INDIA SALES: Two-wheeler OEMs see smart uptick in June

Industry leader Hero MotoCorp pulls up overall industry growth in June 2017, stands out as the largest volume gainer during the month.

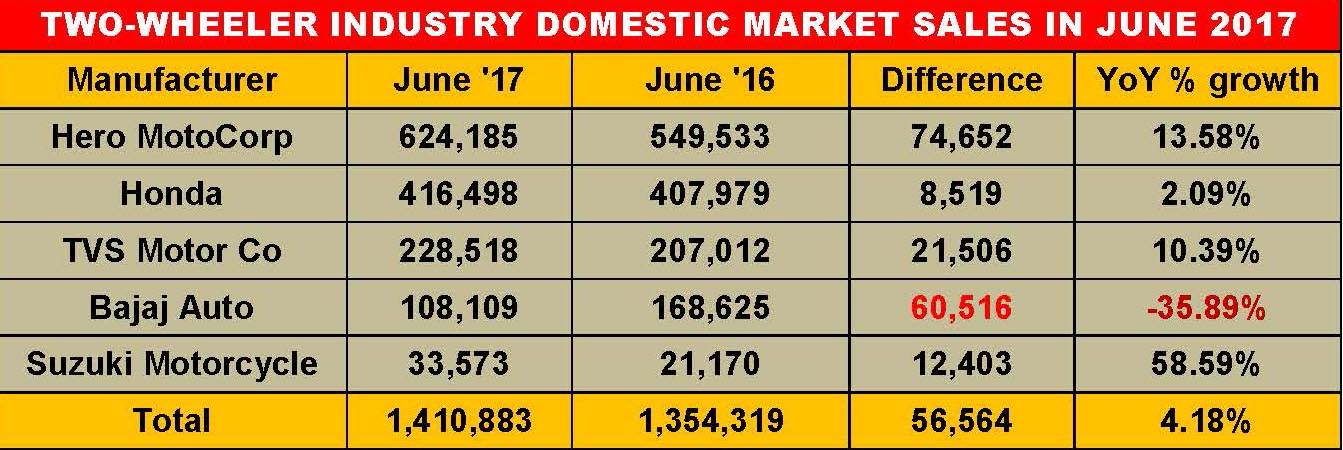

June 2017 sales numbers indicate growth is riding in for the Indian two-wheeler industry. Barring Bajaj Auto, other players, including Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), TVS Motor Company and Suzuki Motorcycle India, have reported growth year-on-year (YoY). India Yamaha Motors and Royal Enfield have not yet released their June 2017 performance reports.

Hero MotoCorp, India’s largest two-wheeler manufacturer, stands out as the biggest volume gainer in June 2017. The company has reported total sales of 624,185 units last month, up by 13.58 percent YoY (June 2016: 549,533).

According to an official company release, Hero registered robust growth on the back of solid performances by both – scooters as well as motorcycles. The company sold 547,185 motorcycles (up by 13 percent YoY) and 77,000 scooters, up by 22 percent YoY.

While demand, according to the company, is up for its commuter bikes that include the Splendor, Passion, HF Deluxe, Glamour and Achiever, scooter volumes appear to have gained from its marketing activities during the previous month. “Scooters have gained volumes driven by the very effective ‘360 degree’ Go-To-Market programs along-with the introduction of new upgrades and refreshes earlier in the quarter,” quotes the company release.

Like other OEMs – both in the two-wheeler and four-wheeler space – Hero MotoCorp has begun passing on GST benefits to vehicle buyers, the quantum of reduction ranging from Rs 400 to Rs 1800 on mass-selling models.

On the Q1 front (April-June 2017), Hero MotoCorp claims to have registered its highest ever sales for any quarter. The company has sold 18,49,375 units in Q1 FY2018. Its previous best quarterly performance was in Q2 FY2016-17 when it registered sales of 18.23 lakh units.

Honda Motorcycle & Scooter India has reported domestic sales of 416,498 units in June 2017, growing by a flat 2.09 percent YoY (June 2016: 407,979). While it sold 271,017 scooters, up by 2.08 percent YoY (June 2016: 265,361), it sold a total of 145,481 motorcycles in June 2017 (June 2016: 142,618). The company is passing on GST-related benefits on its models, with the savings going up to Rs 5,500, depending on the model and the state of purchase.

Honda’s recently launched 110cc scooter Cliq, which has become India’s most affordable scooter in the 100cc and above categories, is expected to soon start contributing substantially to its monthly volumes. The company is working to make the model available across India in a phased manner.

TVS Motor has clocked sales of 228,518 units in June 2017, up by 10.39 percent YoY (June 2016: 207,012). Its scooter sales grew by 33.8 percent YoY, taking June 2016’s sales of 67,590 units to 90,448 units in June 2017. Notably, this growth is driven by its bestselling 110cc Jupiter scooter, which is also India’s second largest selling scooter model month-on-month.

TVS’ motorcycles sales grew by 17.4 percent YoY from 95,542 units in June 2016 to 112,146 units in June 2017.

For Q1 FY2018, the company’s two-wheeler sales grew by 12 percent, increasing from 701,000 units in Q1 FY2016-17 to 785,000 units in Q1 FY2017-18. Its GST savings accrue between Rs 350 to Rs 1,500 in the commuter bike segment and up to Rs 4,150 in the premium segment.

Bajaj Auto has reported a decline of 35.89 percent YoY in its June 2017 sales. It sold 108,109 units last month as against 168,625 units sold in June 2016. The company has just rolled out the Pulsar NS160 in the premium commuter motorcycle segment in an attempt to boost its sales. The model will compete with Honda’s 160cc Unicorn models, Suzuki’s 155cc Gixxer family and TVS Motor’s Apache RTR 160.

In Q1 FY2018, its motorcycle sales are down by 22 percent to 426,562 units as against 548,880 units sold in Q1 FY2017.

Suzuki Motorcycle India has registered sales of 33,573 units in June 2017, up by an impressive growth of 58.59 percent YoY. Suzuki’s 125cc Access 125 scooter continues to drive its monthly volumes in the domestic market. It is estimated that the Access 125 is the largest selling model for Suzuki in Asia, including its volumes from India and Asian countries.

According to an official note from Suzuki, the company’s total sales stood at 38,454 units (in June 2017) as against 30,188 units in June 2016. “This is the fifth consecutive month in which Suzuki has witnessed double-digit growth in its total sales, inclusive of exports,” quotes the document.

With monsoons picking up, along with the GST momentum, it is expected that the market has no reason to not perform well in the coming months.

RELATED ARTICLES

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

SCOOP! TVS Motor begins exporting made-in-India BMW CE 02 e-scooter

TVS Motor Co, which has a longstanding strategic partnership with BMW Motorrad since April 2013 for manufacture of the 3...

Maruti Suzuki tops PV exports for third fiscal in a row, VW, Honda and Toyota shine in FY2024

With its best-ever exports of 280,712 units, Maruti Suzuki retains PV exporter crown in FY2024; Hyundai with 163,155 uni...

05 Jul 2017

05 Jul 2017

11327 Views

11327 Views

Autocar Pro News Desk

Autocar Pro News Desk