UV segment saw the highest increase at 35 percent with 6,432 units sold (January 2014: 4,763).

In the compact car segment comprising the Swift, Dzire, Ritz and Celerio hatchbacks, sales rose 7.5 percent to 45,881 units (January 2014: 42,669). In the van segment, the Omni and Eeco combined sold 10,113 units, 8.2 percent up from 9,345 units in December 2013.

While the Ciaz sedan sold 6,005 units in January 2014, the Dzire Tour taxi sold 1,378 units in the month. For the April 2014-January 2015 period, Maruti has sold a total of 851,662 units, which is a 12.6 percent growth over the corresponding period in the previous year.

Hyundai Motor India has registered domestic sales of 34,780 units and exports of 10,004 units with cumulative sales of 44,784 units for the month of January 2015.

Commenting on HMIL’s January 2015 sales, Rakesh Srivastava, senior vice-president (sales and marketing), said, “Hyundai Motor India sold 34,780 units in the domestic market with a growth of 7 percent over January 2014. This growth came in on the momentum built by products like the new Elite i20, Grand and Eon while facing the stiff challenges of increasing cost of ownership on account of an increase in excise duties. For sustained growth the need of the hour is reduction in interest rates and rationalisation of taxes to increase the inflow of the first-time buyers."

Mahindra & Mahindra (M&M) reported total domestic sales of 18,804 passenger vehicles in January 2015, down 5 percent (January 2014 : 19,792) year on year. Speaking on the monthly performance, Pravin Shah, chief executive, Automotive Division, M&M, said, “The first month of 2015 has not been encouraging as the effect of withdrawal of excise duty subsidy is clearly evident. Unfortunately, the segmented recovery which we were witnessing over the last couple of months has been impacted with the excise duty change. We do hope that the upcoming Union Budget has some positive news for the auto sector. At Mahindra we are happy with the performance of our exports as well as our Trucks & Bus Division.”

For the month, overall total domestic sales combining US and cars, commercial vehicles, three-wheelers and trucks and buses comprised 37045 units, down 8 percent year on year (January 2014 : 40,324. In January 2015, the truck and bus division company sold 796 units, registering a growth of 10 percent (January 2014: 722). Exports for the month stood at 2,885 units, registering a growth of 22 percent year on year.

Honda Cars India recorded monthly domestic sales of 18,331 units in January 2015, witnessing a growth of 17 percent and being the highest monthly sales of this fiscal (January 2014: 15,714). The break-up is as follows: City/ 7671 units, Amaze/6,709 units, and Mobilio/2,942 units. The company also sold 951 Brios and 58 CR-Vs.

The Japanese also registered an overall growth of 47 percent during April 2014-January 2015 with 149,464 units as against 101,370 units during the corresponding period in FY 2013-14.

Jnaneswar Sen, senior, VP, marketing & sales, Honda Cars India, said, “January 2015 has been an extremely good month for HCIL. We registered our highest monthly domestic sales of this fiscal contributed by strong sales momentum for all the models.”

Tata Motors’ passenger vehicles division recorded sales of 13,047 units, up 19 percent as compared to 10,974 units sold in January 2014. In a statement, the company said sales of the Zest sedan, launched in August 2014, has done well while the Bolt has received a good response. Sales of Tata passenger cars in January 2015 were at 11,637 units, higher by 38 percent over January 2014; UV sales however fell by 44 percent at 1,410 units in January 2015. The company’s cumulative sales of all passenger vehicles in the domestic market for the fiscal thus far are 105,274 units, down 8 percent over the corresponding 10-month period the previous year.

Toyota Kirloskar Motor registered a 16 percent growth in the first month of the year. The company sold 12,650 units in the domestic market as compared to 10,910 units in January 2014. N Raja, director and senior VP (sales and marketing), said, “The growth of 16 percent is also credited to the launch of the new Innova and all-new Fortuner 4x4 AT, in early January.” However, he cautioned that “the effect of the increased prices on account of excise duty hike is still impacting the market. We hope the government will reconsider the excise duty concessions in the upcoming Union Budget to achieve sustained growth in 2015. In line with the Make in India campaign, structural reforms for the automotive sector are essential at this point in time.”

General Motors India sold 4,667 vehicles in January 2015 (January 2014: 5,557), a fall of 16 percent. “The withdrawal of excise duty benefits has significantly affected demand during the previous month. High interest rates and weak economic fundamentals continue to put pressure on car purchases,” said P Balendran, VP, GM India. “The sector’s turnaround is possible only if interest rates are reduced in phases and government announces big-ticket reforms in the upcoming Budget to revive consumer sentiments,” said Balendran.

2-WHEELER KEEP UP THE SALES MOMENTUM

The two-wheeler segment continued to see monthly rise during the first month of 2015. While Bajaj Auto registered negative growth during the month, all other major players received a positive response from the domestic market.

Pune-based Bajaj Auto (BAL) has registered total two-wheeler sales (including exports) of 246,955 units during January 2015 as against 281,390 units sold in January 2014, marking a drop of 12.24 percent YoY. On the cumulative (April-January) sales front for the ongoing financial year, BAL has sold a total of 28,66,070 motorcycles as against 28,78,502 units sold during April 2013-January 2014, registering a drop of 0.43 percent YoY.

BAL, which lost the number three rank to TVS Motor Company last year in terms of domestic two- wheeler sales, is planning to launch at least six new models (possibly including refreshes) in 2015 to boost its sliding sales.

Hero MotoCorp has reported flat sales of 558,982 two-wheelers in January 2015, a 0.4 percent growth (January 2014: 561,253). The company says it closed 2014 with sales of 66,45,787 units, its highest-ever sales achieved for any calendar year.

In terms of exports, Hero MotoCorp says it sold over 200,000 units in calendar year 2014, nearly 50 percent more than the 135,184 units sold in calendar year 2013.

Riding on the success of its scooter models, TVS Motor Company, secured total domestic sales of 162,284 units in January 2015, marking a near-flat growth of 3.79 percent YoY (January 2014: 156,138 units). Registering a healthy growth in its scooter portfolio, the company sold 56,032 units during January 2015 growing by 24 percent (January 2014: 45,198 units). Its motorcycle sales, on the other hand, grew by 6.88 percent increasing from 65,449 units sold in January 2014 to 69,949 units sold last month.

Another company registering growth on the back of its scooter sales is Yamaha Motor India. The company has recorded sales of 39,309 units during the month as compared to 32,534 units sold during January 2014, witnessing an upward of jump 20.82 percent. Happy with his company’s monthly sales performance, Roy Kurian, vice-president – sales & marketing, Yamaha Motor India Sales, said, “The incessant growth reinforces our belief in our business and strategic outlook. We are happy with our gradual growth and are extremely positive about 2015 with our new launches and innovative customers connect programs. Leveraging on the same, we will garner major sales and will be able to post some record numbers in the coming months. Upbeat about the future, we are eager to replicate and improve upon our last year’s achievements in 2015 too.”

Meanwhile, Suzuki Motorcycle India (SMIL) has reported total sales of 33,405 units during the month as against 27,825 units sold during January 2014, marking a growth of 20.05 percent. Speaking on SMIL’s January 2015 growth, Atul Gupta, executive vice president, SMIL, said “Our concerted efforts to promote the Gixxer (bike) and Let’s (scooter) have met with positive customer sentiment. Customer satisfaction and word-of-mouth publicity are key factors that work to our advantage.”

The company is known to be working on expanding its pan-India network of sales and distribution on a priority to boost its reach.

Continuing to bank on its brand resurgence, Royal Enfield, has recorded total domestic sales of 28,157 units during January 2015, growing by a handsome 42.15 percent YoY (Jan 2014: 19,808 units). The 346cc models form major chunk of the company’s growing month-on-month sales.

CV MAKERS POSTS GAINS IN M&HCV SALES

The new year has begun on a bright note for the commercial vehicle sector. Sales in January 2015 have given manufacturers a cause for cheer with all OEMs recording positive sales in the medium and heavy commercial vehicles (M&HCV) segment. However, the LCV segment is still in the doldrums as Tata Motors and Mahindra Truck and Bus posted negative sales in the segment. Ashok Leyland, which posted a Rs 32 crore profit in Q3, recorded double-digit growth in the LCV segment.

The positive sales in the M&HCV segment have been attributed to fleet renewals by large fleet operators who are tapping business from increased freight activities.

In terms of company-specific sales, Tata Motors’ overall domestic sales remain flat. The company sold 25,574 units (January 2014: 25,683). The M&HCV segment continued to perform well for the company with 38 percent growth. The company sold 11,273 units as compared to 8,166 a year ago. The LCVs continued to decline with an 18 percent fall with sales of 14,301 units. (January 2014:17,517)

Ashok Leyland’s overall sales grew 36 percent with 10,639 units (January 2014-7,847 units). Its M&HCVs sales surged 45 percent with 8,005 units (January 2014: 5,530 units). Bucking the overall LCV industry trend, the company’s LCVs posted 14 percent growth with 2,634 units sold last month (January 2014: 2,317 units)

VE Commercial Vehicles saw its sales rise 25 percent in the month. In the domestic market in the 5-tonne and above category, the company sold 2,905units (January 2014: 2,322 units).

Mahindra Trucks and Busesrecorded a 10 percent increase with the company selling 796 units (January 2014: 722 units).

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

By Autocar Pro News Desk

By Autocar Pro News Desk

02 Feb 2015

02 Feb 2015

14880 Views

14880 Views